Tax Implications of a President Clinton or a President Trump

By Nicholas Wesley Yee, CPA

By Nicholas Wesley Yee, CPA

Director of Research at Gradient Analytics

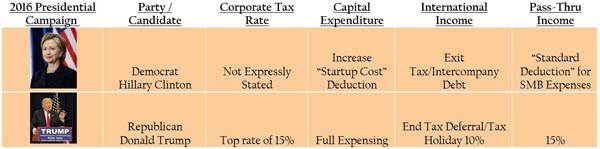

With the 2016 U.S. Presidential Elections coming into the final stretch, Gradient Analytics (a forensic accounting research firm, and a wholly-owned subsidiary of Sabrient Systems) recently published a tax issue commentary for its institutional clients. Included was discussion of the possible impact of each of the two major candidates on the tax code.

;

;