Sector Detector: Fed sticks to the script, but not all investors are comforted

Is it just me or has 2015 been a particularly crazy year? From extreme weather patterns, to a circus of a Presidential election cycle, to divergent central bank strategies, to the first triple-crown winner since 1978, to terrorist plots emanating from our neighborhoods, to counterintuitive asset class behaviors, to some of the most incredible college football finishes -- just to name a few. So, it only seems apropos to cap the year with Steve Harvey messing up on announcing the winner of Miss Universe the other night, only to correct his mistake after allowing the first runner-up to walk around with the crown for a couple of minutes before taking it away from her. It is much like the tug-of-war in stocks this year, in which the bulls walk around with the crown for a short time before the bears take it away for their own brief walk on the runway. But neither side can progress very far.

Although both the technical and fundamental pictures are murky, leading many investors to take chips off the table for the holidays, there are signs that the path of least resistance in 2016 will be to the upside.

In this weekly update, I give my view of the current market environment, offer a technical analysis of the S&P 500 chart, review our weekly fundamentals-based SectorCast rankings of the ten U.S. business sectors, and then offer up some actionable trading ideas, including a sector rotation strategy using ETFs and an enhanced version using top-ranked stocks from the top-ranked sectors.

Market overview:

As we at Sabrient gear up for the unveiling of our eighth annual Baker’s Dozen top picks for the New Year, I am looking forward to being on the road for pretty much the entire month of January, speaking with financial advisors across the country. I was in the Washington D.C. area last week and enjoyed some great meetings with advisors there. When I am in Florida in late January, I am excited to set aside a couple of days to attend part of the Inside ETFs 2016 conference in Hollywood, FL, which takes place January 24-27. ETF.com has provided me with a discount code to share with advisors who might want to attend: IE16-SM. If you attend this premier ETF event, please be sure to look for me.

Well, the ZIRP era has officially come to an end, at least for the foreseeable future. Stocks initially rallied on Wednesday after the Fed stuck to their long-telegraphed script and announced an initial rate hike toward normalization, accompanied by soothing words about future data-dependent but gradual rate increases. Following through as everyone expected on this initial hike was important because suddenly chickening out would have made investors think that the economy had worsened in the eyes of the Fed. Nevertheless, on Thursday things turned south, and Friday was a disaster to the downside on the second-highest trading volume of the year, which typically bodes poorly for prices in the near term. The Dow was down nearly 370 points (its worst day since September 1) and the S&P 500 fell more than -1.5%, with Financials leading the way, down -2.5%. But the S&P 500 held above 2,000, although NASDAQ lost support at 5,000.

However, I doubt Friday’s action is foreshadowing a massive selloff, as the fear mongers are saying. Many observers think that it was related to options expiration given that Friday was a quadruple-witching day, which typically creates high volatility and high volume. Moreover, many traders took chips off the table in advance of the holiday weeks. This implies that some upside (whether a dead-cat bounce or Santa Claus rally) might be in order.

Although the Fed has removed some of the uncertainty regarding rate hikes, there remains uncertainty about corporate earnings going forward, and that translates into a worry that the Fed may be tightening into a weakening economy. If a reversal of their normalization strategy is necessary, DoubleLine Capital CIO Jeffrey Gundlach observed that historically the median time from a rate hike to a reversal has been 16 months among those central banks that had to reverse course. But that would be a dramatic admission of error that seems unlikely short of a Black Swan event or a major turn of events into a recessionary spiral.

The latest Fed dot plot (with the median FOMC member's rate forecast) projects that they will raise rates about 1% per year for the next three years, rising to 2.5% by the end of 2017, then 3.5% for the longer run. But of course, it is all data dependent, and I believe that such a normalization of rates, while laudable for the long term in putting bullets back in the Fed's holster to fight off future economic slowdowns, may well have deleterious impacts on already tenuous domestic growth, or perhaps flatten the yield curve when we need it to steepen. If the Fed begins unwinding the balance sheet of QE-bought securities in an effort to support the longer end of the yield curve, it would likely reduce borrowing and threaten the housing recovery. These are tough choices that are well above my pay grade.|

Notably, Guggenheim's Global CIO Scott Minerd expects to see three 25 bp hikes in 2016 and another three in 2017, but then top out in the 2.5-3.0% range, which should help keep the 10-year Treasury yield under 3%. He thinks that while an initial pullback in stocks of 5-10% is historically normal in the months following the first rate hike, ultimately stocks tend to perform well (although current elevated valuations temper his upside expectations). He also sees the recent junk bond selloff as an attractive buying opportunity -- despite the gating of Third Avenue’s high-yield fund and Stone Lion Capital Partners’ distressed-debt hedge fund.

