Sector Detector: Bulls leverage hopeful news to launch a tepid breakout attempt

Stocks were able to leverage some optimistic news and dovish words from the Fed to take another stab at an upside breakout attempt last week. Although readers have sometimes accused me of being a permabull, I am really a realist, and the reality is that the slogans like “The trend is your friend” and “Don’t fight the Fed” are truisms. And they have worked. Nevertheless, I am still not convinced that we have seen the ultimate lows for this pullback, especially given the weak technical condition of small caps.

Stocks were able to leverage some optimistic news and dovish words from the Fed to take another stab at an upside breakout attempt last week. Although readers have sometimes accused me of being a permabull, I am really a realist, and the reality is that the slogans like “The trend is your friend” and “Don’t fight the Fed” are truisms. And they have worked. Nevertheless, I am still not convinced that we have seen the ultimate lows for this pullback, especially given the weak technical condition of small caps.

In this weekly update, I give my view of the current market environment, offer a technical analysis of the S&P 500 chart, review our weekly fundamentals-based SectorCast rankings of the ten U.S. business sectors, and then offer up some actionable trading ideas, including a sector rotation strategy using ETFs and an enhanced version using top-ranked stocks from the top-ranked sectors.

Market overview:

Bulls got a solid show of support from friends in high places last week. Of course, the biggest drivers of the stock market’s strong performance has been 1) signs of an improving economy, 2) global liquidity provided by dovish central bankers, and 3) global turmoil pushing cautious investors with all that liquidity in their hands into the relative safety and quality of U.S. securities of all types. The FOMC statement on Wednesday indicated no change in the dovish policies and no threat of an imminent move to raise short-term interest rates. ECB quant easing has led to a fall in the British pound and the euro. This has led to a notable strengthening in the U.S. dollar, which has helped keep inflation low, thus giving the Fed room to remain accommodative, which in turn is supportive of elevated valuation multiples in equities.

The 10-year Treasury closed Friday at 2.57%, which is down slightly from the prior week. I still think there is greater downside potential in the 10-year yield, especially given global liquidity and the resulting demand for the safety of U.S. Treasuries. Inflation is hard to find, and many economies around the world are trying to stave off recession and deflation (including Europe and Japan). Low interest rates could be with us for a while.

However, there are still signs of more weakness ahead in stocks, before the eventual launch into the widely anticipated year-end rally to new highs. The week following a triple (or quadruple) witching options expiration day (like last Friday) is usually a down week, according to Stock Trader’s Almanac. Also, the technical picture is not giving me confidence, as described below, and short interest has increased again.

The CBOE Market Volatility Index (VIX), a.k.a. fear gauge, closed Friday at 12.06, which of course is down from the prior Friday given the market breakout. It is well below the important 15 level and also back down below its 50-day simple moving average. However, the 50- and 200-day SMAs appear to be on a collision course, with the 50-day threatening to cross up through the 200-day, which would be bearish for stocks.

Year-to-date, the S&P 500 large cap index is up +8.8% total return, while the Russell 2000 small cap index is up less than +1.0%, and non-U.S. stocks are up only about +3.5%. Many market observers believe the lag in U.S. small caps is appropriate given the outperformance of small caps last year that boosted valuations out of balance.

After 5.5 years of a liquidity-fueled bull market, many observers are saying the market is getting long in the tooth and doomed to end soon. However, bull markets don’t die of old age. In fact, advanced age alone is rarely a sure-fire predictor of flagging performance in any activity, except perhaps professional sports. Take music, for instance. I just attended the Diana Ross concert earlier tonight at the Santa Barbara Bowl, and she is better than ever at age 70. Earlier this year, I attended a Paul McCartney concert in Kansas City, and at 73 he is still phenomenal. Likewise, Sabrient founder, former NASA scientist, and stock-picker extraordinaire David Brown is also a septuagenarian, and he is as good as ever.

Our annual Baker’s Dozen portfolio of 13 top picks for the year is up about +18% since its January 13 launch and continues to pull away from the field on this third-party performance tracking site. Our annual portfolio also strongly outperformed the other diversified portfolios over the prior two years since this site began tracking us. Baker’s Dozen represents a sector-diversified group of stocks based on our Growth At a Reasonable Price (GARP) quant model and confirmed by a rigorous forensic accounting review by our subsidiary Gradient Analytics to help us avoid the landmines.

Among industries, airlines and biotech have been hot. Southwest Airlines (LUV) is the best performer in the S&P 500 this year, and it is one of the top performers in our Baker’s Dozen portfolio, as is Actavis plc (ACT), a biopharma. Last year, our top performers in the Baker’s Dozen included Jazz Pharmaceuticals (JAZZ) and Alaska Air Group (ALK), and both are still highly ranked in our system. Another strong group are the energy service companies that support hydraulic fracturing, and Hi-Crush Partners LP (HCLP) is one of our top performing picks this year, as well.

