Sector Detector: Bold bulls dare meek bears to take another crack

Once again, stocks have shown some inkling of weakness. But every other time for almost three years running, the bears have failed to pile on and get a real correction in gear. Will this time be different? Bulls are almost daring them to try it, putting forth their best Dirty Harry impression: “Go ahead, make my day.” Despite weak or neutral charts and moderately bullish (at best) sector rankings, the trend is definitely on the side of the bulls, not to mention the bears’ neurotic skittishness about emerging into the sunlight.

Once again, stocks have shown some inkling of weakness. But every other time for almost three years running, the bears have failed to pile on and get a real correction in gear. Will this time be different? Bulls are almost daring them to try it, putting forth their best Dirty Harry impression: “Go ahead, make my day.” Despite weak or neutral charts and moderately bullish (at best) sector rankings, the trend is definitely on the side of the bulls, not to mention the bears’ neurotic skittishness about emerging into the sunlight.

In this weekly update, I give my view of the current market environment, offer a technical analysis of the S&P 500 chart, review our weekly fundamentals-based SectorCast rankings of the ten U.S. business sectors, and then offer up some actionable trading ideas, including a sector rotation strategy using ETFs and an enhanced version using top-ranked stocks from the top-ranked sectors.

Market overview:

Several market commentators have noted that the S&P 500 has gone nearly three years without a 10% peak-to-trough correction, which is the third-longest stretch in 25 years. The bears are simply lacking both leadership and new recruits in this low volatility, global-central-bank-liquidity-supported bull market. Not even renowned hedge fund manager Bill Ackman has been able to smack down the one stock that he “will go to the end of the earth” to destroy -- Herbalife (HLF). Nevertheless, Friday’s weakness was notable, even though stocks found support (at the 20-day simple moving average for the S&P 500, and the 200-day SMA for the Russell 2000).

Indeed, there is plenty of global turmoil to create a stout Wall of Worry. Israeli/Palestinian relations are at a new low as violence escalates. Elsewhere, Muslim extremists are creating war and anarchy all over the world, thumbing their noses at the notion of democracy, cooperation, and mutual respect. And then there’s Russia and its shameless push to reestablish hegemony over their former satellite nations (and perhaps take back a little land while they’re at it). But investors finally reacted Friday when European Council President Herman Van Rompuy suggested that new sanctions against Russia should target oil companies, which could create a boomerang effect on the global economy.

In earnings announcements last week, Facebook (FB) was a big winner while Amazon.com (AMZN) was a notable loser. According to FactSet, S&P 500 companies are now expecting a year-over-year gain of 5.6% (versus the previous 4.9%). The P/E multiple for the S&P 500 is now around 16.5x versus estimated 2014 earnings and 14.5x versus next year’s estimated earnings.

The economic numbers are looking good here at home, including unemployment at its lowest level since February 2006. Europe and China have reported better-than-expected economic data, too. Bullish sentiment in the American Association of Individual Investors poll fell for the fourth straight week to below 30%, which means that investors are not overly optimistic as stocks have hit new highs. Furthermore, American R&D spending and domestic energy output both hit new all-time highs.

Some commentators think unemployment could fall below 6% on this Friday’s report. Nevertheless, the fact is that many have simply dropped out of the labor force while many others have shifted into part-time or temporary contract work, which is why Fed Chairwoman Janet Yellen justifies maintaining low rates for the foreseeable future. Thus, bullish investors have taken heart knowing that the Fed is still firmly in their corner, while bears have been kept at bay.

We will witness an unusually busy week regarding economic reports, including the next Conference Board’s Consumer Confidence, FOMC announcement on QE tapering, Q2 GDP, Chicago PMI, July payrolls, July ISM manufacturing report, July car sales, U. of Michigan Consumer Sentiment, and unemployment.

Treasury bonds continue to hold strong, with a low 10-year yield of 2.48% and 30-year of 3.24%. The VIX, a.k.a. fear gauge, closed last Friday at 12.69, which is still quite low by historical standards but greatly elevated when compared with the near-single-digit levels of earlier in the month.

