Sector Detector: No rate hike translates into heightened wall of worry

The Fed’s decision to not raise the fed funds rate at this time was ultimately taken by the market as a no-confidence vote on our economic health, which just added to the fear and uncertainty that was already present. Rather than cheering the decision, market participants took the initial euphoric rally as a selling opportunity, and the proverbial wall of worry grew a bit higher. Nevertheless, keep in mind that markets prefer to climb a wall of worry rather than ride a crowded bandwagon, and I continue to envision higher levels for the markets after further backing-and-filling and testing of support levels (perhaps even including the August lows).

In this weekly update, I give my view of the current market environment, offer a technical analysis of the S&P 500 chart, review our weekly fundamentals-based SectorCast rankings of the ten U.S. business sectors, and then offer up some actionable trading ideas, including a sector rotation strategy using ETFs and an enhanced version using top-ranked stocks from the top-ranked sectors.

Market overview:

Well, the fed funds futures hit the mark once again, as only a 19% chance of a September hike was indicated going into the Fed’s decision, reflecting the sentiment of seasoned institutional traders who were putting real-money bets on the outcome rather than simply pontificating about it. And indeed, Chairwoman Yellen and the gang decided that potential overseas contagion slowing down our recovery was too much of a risk to begin tightening now. As Yellen said, the path of tightening is more important than the timing. As for the Fed’s two primary objectives, the unemployment rate is cooperating, having dipped to 5.1% in August, but inflation is nowhere near the 2% target and in fact is bordering on deflation -- although admittedly much of that is due to oversupply in oil and other commodities, while housing prices and rents are way up.

Nevertheless, three committee members felt that lower unemployment and other economic improvements should outweigh headwinds from abroad and tumultuous markets, while another instead thinks we will need negative interest rates soon to provide new stimulus. As a reminder, the Fed last raised rates in 2006, and their zero interest rate policy (aka ZIRP) has been in place since 2008 (seven years!).

The 10-year yield closed Friday at 2.13%, which is right where it was two weeks earlier. It rose to above 2.30 briefly last Wednesday in anticipation of possible Fed action, but then quickly fell as capital flowed right back in to buy up Treasuries. Fed funds futures currently place the odds of a 1/4 point increase at 14% for October, 40% for December, and 50% for January (i.e., a coin toss).

It has been 3 years since Abenomics ushered in the era of currency devaluations and the race to debase. As Jeffery Gundlach of DoubleLine Capital pointed out, we continue to see multiyear lows in commodity prices, junk bond prices, and emerging market equity prices -- largely driven by weakness in China -- while US equities still hover near their highs, which he sees as out of sync. He believes that global growth must improve before the Fed will be ready to raise rates.

Scott Minerd of Guggenheim reminds us that twice in the past 30 years the Fed has prematurely abandoned tightening in the face of market turmoil. In 1987 after the stock market crash, it reversed course on rate hikes, and then in 1998 after the Long-Term Capital Management debacle, it abandoned planned rate hikes to stabilize markets and stave off a global financial crisis. In both cases, the result was over-inflated asset prices that ultimately destabilized the economy and led to recession.

Last week, the Fed simply could not justify a rate increase (and a further strengthened dollar) given the very real threat of deflation hanging over us. Moreover, the world is adding to leverage rather than deleveraging, with global debt/GDP surging to 290%, led by China and emerging markets, and international reserves are falling. Nevertheless, I think the Fed will be vigilant to act if asset bubbles in real estate or equities become egregious.

In any case, the Fed is not the entity that should be put in the situation of saving the economy. This is the job of elected leaders with legislative powers. As the G20 asserted at its recent meeting, monetary policy alone is insufficient, and real structural reforms must be instituted to offer a long-term sustainable boost to GDP and to stimulate corporate top-line growth.

A major event that should not be minimized is the sudden flood of refugees from Syria seeking sanctuary and opportunity in Western Europe. Images from Germany are broadcast worldwide of their citizens welcoming refugees with open arms, thus indirectly encouraging ever-growing hordes who might not have otherwise risked the arduous trek, overrunning the undermanned borders and limited resources of its less hospitable neighbors, and ultimately leading Germany to plead for other countries to pitch in to support the overwhelming demand. This is not just a humanitarian crisis for an incredible number of displaced Muslims but also a major security problem for the receiving countries. Extremists can easily mix in, thus gaining entrance into well-intentioned but vulnerable Western societies, and even moderates among the refugees (particularly undereducated young men) are at elevated risk of being radicalized later if they become disillusioned by an inability to assimilate in their sanctuary countries. And not to be overlooked is the impact of this resource drain on Europe’s already-sluggish economic recovery (and indeed I think the Fed did not overlook it during this month’s meeting).

The CBOE Market Volatility Index (VIX), a.k.a. fear gauge, closed Friday at 22.28, which is back above the 20 panic threshold, after having briefly dropped below during the initial moments after the Fed announcement on Thursday.