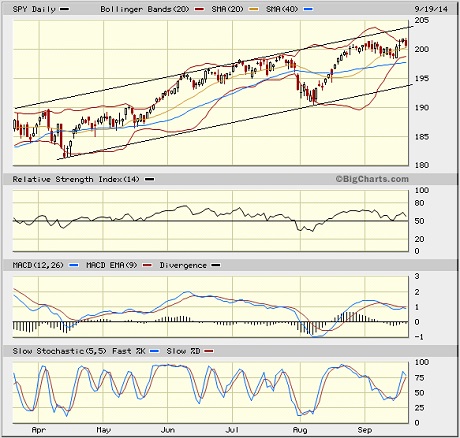

SPY chart review:

The SPDR S&P 500 Trust (SPY) closed last Friday at 200.61. After failing to confirm a breakout above resistance at 200 the prior week, it started last week as if it would pull back to test the 50-day simple moving average around 197.5, but instead rallied to regain its 20-day SMA and confirm a breakout (albeit tepid) above 200. But after Friday’s weakness, it is once again sitting right on support from the 20-day, and the breakout seems at risk of failure. Oscillators RSI, MACD, and Slow Stochastic were each pointing down bearishly the prior Friday, as I discussed in last week’s article, but after a brief reversal last week, they look to be pointing down bearishly once again.

Although both the Dow Jones Industrials and Transports rose to new closing highs last Thursday, keeping Dow Theory buy signal intact, the challenge for bullish investors still remains recruiting enough new bullish conviction to break out in earnest. However, the Russell 2000 small cap index is not cooperating. It is at a critical juncture, with its 50-, 100-, and 200-day SMAs having all converged at the same spot, and its price closed just below all three on Friday. The bulls will need to get small caps onboard the happy train soon. Although the blue chips are capable of leading the market higher without help from small caps, the higher-odds outcome would be perpetual consolidation and slogging through the mud rather than a robust year-end rally.

Latest sector rankings:

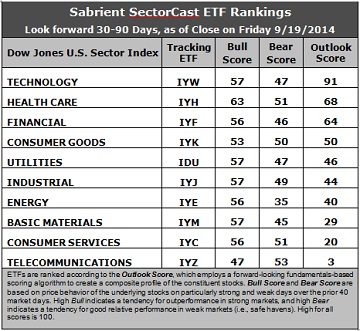

Relative sector rankings are based on our proprietary SectorCast model, which builds a composite profile of each equity ETF based on bottom-up aggregate scoring of the constituent stocks. The Outlook Score employs a forward-looking, fundamentals-based multifactor algorithm considering forward valuation, historical and projected earnings growth, the dynamics of Wall Street analysts’ consensus earnings estimates and recent revisions (up or down), quality and sustainability of reported earnings (forensic accounting), and various return ratios. It helps us predict relative performance over the next 1-3 months.

In addition, SectorCast computes a Bull Score and Bear Score for each ETF based on recent price behavior of the constituent stocks on particularly strong and weak market days. High Bull score indicates that stocks within the ETF recently have tended toward relative outperformance when the market is strong, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well (i.e., safe havens) when the market is weak.

Outlook score is forward-looking while Bull and Bear are backward-looking. As a group, these three scores can be helpful for positioning a portfolio for a given set of anticipated market conditions. Of course, each ETF holds a unique portfolio of stocks and position weights, so the sectors represented will score differently depending upon which set of ETFs is used. We use the iShares that represent the ten major U.S. business sectors: Financial (IYF), Technology (IYW), Industrial (IYJ), Healthcare (IYH), Consumer Goods (IYK), Consumer Services (IYC), Energy (IYE), Basic Materials (IYM), Telecommunications (IYZ), and Utilities (IDU). Whereas the Select Sector SPDRs only contain stocks from the S&P 500, I prefer the iShares for their larger universe and broader diversity. Fidelity also offers a group of sector ETFs with an even larger number of constituents in each.

Here are some of my observations on this week’s scores:

1. There is very little change in the rankings from last week. Technology still holds the top spot with the same Outlook score of 91. The sector displays relatively solid scores across most factors in the model, including the best Wall Street analyst sentiment (net upward revisions to earnings estimates), the strongest return ratios, a good forward long-term growth rate. However, the forward P/E is below average (Financial and Energy sport the lowest). Healthcare returns to the second spot this week with a score of 68 as the sector displays further improvement in both sell-side analyst sentiment (upward revisions) and insider sentiment (open market buying), as well as solid return ratios and a good long-term forward growth rate. Financial has solidified its hold on the third spot, as analyst sentiment continues to show gradual improvement. Consumer Goods/Staples and Utilities round out the top five.

