Sector Detector: Bulls retake the wheel, with a little help from their friends at the Fed

Well, it didn’t take long for the bulls to jump on their buying opportunity, with a little help from the bulls’ friend in the Fed. In fact, despite huge daily swings in the market averages driven by daily news regarding timing of interest rate hikes, the strength in the dollar, and oil prices, trading actually has been quite rational, honoring technical formations and support levels and dutifully selling overbought conditions and buying when oversold. Yes, the tried and true investing clichés continue to work -- “Don’t fight the Fed,” and “The trend is your friend.”

In this weekly update, I give my view of the current market environment, offer a technical analysis of the S&P 500 chart, review our weekly fundamentals-based SectorCast rankings of the ten U.S. business sectors, and then offer up some actionable trading ideas, including a sector rotation strategy using ETFs and an enhanced version using top-ranked stocks from the top-ranked sectors.

Market overview:

Last week, global equity markets posted their biggest weekly gain in nearly two years. The S&P 500 is back above 2,100, the Dow Jones Industrials is back above 18,000, NASDAQ is above 5,000, and Russell 2000 is at new highs. Even China is performing well. Yes, the bulls are back in control and feasting on bear claws. Risk on.

The big catalyst last week of course was the FOMC announcement that at once removed the word “patient” from their strategy but also indicated some concern about the economy. The committee acknowledged that the strong dollar is hindering GDP growth and inflation. Indeed, recent economic data on retail sales, manufacturing, and home building have all been weak. Investors interpreted this to mean a further delay in raising rates, i.e., bad news is good news. After all, rising rates would only serve to make the dollar even stronger. The most likely scenario seems to be a token rate increase in September, followed by very slow going from there.

The S&P 500 has fluctuated an average of 24 points per session so far this year, which is the largest since December 2011. The dollar is up more than 20% over the past year, while oil prices are still quite low, causing many investors to worry that prices could fall too far, negatively impacting oil development projects and by extension the overall economy rather than simply giving consumers some extra spending money.

Top performing sectors so far this year have been Healthcare, Consumer Services (Discretionary/Cyclical), and Telecom. However, keep in mind, the S&P 500 was flat as of the prior Friday (3/13) before last week’s +2.6% rise put the wind back in the bulls’ sails, so it’s no surprise that the top performers have been somewhat defensive.

Cash levels imply that there is good upside for equities. Fund managers have high cash positions and large bond portfolios that should move into equities if a Great Rotation out of bonds ever gets going. Moreover, corporate cash coffers are filled to all-time highs even as debt/equity ratios fall.

The 10-year U.S. Treasury yield closed Friday at 1.93% after falling precipitously from 2.24% just two weeks ago. The CBOE Market Volatility Index (VIX), a.k.a. fear gauge, closed Friday at 13.02, which is back below the 15 threshold of investor fear rather than complacency.

SPY chart review:

The SPDR S&P 500 Trust (SPY) closed Friday at 210.41 and is once again poised to challenge its all-time highs. After a strong February, the chart became quite overbought and needed to pull back, which it did in what turned into a bull flag continuation pattern. The pullback served to refresh bullish conviction, as expected. The 100-day simple moving average combined with the lower trendline of the long-standing rising channel to offer strong support. Then, after a couple of days retesting support from the 50-day SMA, the Fed’s announcement provided the needed spark to light the latest bull flame. Oscillators RSI, MACD, and Slow Stochastic are all looking either bullish or neutral, and now the 20-day SMA has provided recent support. The 50-day SMA is now approaching 207, and below that resides the 100-day SMA and the lower uptrend line of the long-standing bullish rising channel, which are both near 205, and then the critical 200-day SMA near 201. From a technical standpoint, the chart remains bullish in the mid and longer term.

Latest sector rankings:

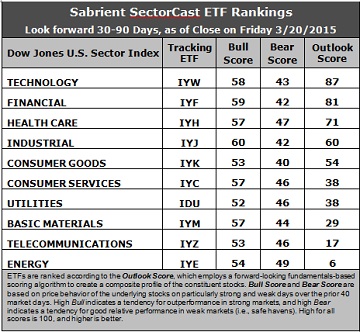

Relative sector rankings are based on our proprietary SectorCast model, which builds a composite profile of each equity ETF based on bottom-up aggregate scoring of the constituent stocks. The Outlook Score employs a forward-looking, fundamentals-based multifactor algorithm considering forward valuation, historical and projected earnings growth, the dynamics of Wall Street analysts’ consensus earnings estimates and recent revisions (up or down), quality and sustainability of reported earnings (forensic accounting), and various return ratios. It helps us predict relative performance over the next 1-3 months.

In addition, SectorCast computes a Bull Score and Bear Score for each ETF based on recent price behavior of the constituent stocks on particularly strong and weak market days. High Bull score indicates that stocks within the ETF recently have tended toward relative outperformance when the market is strong, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well (i.e., safe havens) when the market is weak.

Outlook score is forward-looking while Bull and Bear are backward-looking. As a group, these three scores can be helpful for positioning a portfolio for a given set of anticipated market conditions. Of course, each ETF holds a unique portfolio of stocks and position weights, so the sectors represented will score differently depending upon which set of ETFs is used. We use the iShares that represent the ten major U.S. business sectors: Financial (IYF), Technology (IYW), Industrial (IYJ), Healthcare (IYH), Consumer Goods (IYK), Consumer Services (IYC), Energy (IYE), Basic Materials (IYM), Telecommunications (IYZ), and Utilities (IDU). Whereas the Select Sector SPDRs only contain stocks from the S&P 500, I prefer the iShares for their larger universe and broader diversity. Fidelity also offers a group of sector ETFs with an even larger number of constituents in each.

