Sector Detector: Stocks may stumble but will not fall

Despite an environment of uninspiring economic reports, stocks have regained their footing once again. Last week, bulls found that they simply couldn’t ignore the Boston bombing like all the other worrisome news, but the quick capture of the perpetrators has removed the domestic terrorism cloud. Yes, we are in an environment in which stocks may stumble temporarily, but bears are having a devil of a time making them fall.

Despite an environment of uninspiring economic reports, stocks have regained their footing once again. Last week, bulls found that they simply couldn’t ignore the Boston bombing like all the other worrisome news, but the quick capture of the perpetrators has removed the domestic terrorism cloud. Yes, we are in an environment in which stocks may stumble temporarily, but bears are having a devil of a time making them fall.

Perhaps the generally cautious direction of the equity inflows is playing a role in market stability. Although the general rule is that a healthy bull market is led by economically-sensitive sectors, in this case it appears that investors are seeking the defensive sectors because they don’t intend to pull money out any time soon. In many cases, they are investing for yield from equities because fixed income yield is so pathetic. That means dividend-paying blue chips, value stocks, and steady-eddy utilities and consumer staples.

This is not the standard definition of “risk-on.” Some would say it is the hallmark of a tenuous bull. But perhaps it is indicating that a true risk-on phase of equity investment is still yet to come. That certainly would be bullish.

Looking at the chart of the S&P500 SPDR Trust (SPY), it closed Wednesday at 157.88. Last week, it lost short-term support at its 20-day simple moving average, but found reliable support at both the important 50-day SMA and the bottom line of the sideways channel at 153.5. It then moved steadily higher right through Wednesday of this week. It was a classic bounce at strong support, and now the sideways trading channel appears to have widened from 153.5-157 to 153.5-160. Of course, 160 on the SPY corresponds with 1600 on the S&P 500, which is psychological resistance. I also have drawn a potential rising channel that might be forming.

The CBOE Market Volatility Index (VIX), a.k.a. “fear gauge,” closed Wednesday at 13.61. Even on spikes, it has not come close to challenging the important 20 level.

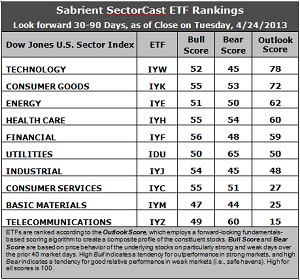

Latest rankings: The table ranks each of the ten U.S. industrial sector iShares ETFs by Sabrient's proprietary Outlook Score, which employs a forward-looking, fundamentals-based, quantitative algorithm to create a bottom-up composite profile of the constituent stocks within the ETF. The multi-factor model considers forward valuation, historical earnings trends, earnings growth prospects, the dynamics of Wall Street analysts' consensus estimates, accounting practices and earnings quality, and various return ratios. In addition, the table also shows Sabrient's proprietary Bull Score and Bear Score for each ETF.

High Bull score indicates that stocks within the ETF have tended recently toward relative outperformance during particularly strong market periods, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well during particularly weak market periods. Bull and Bear are backward-looking indicators of recent sentiment trend.

As a group, these three scores can be quite helpful for positioning a portfolio for a given set of anticipated market conditions.

Observations:

1. Technology (IYW) moves back to the top ranking with an Outlook score of 78, followed by defensive sector Consumer Goods (IYK) at 72. Last week’s top-ranked sector Financial (IYF) falls all the way to fifth this week at 59. IYW continues to display a low forward P/E, strong projected long-term growth, and the best trailing return ratios, while IYK moved up on the basis of its favorable return ratios and strong support among Wall Street analysts (i.e., net upgrades in forward earnings estimates). In fact, defensive sectors Telecom (IYZ), Utilities (IDU), and Consumer Goods (IYK) all show the most improvement in sell-side support.

2. Nevertheless, Telecom (IYZ) stays in the cellar with an Outlook score of 0. It is weak in forward P/E, long-term projected growth, and trailing return ratios. It is joined in the bottom two again this week by Basic Materials (IYM), which continues to be pummeled by Wall Street earnings downgrades.

3. This week’s rankings maintain an overall neutral tone, with a very slight bullish bias given that Tech, Energy, and Financial are all in the top five.

4. Looking at the Bull scores, Financial (IYF) is the leader on particularly strong market days, scoring 56, followed closely by Consumer Goods (IYK), Consumer Services (IYC), and Healthcare (IYH). Basic Materials (IYM) is the laggard on strong market days, scoring 47. But the top-bottom spread is quite narrow at only 9 points, which continues to indicate high sector correlation on strongly bullish days.

5. Looking at the Bear scores, Utilities (IDU) is serving as the favorite “safe haven” on weak market days, scoring 65, while Basic Materials (IYM) is the worst during extreme market weakness as reflected in its low Bear score of 44. The top-bottom spread is 21 points, which continues to indicate lower correlations on weak market days -- i.e., it pays to be in the safe sectors when the market is bearish.

These Outlook scores represent the view that Technology and Consumer Goods sectors may be relatively undervalued, while Telecom and Basic Materials sectors may be relatively overvalued based on our 1-3 month forward look.

Some top-ranked stocks within Technology and Consumer Goods include CACI International (CACI), Cree Inc (CREE), Middleby Corp (MIDD), and Tupperware Brands Corp (TUP).

Disclosure: Author has no positions in stocks or ETFs mentioned.

About SectorCast: Rankings are based on Sabrient’s SectorCast model, which builds a composite profile of each equity ETF based on bottom-up aggregate scoring of the constituent stocks. The Outlook Score employs a fundamentals-based multi-factor approach considering forward valuation, earnings growth prospects, Wall Street analysts’ consensus revisions, accounting practices, and various return ratios. It has tested to be highly predictive for identifying the best (most undervalued) and worst (most overvalued) sectors, with a 1-3 month forward look.

Bull Score and Bear Score are based on the price behavior of the underlying stocks on particularly strong and weak days during the prior 40 market days. They reflect investor sentiment toward the stocks (on a relative basis) as either aggressive plays or safe havens. So, a high Bull score indicates that stocks within the ETF have tended recently toward relative outperformance during particularly strong market periods, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well during particularly weak market periods.

Thus, ETFs with high Bull scores generally perform better when the market is hot, ETFs with high Bear scores generally perform better when the market is weak, and ETFs with high Outlook scores generally perform well over time in various market conditions.

Of course, each ETF has a unique set of constituent stocks, so the sectors represented will score differently depending upon which set of ETFs is used. For Sector Detector, I use ten iShares ETFs representing the major U.S. business sectors.

About Trading Strategies: There are various ways to trade these rankings. First, you might run a sector rotation strategy in which you buy long the top 2-4 ETFs from SectorCast-ETF, rebalancing either on a fixed schedule (e.g., monthly or quarterly) or when the rankings change significantly. Another alternative is to enhance a position in the SPDR Trust exchange-traded fund (SPY) depending upon your market bias. If you are bullish on the broad market, you can go long the SPY and enhance it with additional long positions in the top-ranked sector ETFs. Conversely, if you are bearish and short (or buy puts on) the SPY, you could also consider shorting the two lowest-ranked sector ETFs to enhance your short bias.

However, if you prefer not to bet on market direction, you could try a market-neutral, long/short trade—that is, go long (or buy call options on) the top-ranked ETFs and short (or buy put options on) the lowest-ranked ETFs. And here’s a more aggressive strategy to consider: You might trade some of the highest and lowest ranked stocks from within those top and bottom-ranked ETFs.