SPY chart review:

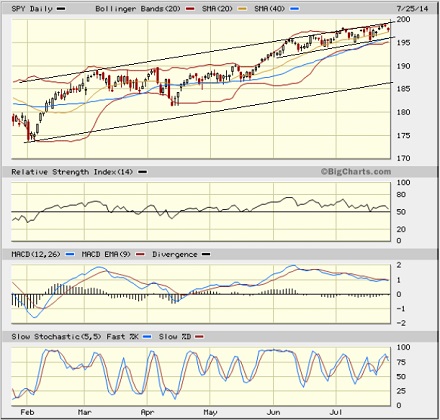

The SPDR S&P 500 Trust (SPY) closed last Friday at 197.72, which is almost exactly where it finished the prior Friday. The big difference is that on the prior Friday, the market finished the week strong after a weak Thursday, whereas last Friday, the market finished quite weak after a strong Thursday in which SPY made yet another new 52-week. The upper line of the long-standing bullish rising channel continues to prove extremely tough resistance, but bulls have been happy to just follow the ascending line to new highs, and the upper Bollinger Band is just riding it, as well. Underneath, the 20-day simple moving average has offered strong support despite some minor violations, and the mini rising channel is still intact and forming quite convincingly. Oscillators RSI, MACD, and Slow Stochastic are all pointing down after Friday’s weakness and really need to work off more of their overbought conditions.

I still believe that a test of support at the 50-day SMA (approaching 195) would be healthy and desirable. The 100-day SMA currently sits around 191, and the 200-day is all the way down around 185, just below the bottom line of the larger rising bullish channel. On the top side, the 200 level is getting tantalizingly close as a bullish target, but should offer extremely tough resistance to penetrate. Adding moral support to the bulls, a new Dow Theory buy signal was generated on July 16 when both the industrials and transports hit a new closing high.

On the other hand, the Russell 2000 small cap index, which had rallied strongly off of a May double-bottom formation before falling again, is now once again struggling to find support at its 200-day SMA. After a strong June, the small caps have been extremely weak during July, and with the oscillators appearing to be turning down again, the R2000 chart has the appearance of a dead-cat bounce. It will be virtually impossible for the S&P 500 large caps to penetrate the 2000 level (200 on the SPY) without cooperation from the small caps.

Latest sector rankings:

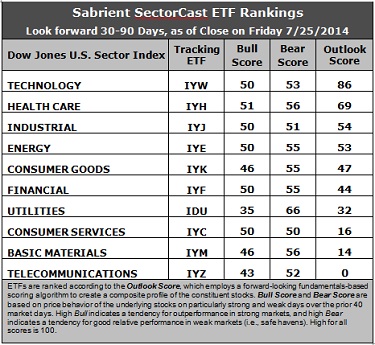

Relative sector rankings are based on our proprietary SectorCast model, which builds a composite profile of each equity ETF based on bottom-up aggregate scoring of the constituent stocks. The Outlook Score employs a forward-looking, fundamentals-based multifactor algorithm considering forward valuation, historical and projected earnings growth, the dynamics of Wall Street analysts’ consensus earnings estimates and recent revisions (up or down), quality and sustainability of reported earnings (forensic accounting), and various return ratios. It helps us predict relative performance over the next 1-3 months.

In addition, SectorCast computes a Bull Score and Bear Score for each ETF based on recent price behavior of the constituent stocks on particularly strong and weak market days. High Bull score indicates that stocks within the ETF recently have tended toward relative outperformance when the market is strong, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well (i.e., safe havens) when the market is weak.

Outlook score is forward-looking while Bull and Bear are backward-looking. As a group, these three scores can be helpful for positioning a portfolio for a given set of anticipated market conditions. Of course, each ETF holds a unique portfolio of stocks and position weights, so the sectors represented will score differently depending upon which set of ETFs is used. We use the iShares that represent the ten major U.S. business sectors: Financial (IYF), Technology (IYW), Industrial (IYJ), Healthcare (IYH), Consumer Goods (IYK), Consumer Services (IYC), Energy (IYE), Basic Materials (IYM), Telecommunications (IYZ), and Utilities (IDU). Whereas the Select Sector SPDRs only contain stocks from the S&P 500, I prefer the iShares for their larger universe and broader diversity. Fidelity also offers a group of sector ETFs with an even larger number of constituents in each.

Here are some of my observations on this week’s scores:

1. Technology has strengthened its hold on the top spot with an Outlook score of 86. The sector displays solid scores across most factors in the model, including solid Wall Street analyst sentiment (net upward revisions to earnings estimates), a good forward long-term growth rate, and strong return ratios. Only the forward P/E is below average; however, most of the sectors are looking less attractive on this metric as multiples have become elevated. Healthcare remains in the second spot this week with a score of 69. The sector continues to display the strongest sell-side analyst sentiment (upward revisions), a good forward long-term growth rate, and reasonable return ratios. Industrial has jumped into the third spot on the strength of some significant sell-side analyst upgrades. Energy and Consumer Goods/Staples round out the top five. In fact, the top five all display notable upward earnings revisions this week, while the bottom five show net downward revisions.