Here are some of my observations on this week’s scores:

1. Technology continues in first place with an Outlook score of 87. Technology displays the best return ratios, a good forward long-term growth rate and forward P/E, and among the best in sell-side analyst sentiment (net revisions to earnings estimates). Financial takes second at 81 and displays by far the lowest forward P/E, reasonably good forward long-term growth rate, and the best sentiment among both insiders (buying activity) and sell-side analysts. Healthcare, Industrial, and Consumer Goods (Staples/Noncyclical) round out the top five, followed by Consumer Services (Discretionary/Cyclical).

2. Once again, Energy continues to hold the bottom spot given the persistent weakness in oil prices and the ongoing downward earnings revisions from Wall Street. Energy is among the worst in all factors in the model, and in fact its forward long-term growth rate is virtually zero. Joining Energy in the bottom two again is Telecom.

3. Looking at the Bull scores, Industrial displays the top score of 60, followed by Financial and Technology. Utilities scores the lowest at 52. Notably, all scores are above 50. The top-bottom spread has suddenly narrowed to 8 points, which reflects high sector correlations (i.e., broad risk-on buying). It is generally desirable in a healthy market to see low correlations reflected in a top-bottom spread of at least 20 points, which indicates that investors have clear preferences in the stocks they want to hold.

4. Looking at the Bear scores, Energy displays the highest score of 49 this week, followed by Healthcare, which means that stocks within the sector have been the preferred safe havens on weak market days. Consumer Goods (Staples/Noncyclical) has the lowest score of 40. Notably, all scores are below 50. The top-bottom spread has suddenly narrowed further to only 9 points, which reflects high sector correlations on particularly weak market days (i.e., broad risk-off selling). Ideally, certain sectors will hold up relatively well while others are selling off. Again, it is generally desirable in a healthy market to see low correlations reflected in a top-bottom spread of at least 20 points.

5. Technology displays the best all-around combination of Outlook/Bull/Bear scores, while Energy is the worst. Looking at just the Bull/Bear combination, Healthcare is back on top as the strongest, followed by Energy and Consumer Services (Discretionary/Cyclical), indicating superior relative performance (on average) in extreme market conditions (whether bullish or bearish), which to me is a bullish ranking. Consumer Goods (Staples/Noncyclical) scores the worst.

6. Overall, this week’s fundamentals-based Outlook rankings still look bullish to me, with economically-sensitive sectors Tech, Financial, all-weather Healthcare, and Industrial making up the top four, and with Consumer Services (Discretionary/Cyclical) holding up well. Defensive sectors Utilities and Telecom rank near the bottom. However, keep in mind, the Outlook Rank does not include timing or momentum factors, but rather is a reflection of the fundamental expectations of individual stocks aggregated by sector.

Stock and ETF Ideas:

Our Sector Rotation model, which appropriately weights Outlook, Bull, and Bear scores in accordance with the overall market’s prevailing trend (bullish, neutral, or defensive), retains its bullish bias, and the model suggests holding Financial, Technology, and Industrial, in that order. (Note: In this model, we consider the bias to be bullish from a rules-based trend-following standpoint when SPY is above both its 50-day and 200-day simple moving averages.)

Other highly-ranked ETFs from the Financial, Technology, and Industrial sectors include iShares US Financial Services ETF (IYG), iShares North American Tech-Multimedia Networking (IGN), and SPDR S&P Transportation ETF (XTN).

For an enhanced sector portfolio that enlists some top-ranked stocks (instead of ETFs) from within the top-ranked sectors, some long ideas from Financial, Technology, and Industrial sectors include Intercontinental Exchange (ICE), Affiliated Managers Group (AMG), Palo Alto Networks (PANW), Infinera (INFN), AMERCO (UHAL), and American Airlines Group (AAL). All are highly ranked in the Sabrient Ratings Algorithm.

However, if you prefer to maintain a neutral bias, the Sector Rotation model suggests holding Technology, Financial, and Healthcare, in that order. And if you prefer a defensive stance on the market, the model suggests holding Healthcare, Technology, and Consumer Services (Discretionary/Cyclical), in that order.

IMPORTANT NOTE: I post this information each week as a free look inside some of our institutional research and as a source of some trading ideas for your own further investigation. It is not intended to be traded directly as a rules-based strategy in a real money portfolio. I am simply showing what a sector rotation model might suggest if a given portfolio was due for a rebalance, and I may or may not update the information each week. There are many ways for a client to trade such a strategy, including monthly or quarterly rebalancing, perhaps with interim adjustments to the bullish/neutral/defensive bias when warranted -- but not necessarily on the days that I happen to post this weekly article. The enhanced strategy seeks higher returns by employing individual stocks (or stock options) that are also highly ranked, but this introduces greater risks and volatility. I do not track performance of the ETF and stock ideas mentioned here as a managed portfolio.

Disclosure: Author has no positions in stocks or ETFs mentioned.

Disclaimer: This newsletter is published solely for informational purposes and is not to be construed as advice or a recommendation to specific individuals. Individuals should take into account their personal financial circumstances in acting on any rankings or stock selections provided by Sabrient. Sabrient makes no representations that the techniques used in its rankings or selections will result in or guarantee profits in trading. Trading involves risk, including possible loss of principal and other losses, and past performance is no indication of future results.