Acquisition accounting can temporarily mask financial weakness

by Bradley Cipriano, CPA

by Bradley Cipriano, CPA

Equity Analyst, Gradient Analytics LLC (a Sabrient Systems company)

As interest rates remain at historic lows, mergers and acquisitions (M&A) have soared in recent years. With the rise in M&A activity comes a rise in accounting complexity, introducing a plethora of ways that management can cosmetically improve their as-presented results – and mislead investors. Gradient Analytics specializes in forensic accounting analysis that helps to uncover these types of financial shenanigans, including overstated assets and revenues, understated liabilities and expenses, and weakening earnings quality. This type of analysis is useful for both vetting long positions and generating short ideas.

In this article, I describe four acquisitions that we believe were used to obscure underlying financial weakness at the parent company by temporarily shoring up growth and earnings. Key takeaways are how management can utilize acquisitions, purchase price accounting, and non-GAAP adjustments to optically improve their as-presented results. In each case, the theme will remain consistent: the acquiring company was under fundamental business stress.

The subject transactions include:

- SodaStream (SODA) acquisition of its distributors in 2012 and 2013

- SNC-Lavalin (SNC) acquisition of WS Atkins in 2017

- Belden Inc. (BDC) acquisitions in 2017 and 2018

- The Walt Disney Corporation (DIS) acquisition of 21st Century Fox in 2019

SodaStream pads revenues by selling inventory twice:

I begin my discussion with the interesting case study of SodaStream’s (SODA) acquisition of some of its distributors. In the period between 2012-2013, SODA exhibited erratic and slowing sales, a warning sign that there was an underlying weakness at the firm. Gradient believes that management tried to obscure this weakness in its business through acquisition accounting. Our concerns are based on the unusual acquisition of three separate distributors in 2012 and 2013. What made these acquisitions unique was that a portion of the consideration paid by SODA was the cancelation of receivables due to the parent company from these distributors. In other words, SODA had previously sold inventory to these distributors and booked revenue as accounts receivable (prior to actual payment), and then it acquired the distributors and effectively forgave the outstanding receivables balances due.

So, what’s wrong with that, you may ask? Well, the acquisition of the distributors allowed SODA to reacquire inventory that was recently sold, giving the company the opportunity to sell the same inventory twice. We view this as a source of unsustainable growth since the company would not be able to repeat this process indefinitely. To do so would require SODA to eventually acquire all its distributors. To top it off, management reported goodwill with these acquisitions, implying that it paid a premium for the inventory that it had previously sold to the distributors.

We suspect that SODA’s management likely reacquired these distributors because sales in their respective regions had slowed. If the distributors were unable to resell the inventory, they likely would have been unable to pay off the receivables balance due to SODA. This then would have resulted in a write-off of uncollectable receivables and increased losses reported in SODA’s earnings. Acquiring the distributors and forgiving their outstanding receivables temporarily avoided the recognition of these losses.

However, SODA’s acquisition of its distributors only temporarily delayed the inevitable. In Q4 2013, the firm reported that gross margins had declined 1,060 bps YOY, driven in large part by inventory discounting and impairments. Nonetheless, management continued its strategy of acquiring distributors, as the company reported in early 2014 that it would pay $7.3 million to reacquire $6.4 million of soda maker inventories – effectively paying a 14.0% premium to reacquire the company’s own goods.

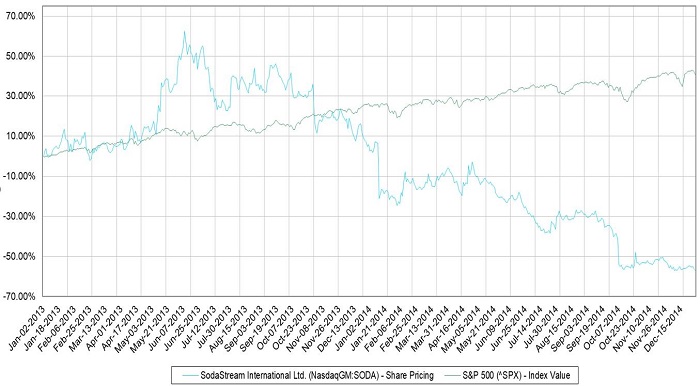

Clearly, at the beginning of 2014, SODA was under fundamental business stress. Unfortunately for investors, the common warning signs of a deteriorating business, such as growing losses and slowing sales, had been temporarily obscured by management’s clever acquisition accounting. Eventually management could no longer hide the company’s woes as margin contraction was coupled with topline weakness throughout 2014. In the year following the acquisitions, SODA’s stock materially underperformed relative to the S&P 500 (pictured below).