2. Telecom stays in the cellar this week with an Outlook score of 3, as the sector has low scores on most factors in the model. Consumer Services/Discretionary stays in the bottom two with a score of 20, despite the highest forward long-term growth rate.

3. Looking at the Bull scores, Healthcare displays the strongest score of 63, while Telecom is the only sector scoring below 50, with a score of 47. The top-bottom spread is now 16 points, reflecting slightly higher sector correlations on particularly strong market days. It is generally desirable in a healthy market to see low correlations and a top-bottom spread of at least 20 points, which indicates that investors have clear preferences in the stocks they want to hold, rather than the all-boats-lifted-in-a-rising-tide mentality that dominated 2013.

4. Looking at the Bear scores, Utilities is still scoring surprisingly low (especially compared with the 60-70 range it had been showing recently), as the threat of rising interest rates had investors fleeing. Telecom displays the highest Bear score this week once again, although at 53 it is fairly low, indicating only mild investor interest when the market is weak. Still, on a relative basis, Telecom stocks have been the preferred safe havens on weak market days. Energy continues to display the lowest score, this week falling even further to 35. The top-bottom spread is 18 points, reflecting lower sector correlations on particularly weak market days. Again, it is generally desirable in a healthy market to see low correlations and a top-bottom spread of at least 20 points.

5. Technology displays the best all-weather combination of Outlook/Bull/Bear scores, followed by Healthcare, while Telecom is clearly the worst. Looking at just the Bull/Bear combination, Healthcare is the clear leader, followed by Consumer Services/Discretionary, indicating superior relative performance (on average) in extreme market conditions (whether bullish or bearish). Energy scores the worst, indicating general investor avoidance during extreme conditions.

6. Overall, this week’s fundamentals-based Outlook rankings continue to look neutral, as defensive and economically-sensitive sectors are mixed about in the rankings. Defensive sectors Utilities and Consumer Goods/Staples are both in the top five. However, I am seeing a glimmer of bullish hope in that the top two Outlook scores also sport the highest Bull scores, and Industrial and Financial seem to be subtly gaining some strength in the rankings. We’ll see how this plays out over the next couple of months.

These Outlook scores represent the view that the Technology and Healthcare sectors remain relatively undervalued, while Telecom and Consumer Services/Discretionary may be relatively overvalued based on our 1-3 month forward look.

Stock and ETF Ideas:

Our Sector Rotation model, which appropriately weights Outlook, Bull, and Bear scores in accordance with the overall market’s prevailing trend (bullish, neutral, or bearish), suggests holding Healthcare, Technology, and Financial (in that order) in the prevailing bullish climate. (Note: In this model, we consider the bias to be bullish from a rules-based trend-following standpoint because SPY is above both its 50-day simple moving average and its 200-day SMA.)

Other highly-ranked ETFs from the Healthcare, Technology, and Financial sectors include PowerShares Dynamic Pharmaceuticals Portfolio (PJP), First Trust Technology AlphaDEX Fund (FXL), and Market Vectors Mortgage REIT Income ETF (MORT).

For an enhanced sector portfolio that enlists top-ranked stocks (instead of ETFs) from within Healthcare, Technology, and Financial, some long ideas include Lannett Company (LCI), DepoMed (DEPO), Skyworks Solutions (SWKS), Broadcom (BRCM), Capstead Mortgage (CMO), and FirstMerit Corp (FMER). All are highly ranked in the Sabrient Ratings Algorithm and also score within the top two quintiles (lowest accounting-related risk) of our Earnings Quality Rank (a.k.a., EQR), a pure accounting-based risk assessment signal based on the forensic accounting expertise of our subsidiary Gradient Analytics. We have found EQR quite valuable for helping to avoid performance-offsetting meltdowns in our model portfolios.

However, if you think the market has come too far and you prefer to maintain a neutral bias, the Sector Rotation model suggests holding the same three: Technology, Healthcare, and Financial (in that order). Surprisingly, if you have a bearish outlook on the market, the model suggests holding Healthcare, Technology, and Consumer Goods/Staples (in that order).

Disclosure: Author has no positions in stocks or ETFs mentioned.

Disclaimer: This newsletter is published solely for informational purposes and is not to be construed as advice or a recommendation to specific individuals. Individuals should take into account their personal financial circumstances in acting on any rankings or stock selections provided by Sabrient. Sabrient makes no representations that the techniques used in its rankings or selections will result in or guarantee profits in trading. Trading involves risk, including possible loss of principal and other losses, and past performance is no indication of future results.