Nevertheless, I will reiterate that on balance there are still more reasons for U.S. stocks to rise than to fall over the next 12 months, especially when you compare the various investment alternatives. Keep in mind; although earnings growth for Q2 was anemic, the Energy sector was by far the main culprit at work. Strip away Energy and the S&P 500 would have been up more like +5.2% in EPS and +1.3% in revenues. Reports on payrolls, retail sales, and construction have been encouraging. In addition, the ultra-low borrowing rates continue to be a boon for stock buybacks, with multinationals like Apple (AAPL) raising billions in eurozone debt to fund buybacks.

SPY chart review:

The SPDR S&P 500 Trust (SPY) closed Friday at 195.45, which is about 8% off its 52-week high from summer. After an attempt to bounce from the big August selloff, SPY remains well below its 200-day simple moving average, and as I suspected, the 200 price level (corresponding to 2,000 on the S&P 500) was tested for resistance (three times), and the 204 level (former support line for the long sideways consolidation from February through late-August) was approached in the initial moments after the Fed announcement on rates. During these tests of resistance, higher lows and a potentially bullish ascending triangle were forming, but on Friday it broke bearishly to the downside of the rising support line, and now it is likely we will see more backing-and-filling and perhaps retests of recent support at 191 -- and perhaps even the August intraday low near 182. Oscillators RSI, MACD, and Slow Stochastic are pointing down bearishly from neutral levels, although none are in overbought territory.

Latest sector rankings:

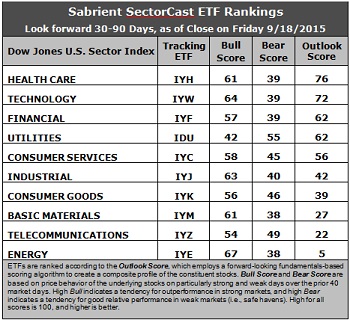

Relative sector rankings are based on our proprietary SectorCast model, which builds a composite profile of each equity ETF based on bottom-up aggregate scoring of the constituent stocks. The Outlook Score employs a forward-looking, fundamentals-based multifactor algorithm considering forward valuation, historical and projected earnings growth, the dynamics of Wall Street analysts’ consensus earnings estimates and recent revisions (up or down), quality and sustainability of reported earnings (forensic accounting), and various return ratios. It helps us predict relative performance over the next 1-3 months.

In addition, SectorCast computes a Bull Score and Bear Score for each ETF based on recent price behavior of the constituent stocks on particularly strong and weak market days. High Bull score indicates that stocks within the ETF recently have tended toward relative outperformance when the market is strong, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well (i.e., safe havens) when the market is weak.

Outlook score is forward-looking while Bull and Bear are backward-looking. As a group, these three scores can be helpful for positioning a portfolio for a given set of anticipated market conditions. Of course, each ETF holds a unique portfolio of stocks and position weights, so the sectors represented will score differently depending upon which set of ETFs is used. We use the iShares that represent the ten major U.S. business sectors: Financial (IYF), Technology (IYW), Industrial (IYJ), Healthcare (IYH), Consumer Goods (IYK), Consumer Services (IYC), Energy (IYE), Basic Materials (IYM), Telecommunications (IYZ), and Utilities (IDU). Whereas the Select Sector SPDRs only contain stocks from the S&P 500, I prefer the iShares for their larger universe and broader diversity. Fidelity also offers a group of sector ETFs with an even larger number of constituents in each.

Here are some of my observations on this week’s scores:

1. Healthcare comes back to the top spot this week with an Outlook score of 76, primarily due to net positive sentiment among Wall Street analysts (net revisions to earnings estimates) -- even though the overall trend continues to be skewed toward cuts to forward estimates, so a lack of cuts earns a sector a good relative score. Forward long-term growth rate and return ratios are also solid, although the forward P/E is a little pricey (nearly 17x). Technology holds the second spot with a score of 72 on the strength of its strong return ratios and forward long-term growth rate, followed by Financial and Utilities. Financial has the lowest (attractive) forward P/E (less than 14x). Consumer Services (Discretionary/Cyclical) rounds out the top five, followed by Industrial in sixth.

2. Energy remains at the bottom with an Outlook score of 5 as the sector scores among the worst in all factors of the GARP model across the board -- although insider sentiment (open market buying among corporate executives and directors) is perking up. In particular, the sector still sports a negative forward long-term growth rate and low return ratios, as well as the highest forward P/E (over 23x). (However, note that the refining & marketing segment remains an area of strength within the sector.) Telecom takes the other spot in the bottom two with an Outlook score of 22, given its poor return ratios and elevated forward P/E (about 19x).

3. Looking at the Bull scores, Energy displays the top score of 67, followed by Technology and Industrial. Utilities is the lowest at 42. The top-bottom spread has widened to a robust 25 points, which reflects low sector correlations on particularly strong market days, which is good. It is generally desirable in a healthy market to see low correlations reflected in a top-bottom spread of at least 20 points, which indicates that investors have clear preferences in the stocks they want to hold (rather than broad risk-on behavior).