SNC-Lavalin hides declining sales and obscures risk exposure with an acquisition:

My next example details how management at SNC-Lavalin Group Inc. (SNC), a Canadian construction and engineering firm, utilized a large acquisition in 2017 to obscure both a long-running trend of declining sales as well as growth in higher risk construction contracts. Prior to the acquisition of WS Atkins in Q3 2017, SNC had reported that its sales had declined on a YOY basis for the prior seven consecutive quarters. The firm also reported that over 50% of its backlog was composed of high risk fixed-price contracts, which essentially pass the financing risk from the client to the contractor. Declining sales coupled with growth in risky contracts signals that SNC was likely struggling to win new contracts. Investors should be wary of investing in a company that had shrinking sales while concurrently increasing its own risk exposure.

Cognizant of these unfavorable trends, the acquisition of WS Atkins helped SNC accomplish two things: 1) improve the optics of its topline growth rate and 2) lower the firm’s as-presented risk exposure to fixed-price contracts. Since WS Atkins was a large engineering firm, its consolidation into SNC’s financials would help offset the steep decline in SNC’s sales. Moreover, its backlog of uncompleted projects could be used to dilute the concentration of SNC’s risky fixed-price contracts.

Following the completion of the acquisition in Q3 2017, SNC reported that its as-presented sales had increased 21.4% YOY, a remarkable improvement from the 8.0% YOY decline in the prior quarter. However, since WS Atkins sales were clearly broken out in the notes of SNC’s financial statements, it was relatively easy for investors to see that organic sales had declined by 15.7% YOY during the quarter. This trend continued into Q4 2017, as reported sales increased 32.0% YOY while organic sales declined 13.0% YOY.

Luckily for management, the adoption of a new revenue standard (IFRS 15) was on the horizon, which allowed for further obfuscation of its topline growth rate. Following the adoption of the new revenue standard in Q1 2018, management subsequently reshuffled its segment disclosures. Paired with a recent acquisition, the reshuffling of segment disclosures made any YOY comparisons of organic growth nearly impossible. The following exchange during SNC’s Q1 2018 Conference Call further highlights the difficulty that an analyst had in deriving the firm’s organic growth rate:

Analyst: “Could you provide some color… around organic growth. I mean, if we strip out acquisitions and the benefit from acquisitions, were you able to generate positive organic growth this quarter?”

CEO Neil A. Bruce: “Well, I think if we look at it from the revenue perspective, fairly flat.”

CEO Bruce’s comment that organic sales were “fairly flat” in Q1 2018 suggested a stark improvement from the -13.0% and -15.7% YOY declines in organic sales during Q4 and Q3 2017, respectively. However, while management refused to disclose the actual organic growth figures on its Q1 2018 Conference Call or Earnings Release, the firm’s auditors likely necessitated that it had to be disclosed in SNC’s filings. As a result, the only place that the firm disclosed acquired sales was on the second to last page (page 79/80) in its Q1 2018 Management's Discussion and Analysis (MD&A) report. In an often-ignored disclosure (note 13, Controls and Procedures), the company stated: “Atkins … represents 35% of revenues … of the consolidated figures reported in the unaudited interim condensed consolidated financial statements for the first quarter of 2018.”

Following this disclosure and backing out acquired sales from total Q1 2018 revenues, it was clear that organic sales actually declined 14.5% YOY in Q1 2018 (in line with Q4 and Q3 2017 results). This decline in sustainable sales was a far cry from CEO Bruce’s original statement that organic sales were “fairly flat.” Clearly, management had obfuscated its reported results by reshuffling its segment disclosures. Unfortunately, investors that relied on management’s statements on the Conference Call would have been unaware of the anemic topline trends at SNC.

In addition to the decline in organic sales, SNC was also able to cosmetically improve its as-presented risk exposure with its WS Atkins acquisition. As mentioned earlier, the majority of the firm’s backlog was composed of high risk fixed-priced contracts. Specifically, in Q4 2017, SNC reported that 52.5% of its $10.4 billion of backlog was composed of fixed-price contracts. However, just three-months later in Q1 2018, the firm reported that just 30.4% of its $13.3 billion backlog was composed of fixed-price contracts. As we will show, management was able to dramatically improve its as-presented risk exposure by changing the definition of its recently acquired backlog.