Sabrient founder and chief market strategist David Brown says 2015 has been the toughest year for stock picking in his recollection, and similarly, legendary trader Art Cashin has called it one of the more difficult markets he has seen in 50 years. My observation is that it has been more of a news-driven trader’s market than a valuation-driven investor’s market. Since summer, the Healthcare sector went from the long-time market leader to the doghouse in a New York minute, with shares across the sector being dumped in droves as short-selling and profit-taking set in, with only the Energy and Materials sectors faring worse.

Indeed, this has been a year of narrow market breadth, particularly since the summer highs for small caps on June 23. To illustrate, just look at the performance difference of the cap-weighted SPDR S&P 500 Trust (SPY) versus the Guggenheim Russell 2000 Equal Weight ETF (EWRS). EWRS has underperformed by -11.3%. Many have observed that you had to be in the “FANG” stocks (i.e., Facebook, Amazon, Netflix, and Google) to have had any chance of outperformance this year. As if to further corroborate this, Yahoo Finance just named Facebook (FB) as its Company of the Year for 2015. On the other hand, shares of juggernaut Apple (AAPL) are down slightly this year, but since its summer highs when news of a China growth slowdown came out, the stock is down around 20% -- or about $160 billion in market cap, which is more than what the vast majority of S&P 500 companies are worth, including bellwethers like Oracle (ORCL), Citigroup (C), Merck (MRK), Pepsico (PEP), Cisco Systems (CSCO), and IBM (IBM).

Part of the reason why stock performance has been poor and leadership is so narrow is that corporate earnings have been moribund, largely due to the Energy sector and its web of impacts throughout the Industrial sector. Oil is a Goldilocks market that needs to be not too hot and not too cold to work for all market segments. Q3 EPS growth of -1.4% marked the first quarterly decline in earnings since the Great Recession of 2009. For Q4, analysts currently expect earnings to fall by almost -5% and sales to fall -3% across the S&P 500 companies when they report early next year, with the main culprits being low oil prices, a strong dollar, and persistently weak top-line growth. This would mean that S&P 500 earnings will be down year-over-year for the first time in six years. In 2016, however, analyst consensus points to nearly +8% EPS growth and +4% revenue growth for the year. As a whole, Wall Street analysts expect the Healthcare and Consumer Discretionary sectors to be the leaders in 2016, with Energy a continued laggard.

For its part, Barron’s magazine recently published a 2016 market outlook that documents its polling of an assortment of market strategists who universally expect that EPS growth will be the major driver of the stock market in 2016, while P/E multiples will stay mostly unchanged -- and none of the strategists made a bearish case. On average, these individuals think the major averages will rise around 10%, led by Technology and Financials.

Here at Sabrient, our fundamentals-based SectorCast forward-looking rankings currently favor Financials, Technology, and Healthcare, as discussed below, with Energy mired at the bottom. However, with a little help from the lifting of the 40-year ban on oil exports, I expect oil to find a bottom soon and drift back toward the $50 level during 2016, which might give Energy a bit of a lift.

On the other hand, many investors remain concerned that equity valuations are high. As of the end of November, the S&P 500's trailing P/E was nearly 22x, with a projected forward P/E of about 17x, and economist Robert Shiller's CAPE ratio (cyclically-adjusted P/E) sits near 26x, which is elevated versus historical norms. But low long-term interest rates arguably allow for such elevated equity valuations, given that the fixed-income market is even more overvalued. The 10-year Treasury yield closed Tuesday at 2.24%, with a closing range during December between 2.14% and 2.33%. So far, the longer end of the fixed-income market has avoided a big rise in rates despite the Fed’s short-term rate hike.

Looking at ETF inflows during Q4, ConvergEx notes that 59% of this quarter’s total ETF inflows ($87 billion) went to U.S. equity products, while fixed income garnered just 12% ($11 billion), and non-U.S. equities is also modestly lower -- all of which suggests that domestic equities may have a bit of a tailwind from ETF money flows heading into the New Year.

The CBOE Market Volatility Index (VIX), a.k.a. fear gauge, closed Friday at 20.70 during the extreme weakness in the wake of the Fed announcement and ahead of the Christmas holiday week, but fell to 18.70 on Monday and then to 16.60 at Tuesdays close, which is still above the 15 fear threshold but well below the 20 panic threshold. ConvergEx has observed that while the VIX typically bottoms in December more often than any other month of the year, 2015 doesn’t appear destined to be one of those years given that the closing lows in July hit 11.95.

