Sector Detector: Rankings take a bearish turn as the flight to safety solidifies

Although the large caps set new highs early on Friday, small caps and NASDAQ have not come close to their prior highs. Friday closed with extreme weakness across the board, and it was on high volume. The technical picture and our fundamentals-based sector rankings have both taken a bearish turn, so we might see more weakness ahead. But longer term, I expect higher prices, so an extended pullback likely will turn into a good buying opportunity. In any case, the rotation from speculative stocks into higher quality companies should continue, so it’s best not rush back into the lower quality speculative stocks on this selloff.

Although the large caps set new highs early on Friday, small caps and NASDAQ have not come close to their prior highs. Friday closed with extreme weakness across the board, and it was on high volume. The technical picture and our fundamentals-based sector rankings have both taken a bearish turn, so we might see more weakness ahead. But longer term, I expect higher prices, so an extended pullback likely will turn into a good buying opportunity. In any case, the rotation from speculative stocks into higher quality companies should continue, so it’s best not rush back into the lower quality speculative stocks on this selloff.

Indeed, the momentum darlings from biotech, internet, and social media have taken a severe hit. And many of the highly popular but lower quality/overvalued stocks like Netflix (NFLX) and Tesla Motors (TSLA) have been taken out to the wood shed. During cleansing periods like this, however, the market will often throw the proverbial baby out with the bathwater. Sabrient favorite Jazz Pharmaceuticals (JAZZ) is an example. It is still in great shape fundamentally, but it is either guilty by association (with biotech) or the momentum traders (weak hands) are protecting their fabulous profits, or both. Whatever the reason, longer-term investors are getting a new chance to scoop up at reduced prices high quality companies like JAZZ that had become momentum favorites.

Among the ten U.S. business sectors, Utilities has solidified its position as the year-to-date leader, up +8.2% and hitting a new intraday high on Friday and closing very near its all-time closing high.

Examining ETF money flows, the first two months of Q1 saw positive inflows for fixed income funds and negative for equity funds. Even during the big rally in stocks during February, capital did not rotate out of bonds as one might have expected. But then March saw a reversal, led by traditionally bullish sectors Financial, Technology, and Basic Materials, even though the major indexes did not advance. Of course, last week was a different story as equity funds bled redemptions. So, in retrospect, one might wonder whether February actually a bull trap.

From the standpoint of fundamental strength, the U.S. economy is strong enough to tolerate rising interest rates, but most other countries are not. Japan is implementing quant easing and Europe will soon see it, too. China is in the unenviable position of needing to address its credit bubble while still stimulating the economy. For now, it is targeting tax breaks for small businesses, replacing shantytowns with “social housing,” and funding railway construction projects. But economists are predicting U.S. annualized GDP growth upwards of 3% for the balance of this year and next. And the Dow Jones Transportation Average has been quite strong, which bodes well longer term for the Industrial sector and the economy in general.

The CBOE Market Volatility Index (VIX), a.k.a. “fear gauge,” closed Friday at 13.96, which is still quite low despite the market weakness on Friday. It has remained below 15 for the past couple of weeks, indicating an absence of significant investor trepidation.

SPY chart review:

The SPDR S&P 500 Trust (SPY) closed Friday at 186.40, and it was up for the week despite Friday’s weakness. SPY hit a new all-time intraday high on Friday of 189.70 and a new closing high on Wednesday of 188.88. But Friday’s action gave a nasty bearish engulfing candle on high volume (more than twice Thursday’s volume), and price now sits right at the fragile 20-day simple moving average. The bearish descending triangle pattern I spoke of last week instead turned out to be yet another bull flag breakout. But things suddenly look much more ominous.

Oscillators RSI and MACD are in neutral territory but pointing down, and Slow Stochastic is overbought and pointing down, as well. It appears that the path of least resistance right now is down, but there will be plenty of support levels to cushion the fall, starting with the 50-day SMA (near 184), the 100-day SMA (near 183), round-number support at 180, and the bottom of the rising channel (currently near 178), and finally the 200-day SMA (near 176).

Also, if you look at a chart of the Russell 2000 small cap index, it is threatening to violate the bottom of its rising channel, so a confirmed break down early this week will further strengthen the short-term bear case.

Latest sector rankings:

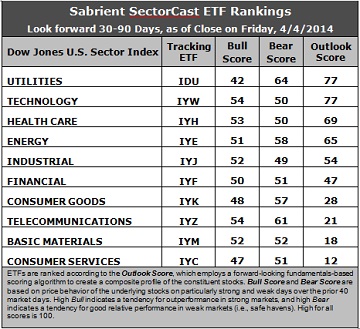

Relative sector rankings are based on our proprietary SectorCast model, which builds a composite profile of each equity ETF based on bottom-up aggregate scoring of the constituent stocks. The “Outlook Score” employs a forward-looking, fundamentals-based multifactor algorithm considering forward valuation, historical and projected earnings growth, the dynamics of Wall Street analysts’ consensus earnings estimates and recent revisions (up or down), quality and sustainability of reported earnings (forensic accounting score), and various return ratios. It helps us predict relative performance over the next 1-3 months.

In addition, SectorCast computes our Bull Score and Bear Score for each ETF based on recent price behavior of the constituent stocks on particularly strong and weak market days. High Bull score indicates that stocks within the ETF have tended recently toward relative outperformance when the market is strong, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well (“safe havens”) when the market is weak.