Following the adoption of IFRS 15 in Q1 2018, management utilized the opportunity to change how it defined its own backlog. Going forward, the firm began to include all of WS Atkins’ backlog within reimbursable contracts. This was a peculiar decision by management, considering that the firm disclosed in its Q1 2018 MD&A report that Atkins’ backlog included fixed-price contracts. In other words, SNC was including fixed-price contracts within reimbursable contracts, which materially lowered the firm’s as-presented risk exposure to fixed-price contracts.

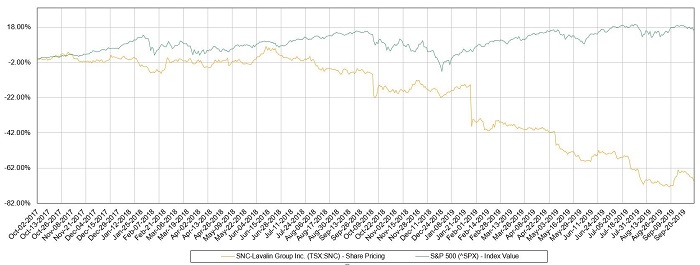

In early 2018, investors were largely unaware of SNC’s concerning trends. Management had utilized an acquisition and the adoption of a new accounting standard to obscure its growth rate and risk exposure. Unfortunately, this only temporarily supported the firm’s financials. But shortly after the acquisition had fully annualized, SNC’s stock price began to reflect reality, as the firm was no longer able to hide the growing losses from fixed-price contracts, nor the persistent decline in consolidated sales.

Belden finds a way to hit executive bonus targets:

The next example of financial window dressing through M&A illustrates how management of a roll-up company was able to support adjusted EBITDA with acquisitions. As I will discuss, the firm was able to maintain a stable adjusted EBIDA margin by acquiring firms and instituting aggressive restructuring and integration programs, which were subsequently excluded from adjusted EBITDA. A possible motive for this type of activity was that 25% of the CEO’s bonus was based on adjusted EBITDA. Our analysis revealed that management was able to just barely meet its executive bonus targets in 2017 and 2018 with increasingly vague acquisition-related adjustments.

Belden Inc. (BDC) operates in broadcasting, an industry that has been in secular decline. With the rise in streaming and direct-to-consumer content, the firm was struggling to grow sales. Against this type of backdrop, it is not surprising that management would look to engage in accounting games to help temporarily prop up its earnings. We note that the firm had a habit of acquiring companies and then immediately implementing restructuring and integration programs, a vague term that allowed management to exclude a variety of costs from the firm’s key performance metrics.

To that very point, in 2017, BDC acquired a company for $171.3 million and then immediately implemented a large restructuring and integration program. While the restructuring and integration program was broad based across multiple segments, the size of the program appeared excessive. For instance, BDC ended up incurring (and excluding from adjusted EBITDA) $48.9 million in restructuring, integration, and acquisition related expenses during the year, giving a large boost to its adjusted EBITDA. As outsiders, we are unable to determine how much of the restructuring, integration, and acquisition charges were non-recurring. However, we do note that without the $48.9 million adjustment in 2017, management would have missed the minimum bonus threshold for adjusted EBITDA by $38.5 million (i.e., the target was achieved by a slim $10.4 million).

Furthermore, in 2018, BDC acquired another company for $104.5 million and then excluded $72.1 million in restructuring, integration and acquisition costs during the year. BDC also added back $6.6 million in deferred-revenue adjustments during this period, which was an aggressive non-GAAP adjustment as it represents sales that would have been accrued had the subsidiary not been acquired. Since adjustments to sales flow directly to the bottom-line, they often have a material impact on earnings. In aggregate, these acquisition-related adjustments provided a $78.7 million benefit to BDC’s adjusted EBITDA in 2018. As a result, management was able to exceed it 2018 bonus target by just $7.7 million. Clearly, without the material acquisition related adjustments to EBITDA, management would have missed the bonus threshold by a wide margin.

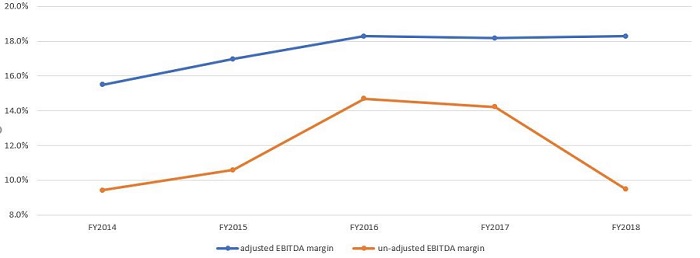

As pictured below, the firm’s adjusted EBITDA margin in 2017 and 2018 remained stable YOY while un-adjusted EBITDA margin declined on a YOY basis in 2017 and 2018. So, while the unadjusted EBITDA margin reveals a company that was under considerable stress, the firm’s adjusted EBITDA margin showcases a company with stable margins – all thanks to the acquisitions.