4. Looking at the Bear scores, Utilities displays the top score of 55, which means that stocks within this sector have been the preferred safe havens (relatively speaking) on weak market days. However, this score is down substantially from 73 just a few weeks ago. Basic Materials and Energy score the lowest at 38, as investors flee these sectors during market weakness. The top-bottom spread is 17 points, which reflects relatively low sector correlations on particularly weak market days. Ideally, certain sectors will hold up relatively well while others are selling off (rather than broad risk-off behavior), so it is generally desirable in a healthy market to see low correlations reflected in a top-bottom spread of at least 20 points.

5. Healthcare displays the best all-around combination of Outlook/Bull/Bear scores, while Energy is the worst. Looking at just the Bull/Bear combination, Energy scores the highest, but Telecom is close behind and displays better Bull/Bear balance, indicating superior relative performance (on average) in extreme market conditions (whether bullish or bearish), while Financial is the worst.

6. Dare I say, this week’s fundamentals-based Outlook rankings have a more bullish look, with five of the top six comprising all-weather and high-performing Healthcare plus economically-sensitive Technology, Financial, Consumer Services (Discretionary/Cyclical), and Industrial, while defensive sectors Utilities and Consumer Goods (Staples/Noncyclical) have fallen somewhat. On the other hand, our Net Revisors score, which reflects the mood of Wall Street analysts, continues to show very little in the way of positive earnings revisions, which is worrisome. Keep in mind, the Outlook Rank does not include timing, momentum, or relative strength factors, but rather is a reflection of the fundamental expectations of individual stocks aggregated by sector.

Stock and ETF Ideas:

Our Sector Rotation model, which appropriately weights Outlook, Bull, and Bear scores in accordance with the overall market’s prevailing trend (bullish, neutral, or defensive), has reflected a defensive bias since August 20 and suggests holding Utilities, Consumer Services (Discretionary/Cyclical), and Telecom, in that order. (Note: In this model, we consider the bias to be defensive from a rules-based trend-following standpoint when SPY is below both its 50-day and 200-day simple moving averages.)

Other highly-ranked ETFs in SectorCast from the Utilities, Consumer Services (Discretionary/Cyclical), and Telecom sectors include Fidelity MSCI Utilities Index ETF (FUTY), PowerShares Dynamic Leisure & Entertainment Fund (PEJ), and Fidelity MSCI Telecommunications Services Index ETF (FCOM).

But overall, our rankings continue to indicate that the best ETF bet right now might be the US Global Jets ETF (JETS), which is mostly airlines -- it scores a perfect 100 in its Outlook rank, plus solid scores in both its Bull and Bear ranks. Also rising to near the top of our ETF rankings are the Global X SuperDividend REIT ETF (SRET), Market Vectors Biotech ETF (BBH), and First Trust NASDAQ Technology Dividend Index Fund (TDIV). In addition, the First Trust Long Short Equity ETF (FTLS), which licenses our Earnings Quality Rank (a quant model we developed together with our forensic accounting subsidiary Gradient Analytics) for idea generation.

For an enhanced sector portfolio that enlists some top-ranked stocks (instead of ETFs) from within the top-ranked sectors, some long ideas from Utilities, Consumer Services (Discretionary/Cyclical), and Telecom sectors include Atmos Energy Corp (ATO), NextEra Energy (NEE), Expedia (EXPE), Delta Air Lines (DAL), RingCentral (RNG), and CenturyLink (CTL). All are highly ranked in the Sabrient Ratings Algorithm.

If you prefer to take a bullish bias, the Sector Rotation model suggests holding Technology, Healthcare, and Industrial, in that order. But if you prefer a neutral stance on the market, the model suggests holding Healthcare, Technology, and Financial, in that order.

IMPORTANT NOTE: I post this information each week as a free look inside some of our institutional research and as a source of some trading ideas for your own further investigation. It is not intended to be traded directly as a rules-based strategy in a real money portfolio. I am simply showing what a sector rotation model might suggest if a given portfolio was due for a rebalance, and I may or may not update the information each week. There are many ways for a client to trade such a strategy, including monthly or quarterly rebalancing, perhaps with interim adjustments to the bullish/neutral/defensive bias when warranted -- but not necessarily on the days that I happen to post this weekly article. The enhanced strategy seeks higher returns by employing individual stocks (or stock options) that are also highly ranked, but this introduces greater risks and volatility. I do not track performance of the ETF and stock ideas mentioned here as a managed portfolio.

Disclosure: Author has no positions in stocks or ETFs mentioned.

Disclaimer: This newsletter is published solely for informational purposes and is not to be construed as advice or a recommendation to specific individuals. Individuals should take into account their personal financial circumstances in acting on any rankings or stock selections provided by Sabrient. Sabrient makes no representations that the techniques used in its rankings or selections will result in or guarantee profits in trading. Trading involves risk, including possible loss of principal and other losses, and past performance is no indication of future results.