SPY chart review:

The SPDR S&P 500 Trust (SPY) closed Tuesday at 203, and is below its 50-day and 200-day simple moving averages (which have converged together at about 207). Market weakness late last week pushed price down and outside of the short-term sideways consolidation channel between 207 and 211, and the huge bearish engulfing candle on Thursday was a telltale indication of more downside. But psychological round-number support held at 200, and now price is making the effort to bounce back into the slightly larger sideways channel between 205 and 214 that has been in place since early February. Or is it 205 to 211? Or perhaps price is in a larger long-term channel between 200 and 214. It’s all kind of murky. Certainly the bearish gap down on Friday from Thursday’s close is acting as a magnet. Ocillators RSI, MACD, and Slow Stochastic all seem poised to cycle back up. So, the question is what happens once price gets back up to that level -- will it serve as strong resistance (i.e., a dead cat bounce) or will bulls easily break through it? Perhaps even tougher resistance will be the convergence of the 50- and 200-day SMAs near 207. At this point, I think the bulls’ best hope is a trip back up to the recent highs near 211 before year end, while bears will be trying to fill the bullish gap down around 195.

Latest sector rankings:

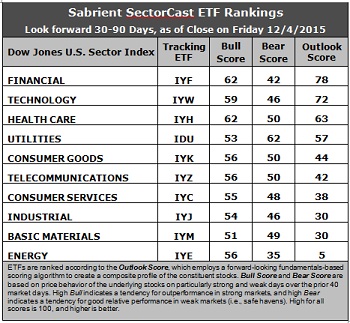

Relative sector rankings are based on our proprietary SectorCast model, which builds a composite profile of each equity ETF based on bottom-up aggregate scoring of the constituent stocks. The Outlook Score employs a forward-looking, fundamentals-based multifactor algorithm considering forward valuation, historical and projected earnings growth, the dynamics of Wall Street analysts’ consensus earnings estimates and recent revisions (up or down), quality and sustainability of reported earnings (forensic accounting), and various return ratios. It helps us predict relative performance over the next 1-3 months.

In addition, SectorCast computes a Bull Score and Bear Score for each ETF based on recent price behavior of the constituent stocks on particularly strong and weak market days. High Bull score indicates that stocks within the ETF recently have tended toward relative outperformance when the market is strong, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well (i.e., safe havens) when the market is weak.

Outlook score is forward-looking while Bull and Bear are backward-looking. As a group, these three scores can be helpful for positioning a portfolio for a given set of anticipated market conditions. Of course, each ETF holds a unique portfolio of stocks and position weights, so the sectors represented will score differently depending upon which set of ETFs is used. We use the iShares that represent the ten major U.S. business sectors: Financial (IYF), Technology (IYW), Industrial (IYJ), Healthcare (IYH), Consumer Goods (IYK), Consumer Services (IYC), Energy (IYE), Basic Materials (IYM), Telecommunications (IYZ), and Utilities (IDU). Whereas the Select Sector SPDRs only contain stocks from the S&P 500, I prefer the iShares for their larger universe and broader diversity. Fidelity also offers a group of sector ETFs with an even larger number of constituents in each.

Here are some of my observations on this week’s scores:

1. Financial remains at the top spot this week with an Outlook score of 78. Keep in mind, top scores can reach into the 90s, so 78 doesn’t represent strong conviction. The sector has the lowest forward P/E (down to 14.4x after last week’s market hit in which Financial led to the downside) and good sentiment among both insiders (open market buying) and Wall Street analysts (net revisions to earnings estimates). Analysts seem to expect Financials to finally have a chance to benefit from higher interest rates. Technology takes second at 72 and displays the highest forward long-term growth rate and return ratios, as well as good sell-side sentiment and a reasonable forward P/E (about 15.5x). Healthcare, Utilities, and Consumer Goods (Staples/Noncyclical) round out the top five, followed by Telecom and Consumer Services (Discretionary/Cyclical).

2. Energy remains at the bottom with an Outlook score of 5 as the sector scores among the worst in most factors of the GARP model. In particular, stocks within the sector still show a negative forward long-term growth rate and low return ratios, as well as the highest forward P/E (around 23.1x). Telecom has risen up to the sixth spot, so the other spot in the bottom two is shared by Industrial and Basic Materials (both victims of global malaise) with an Outlook score of 30.