Disney’s acquisition of 21st Century Fox timed perfectly with favorable accounting change:

Our final case study describes the acquisition of 21st Century Fox (TFCF) by the Walt Disney Company (DIS). Disney’s fundamental headwinds have strengthened in recent years, as ESPN struggles with a decline in viewership while direct to consumer content has also challenged Disney’s dominance at the box office. This backdrop helps to explain why Disney appears to be engaging in low-quality accounting tricks.

Last year, Disney acquired TFCF in a blockbuster $69.5 billion deal. As a result of the acquisition, Disney acquired $20.1 billion in film and TV assets. However, a subtle accounting tactic that Disney appears to be using is that it has steadily decreased the value of the acquired TV and film assets since the acquisition closed in March 2019 (Q2 FY2019). For example, in the quarter after the acquisition closed (Q3 FY2019), Disney moved $2.1 billion of its acquired film and TV assets to goodwill. This had a large impact on Disney’s P&L going forward, since goodwill is not expensed. And management has continued to reduce the value of acquired TV and film assets in subsequent quarters by a total of $2.4 billion.

Gradient believes that this quarterly change in purchase price accounting has provided a one-time benefit to sequential earnings growth. Because the firm must amortize its acquired TV and film assets, lowering the value of those assets (and subsequently raising its goodwill) has therefore lowered the firm’s operating expenses. Although we are unable to ascertain the exact benefit that the change in purchase price accounting has had on Disney’s earnings growth, considering that the firm expensed $2.7 billion of content costs in the latest quarter, we believe that the $2.4 billion shift from capitalized content costs to goodwill was material to earnings.

A proxy for the potential earnings benefit was the decline in fair value step-up costs on DIS’s acquired TV and film assets. Fair value step-up costs are the acquisition-related adjustments that help to revalue any acquired asset from its original book value (which is often too low) up to the current fair market value at the time of the acquisition. Interestingly, Disney has excluded these step-up costs from its adjusted earnings as TFCF was not recognizing these additional costs in its historical financials (because TFCF had booked these TV and film assets at a lower cost, not at the latest fair market value). A decline in fair value step-up costs can signal that the value of acquired TV and film assets had fallen. We note that these charges declined 20.8% since the acquisition closed, signaling that the associated amortization of these assets likely declined at a similar rate. We view this as a source of unsustainable earnings growth as the benefit will begin to annualize next quarter (Q3 FY2020).

Lastly, Disney also early-adopted a new accounting standard in FY2020 on a prospective basis. The new standard allowed Disney to reclassify acquired TV rights to long-term assets. As a result, Disney moved $3 billion spent on TV rights to long-term assets in Q1 FY2020. Since this adjustment was done on a prospective basis, it had a material benefit to earnings growth as the comparative prior period was not restated. Moreover, it effectively shifted $3 billion of current-period expenses into the future. Disney reported in its most recent 10K filing that it expensed long-term TV and film assets over 19 years. In other words, $3 billion in annual expenses likely were suddenly transformed into an annual expense of just $157.9 million (a 95% reduction!). This one-time comparative benefit to earnings will annualize in FY2021. We wonder whether Disney will be able to continue to grow its earnings without the benefits of either acquisition accounting tricks or new accounting standards.

Staying vigilant in the face of evolving accounting shenanigans:

Ultimately, we at Gradient believe that each of these acquisition-related tactics are unsustainable and that the hidden financial weakness and fundamental business stress soon will become evident. Acquisitions often provide management multiple avenues to distort economic reality, so it is important for investors to thoroughly analyze the financial statements to bypass management’s accounting machinations. The Gradient Analytics team has extensive experience scrutinizing suspicious acquisitions. However, as clever accounting and reporting techniques evolve, we surely will encounter new ways that corporate management can utilize acquisitions to distort their as-presented results. As such, we continue to stand vigilant in support of our research clients.

Disclosure: At the time of this writing, the author held no positions in the securities mentioned.

Disclaimer: This newsletter is published solely for informational purposes and is not to be construed as advice or a recommendation to specific individuals. Individuals should take into account their personal financial circumstances in acting on any opinions, commentary, rankings, or stock selections provided by Sabrient Systems or its wholly owned subsidiary Gradient Analytics. Sabrient Systems makes no representations that the techniques used in its rankings or analysis will result in or guarantee profits in trading. Trading involves risk, including possible loss of principal and other losses, and past performance is no indication of future results.