Net Insider Trading Turns Positive

Sabrient's research team posts a wide variety of useful data for internal reference, and much of it is used within our quantitative models and client deliverables. One of the things that we track is Net Insider Transactions.

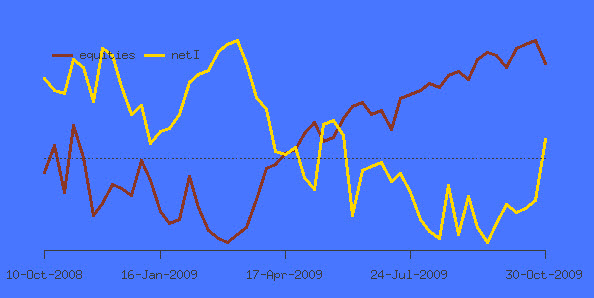

It appears that for the first time since late May, the market has seen positive net Insider Buying, as of October 30. (I tweeted about this last week.) We are simply adding up the number of unique insider purchases during the week minus the number of insider sales, as reported to the SEC on Form 4 - open market transactions.

Below is a chart illustrating this point.

Again, Buys represent the open market insider transactions during the given week that increase an insider's net holdings; while Sells are open market insider transactions during the given week that decrease an insider's net holdings. (The black line shows the overall market performance.)

Note that for the full year, this metric was the most strongly positive the week ending March 13 (remember the big bounce from the abyss that week?) when it clocked in at 840 buys vs. 189 sells for a net +651. In contrast, the week ending 10/30 was only at +47, but it has been trending up steadily since mid-September.

Of course, I see this as a positive development with respect to near-term market performance, and indeed November has looked quite strong so far. Insiders sell for a lot of reasons, including diversification, retirement, paying for kids' college expenses or a new vacation home, etc. But they generally only buy on the open market for one reason -- i.e., they think the stock is undervalued relative to growth prospects and should go up.