3. Looking at the Bull scores, Healthcare and Financial top the list with a 62, while Basic Materials is the lowest at 51. The top-bottom spread is only 11 points, which reflects high sector correlations on particularly strong market days, which is not so good for stock picking. It is generally desirable in a healthy market to see low correlations reflected in a top-bottom spread of at least 20 points, which indicates that investors have clear preferences in the stocks they want to hold (rather than broad risk-on behavior).

4. Looking at the Bear scores, Utilities displays the top score of 62, which means that stocks within this sector have been the preferred safe havens (relatively speaking) on weak market days. Energy scores the lowest at 35 as investors flee during market weakness. The top-bottom spread is a robust 27 points, which reflects quite low sector correlations on weak market days, which is good for stock picking. Ideally, certain sectors will hold up relatively well while others are selling off (rather than broad risk-off behavior), so it is generally desirable in a healthy market to see low correlations reflected in a top-bottom spread of at least 20 points.

5. Financial displays the best all-around combination of Outlook/Bull/Bear scores, followed by Technology, while Energy is by far the worst. However, looking at just the Bull/Bear combination, Utilities is the best, followed by Healthcare, indicating superior relative performance (on average) in extreme market conditions (whether bullish or bearish), while Energy is the worst.

6. This week’s fundamentals-based Outlook rankings still look neutral to me. The top two are Financial and Tech, which is bullish, but next is all-weather Healthcare followed by defensive sectors Utilities, Consumer Goods (Staples/Noncyclical), and Telecom, which tempers the enthusiasm. Keep in mind, the Outlook Rank does not include timing, momentum, or relative strength factors, but rather is a reflection of the fundamental expectations of individual stocks aggregated by sector.

Stock and ETF Ideas:

Our Sector Rotation model, which appropriately weights Outlook, Bull, and Bear scores in accordance with the overall market’s prevailing trend (bullish, neutral, or defensive), has flipped to a defensive bias and suggests holding Utilities, Healthcare, and Technology, in that order. (Note: In this model, we consider the bias to be defensive from a rules-based trend-following standpoint when SPY is below both its 50-day and 200-day simple moving averages.)

Other highly-ranked ETFs in SectorCast from the Utilities, Healthcare, and Technology sectors include Guggenheim Invest S&P 500 Equal Weight Utilities ETF (RYU), SPDR S&P Health Care Services ETF (XHS), and iShares North American Tech-Multimedia Networking (IGN). Other notable ETFs that are highly ranked in our quant model include US Global Jets ETF (JETS), which is mostly airlines, plus the Direxion All Cap Insider Sentiment Shares (KNOW), which tracks a Sabrient index, and some REIT funds, including the Global X SuperDividend REIT ETF (SRET).

For an enhanced sector portfolio that enlists some top-ranked stocks (instead of ETFs) from within the top-ranked sectors, some long ideas from Utilities, Healthcare, and Technology sectors include NextEra Energy (NEE), FirstEnergy Corp (FE), Jazz Pharmaceuticals (JAZZ), Chemed Corp (CHE), Facebook (FB), and Juniper Networks (JNPR). All are highly ranked in the Sabrient Ratings Algorithm.

If you prefer to take a neutral bias, the Sector Rotation model suggests holding Financial, Technology, and Healthcare, in that order. On the other hand, if you prefer a bullish stance on the market, the model suggests holding Financial, Healthcare, and Technology, in that order.

IMPORTANT NOTE: I post this information periodically as a free look inside some of our institutional research and as a source of some trading ideas for your own further investigation. It is not intended to be traded directly as a rules-based strategy in a real money portfolio. I am simply showing what a sector rotation model might suggest if a given portfolio was due for a rebalance, and I may or may not update the information each week. There are many ways for a client to trade such a strategy, including monthly or quarterly rebalancing, perhaps with interim adjustments to the bullish/neutral/defensive bias when warranted -- but not necessarily on the days that I happen to post this weekly article. The enhanced strategy seeks higher returns by employing individual stocks (or stock options) that are also highly ranked, but this introduces greater risks and volatility. I do not track performance of the ETF and stock ideas mentioned here as a managed portfolio.

Disclosure: Author has no positions in stocks or ETFs mentioned.

Disclaimer: This newsletter is published solely for informational purposes and is not to be construed as advice or a recommendation to specific individuals. Individuals should take into account their personal financial circumstances in acting on any rankings or stock selections provided by Sabrient. Sabrient makes no representations that the techniques used in its rankings or selections will result in or guarantee profits in trading. Trading involves risk, including possible loss of principal and other losses, and past performance is no indication of future results.