Sabrient Earnings Busters Portfolio

The Best Kept Secret in Investing . . . Until Now

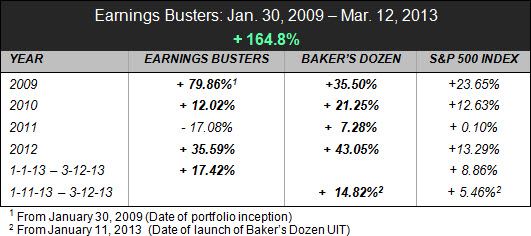

The Earnings Busters Portfolio was launched on January 30, 2009. Managed by David Brown, Sabrient’s chief market strategist, the portfolio has gained +164.8%, compounded, since inception (January 30, 2009) through March 12, 2013. That's an average of more than 40% per year for the past 4 years!

The Earnings Busters Portfolio was launched on January 30, 2009. Managed by David Brown, Sabrient’s chief market strategist, the portfolio has gained +164.8%, compounded, since inception (January 30, 2009) through March 12, 2013. That's an average of more than 40% per year for the past 4 years!

Earnings Busters Strategy

The original portfolio was built over 13 weeks, with a new position added each week until the portfolio contained 13 stocks (which is how we suggest new subscribers build their portfolios).

- Each position is personally selected by David Brown from a universe of top stocks ranked weekly by the Sabrient quantitative methodology.

- Every week, the oldest position is reviewed and renewed or replaced—if it still meets the strategy requirements, it is renewed; if it does not, it is replaced with a stock that meets the requirements.

- Emphasis is given to the Sabrient Outlook Score which measures a company’s forward looking prospects based on analysts’ earnings estimates for the next quarter and next year, the company’s short-term earnings growth rate (1 to 3 years), and positive revisions by analysts making those projections.

- Forward P/E is considered but it is less emphasized that in the Baker’s Dozen, which are classic GARP stocks.

- Stocks must carry a Sabrient Strong Buy or Buy rating at the time of selection. At the time of renewal, a Hold rating is acceptable.

The Earnings Busters Portfolio is part of the Sabrient Platinum Subscription:- $37.50/month or $455/year. Click here to subscribe.

Earnings Busters vs. Baker’s Dozen Strategy

The Earnings Busters strategy differs from the Baker’s Dozen in two ways.

- The Baker’s Dozen is a long-term “buy-and-hold” portfolio, with stocks selected at the beginning of the year and held for a full year, while Earnings Busters is a “rolling” shorter-term portfolio, with each stock held for 13 weeks, at which time it is reviewed and either renewed or replaced.

- The Baker’s Dozen are classic GARP stocks, with an emphasis on “growth at a reasonable price,” while Earnings Busters are “high growth” stocks; valuation based on forward P/E is considered, but it much less emphasized in this shorter term portfolio.

Performance Comparison

This table compares the annual results of Earnings Busters to the Sabrient’s Baker’s Dozen and the S&P 500 Index:

The Earnings Busters Portfolio is part of the Sabrient Platinum Subscription:- $37.50/month or $455/year. Click here to subscribe.