Outlook Score is forward-looking while Bull and Bear are backward-looking. As a group, these three scores can be helpful for positioning a portfolio for a given set of anticipated market conditions. Of course, each ETF holds a unique portfolio of stocks and position weights, so the sectors represented will score differently depending upon which set of ETFs is used. For Sector Detector, I use the iShares that represent the ten major U.S. business sectors: Financial, Technology, Industrial, Healthcare, Consumer Goods, Consumer Services, Energy, Basic Materials, Telecom, and Utilities. Whereas the Select Sector SPDRs only contain stocks from the S&P 500, I prefer the iShares for their larger universe and broader diversity. Fidelity also offers a group of sector ETFs with an even larger number of constituents in each.

Here are some of my observations on this week’s scores:

1. Utilities (IDU) has suddenly leapt to the top of the rankings, scoring a 77, which is a bearish development. However, it is really in a dead heat with Technology (IYW), so we’ll see how the rankings unfold during the next couple of weeks. The Utilities sector displays a reasonably low forward P/E, but most notable is the strongly positive sentiment displayed by sell-side analysts (net positive revisions to forward earnings estimates) as well as improving sentiment among insiders. Technology generally displays solid factor scores across the board, with a strong forward long-term growth rate, a reasonable forward P/E, and the highest return ratios; however, it has slipped a bit in sentiment among sell-side analysts and insiders. Healthcare (IYH) is third at 69, followed by Energy (IYE) and Industrial (IYJ).

2. Consumer Services (IYC) stays in the cellar with an Outlook score of 12, even though it has the highest forward long-term growth rate and Wall Street’s prior deluge of negative earnings revisions has largely subsided. Basic Materials (IYM) is now in the second worst spot, scoring 18 this week, primarily because improving sentiment among sell-side analysts and insiders has boosted the Outlook score for perennial weakling Telecommunications (IYZ).

3. Overall, this week’s rankings have taken a bearish turn, with Utilities rising to the top and with Financial and Basic Materials showing marked weakness. Of course, Utilities has been the leading sector from a performance standpoint during Q1, and now our Outlook score is supporting it -- at least temporarily -- primarily due to recent trends in analyst earnings revisions. Notably, Financial (IYF) saw its score fall by 26 points from last week, primarily due to its relatively poor showing in sell-side analyst revisions as we head into the next earnings reporting season. However, sometimes these are just one-week anomalies, so we’ll see how persistent this score is over the coming weeks.

4. Looking at the Bull scores, Technology and Telecom share the lead with a score of 54, while Utilities is by far the laggard with a score of 42. Consumer Goods and Consumer Services are the only other sectors scoring below 50. The top-bottom spread is still 12 points, reflecting moderately high sector correlations on particularly strong market days. It is generally preferable in a healthy market to see the top-bottom spread approach 20 points, which indicates that investors have clear preferences in the stocks they want to hold, rather than a “all boats lifted in a rising tide” mentality that we saw during 2013.

5. Looking at the Bear scores, Utilities scores 64, which means that stocks within this defensive sector are the preferred “safe havens” on recent weak market days. No surprise. Telecom also scored above 60 this week. Industrial scores the lowest at 49. The top-bottom spread is now only 15 points, which is showing somewhat elevated sector correlations on weak market days compared with the scores in recent weeks. It is generally preferable in a healthy market to see a top-bottom spread of 20 points.

6. Utilities displays the best all-weather combination of Outlook/Bull/Bear scores, while Consumer Services is the worst. Looking at just the Bull/Bear combination, Telecom is the clear leader, indicating superior relative performance (on average) in extreme market conditions, while Consumer Services scores the lowest, indicating investor avoidance (relatively speaking) during extreme conditions. All of this is bearish.

These Outlook scores represent the view that Utilities and Technology sectors are relatively undervalued, while Consumer Services and Materials may be relatively overvalued based on our 1-3 month forward look.

Stock and ETF Ideas:

Our Sector Rotation Model, which appropriately weights Outlook, Bull, and Bear scores in accordance with the overall market’s prevailing trend (bullish, neutral, or bearish), suggests holding Technology (IYW), Healthcare (IYH), and Energy (IYE) in the current bullish climate. (We consider the bias to be bullish from a rules-based standpoint because the SPY is still above its 50 and 200-day simple moving averages.)

However, if you are more comfortable moving to a neutral bias, the model suggests holding Technology (IYW), Healthcare (IYH), and Utilities (IDU).

Other ETFs that are ranked high by our algorithm from the Technology, Energy, Healthcare, and Utilities sectors include PowerShares Dynamic Semiconductors Portfolio (PSI), Guggenheim Solar ETF (TAN), iShares Global Healthcare ETF (IXJ), PowerShares S&P SmallCap Utilities (PSCU).

For an “enhanced” sector portfolio that employs top-ranked stocks (instead of ETFs) from within Tech, Healthcare, and Energy, some long ideas include SanDisk (SNDK), Western Digital (WDC), Jazz Pharmaceuticals (JAZZ), Allergan (AGN), Helmerich & Payne (HP), and Phillips 66 (PSX). All are ranked highly in the Sabrient Ratings Algorithm and also score within the top two quintiles of our Earnings Quality Rank (EQR), which is a pure accounting-based risk assessment signal based on the forensic accounting expertise of our subsidiary Gradient Analytics. We have found EQR quite valuable for helping to avoid performance-offsetting meltdowns in our model portfolios.

On the other hand, if you have a bearish outlook on the market, our Sector Rotation Model would suggest holding Utilities (IDU), Energy (IYE), and Telecom (IYZ).