ETF Ratings Reports

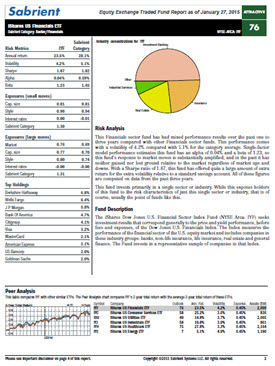

Our ETF reports cover more than 500 equity exchange-traded funds. Our system uses a bottom-up approach to aggregate scores of the underlying stocks within a given ETF based on a GARP (growth at a reasonable price) multi-factor model.

Each report assesses an ETF’s relative probability of upside or downside action over the ensuing 1-6 months and assigns a rating of Most Attractive, Attractive, Neutral, Unattractive, or Least Attractive.

Reports are updated weekly and may be retrieved up to ten at a time in pdf format Reports are updated weekly and may be retrieved up to ten at a time in pdf format.

Download a sample ETF Ratings Report.