2. Telecom stays in the cellar this week with a dismal Outlook score of 0, as it scores at or near the bottom in every factor in the model. Basic Materials returns to the bottom two in its weekly duel with Consumer Services/Discretionary, with a score of 14, despite a generally solid forward long-term growth rate.

3. Looking at the Bull scores, Healthcare has become the leader despite a relatively low score of 51, while five other sectors are scoring right behind at 50. Utilities remains the clear laggard at 35. The top-bottom spread is 16 points, reflecting average sector correlations on particularly strong market days, but the crowd at the top shows some significant correlation among the economically sensitive sectors. It is generally desirable in a healthy market to see lower correlations and a top-bottom spread of at least 20 points, which indicates that investors have clear preferences in the stocks they want to hold, rather than the all-boats-lifted-in-a-rising-tide mentality that dominated 2013.

4. Looking at the Bear scores, Utilities is the clear leader with a solid score of 66, which means that stocks within this sector have been the preferred safe havens on weak market days. Consumer Services/Discretionary displays the lowest score of 50. Notably, all sectors are scoring at or above 50, which is somewhat bearish. The top-bottom spread is 16 points, reflecting average sector correlations on particularly weak market days. Again, it is generally desirable in a healthy market to see low correlations and a top-bottom spread of at least 20 points.

5. Technology displays the best all-weather combination of Outlook/Bull/Bear scores, while Telecom is by far the worst. Looking at just the Bull/Bear combination, Healthcare is the new leader, indicating superior relative performance (on average) in extreme market conditions (whether bullish or bearish). Telecom scores by far the lowest, indicating general investor avoidance during extreme conditions.

6. Overall, although still not clear-cut, this week’s fundamentals-based Outlook rankings again look slightly bullish to me, mainly because the top four Outlook scores also display the strongest Bull scores, and Industrial has made a nice move up, albeit at the expense of Financial.

These Outlook scores represent the view that the Technology and Healthcare sectors are relatively undervalued, while Telecom and Basic Materials may be relatively overvalued based on our 1-3 month forward look.

Stock and ETF Ideas:

Our Sector Rotation model, which appropriately weights Outlook, Bull, and Bear scores in accordance with the overall market’s prevailing trend (bullish, neutral, or bearish), suggests holding Technology, Healthcare, and Industrial (in that order) in the prevailing bullish climate. (Note: In this model, we consider the bias to be bullish from a rules-based standpoint because SPY is still above its 50-day simple moving average while also remaining above its 200-day SMA.)

Other highly-ranked ETFs from the Technology, Healthcare, and Industrial sectors include Market Vectors Semiconductor ETF (SMH), Market Vectors Biotech ETF (BBH), and SPDR S&P Transportation ETF (XTN).

For an enhanced sector portfolio that enlists top-ranked stocks (instead of ETFs) from within Technology, Healthcare, and Industrial, some long ideas include Syntel (SYNT), Western Digital (WDC), Biogen Idec (BIIB), Gilead Sciences (GILD), AMERCO (UHAL), and Allegiant Travel (ALGT). All are highly ranked in the Sabrient Ratings Algorithm and also score in the top quintile (lowest accounting-related risk) of our Earnings Quality Rank (a.k.a., EQR), a pure accounting-based risk assessment signal based on the forensic accounting expertise of our subsidiary Gradient Analytics. We have found it quite valuable for helping to avoid performance-offsetting meltdowns in our model portfolios.

If you are more comfortable with a neutral market bias, the Sector Rotation model still suggests holding Technology, Healthcare, and Industrial (in that order). But if you have a bearish outlook on the market, the model suggests holding Utilities, Healthcare, and Technology (in that order).

Disclosure: Author has no positions in stocks or ETFs mentioned.

Disclaimer: This newsletter is published solely for informational purposes and is not to be construed as advice or a recommendation to specific individuals. Individuals should take into account their personal financial circumstances in acting on any rankings or stock selections provided by Sabrient. Sabrient makes no representations that the techniques used in its rankings or selections will result in or guarantee profits in trading. Trading involves risk, including possible loss of principal and other losses, and past performance is no indication of future results.Sector Detector: Bold bulls dare meek bears to take another crack