Gradient Insights: SPACs create new opportunities, but accounting tells help decipher quality

by Ian Striplin

by Ian Striplin

Equity Analyst, Gradient Analytics LLC (a Sabrient Systems company)

Special Purpose Acquisition Companies (SPACs) are publicly traded companies formed with the sole purpose of raising capital to acquire one or more unspecified businesses – which is why they are often called “blank-check” companies. They will often (but not always) have an espoused target market or desired exposure for which they are pursuing target companies, but little else in the way of visibility to indicate what an investor ultimately will own. The management team that forms the SPAC (the “sponsor”) funds the offering expenses in exchange for founders shares in the entity.

SPAC preference has been increasing in recent years as a way to get a private firm into public markets more expeditiously. We believe the change in preference likely tracks well to abundant liquidity, ultra-low interest rates, and lofty valuations in many equity markets. Therefore, we view the rash of SPAC deals announced this year as a cautionary signal that markets may have become overly speculative. The SPAC process can be instrumental in unlocking private “unicorn-style” valuations, and its rise in popularity is contemporaneous to growth in private equity demand. Furthermore, many of the headline-generating deals are principally based on a long growth runway into questionable TAM (total addressable market) estimations. However, the growing reliance on non-GAAP earnings and consistently unprofitable public companies illustrates that investors’ willingness to wait for a return appears greater than ever.

In this article, I highlight several considerations for evaluating SPAC investments both in the pre-target phase and following the release of audited financials. I discuss several recent adaptations of the SPAC model, branding and potential outcomes from the blank-check boom, and use South Mountain Merger Corp (SMMC) and its reverse merger with Billtrust as an example of how investors might recognize “creative accounting” tactics with limited financial disclosures. As Elon Musk recently tweeted, “Caution strongly advised with SPACs.” Read on...

SPAC investment process:

The SPAC process basically can be described as follows:

1. The SPAC entity is formed by an investor group.

2. The SPAC undergoes the typical initial public offering (IPO) process and takes on a ticker symbol.

3. The SPAC launches a search to identify and reach a definitive agreement with a target company. There is typically a specified amount of time to engage a target (usually 24 months), and if it fails to do so before expiration, the SPAC must dissolve and return investor capital.

4. Shareholder and board approval are needed to merge the SPAC and target company, which then trades under the SPAC ticker or changes its ticker to something else. For example, Diamond Eagle Acquisition Corp (DEAC) became DraftKings (DKNG).

As described above, the IPO is done before the operating company merges with its blank-check shell. This dynamic can be favorable for a company that might have had a disastrous S-1 or a less than ideal roadshow, which normally would allow investors to scrutinize operations ahead of the IPO. Recall, it is this very public process that doomed the WeWork IPO.

In fact, unlike the traditional IPO process, target companies of the SPAC generally work with a small group of investors (often just the sponsor) to value and execute the merger. In this regard, the SPAC reverse merger proposal offers a go-public option with far less execution risk than the traditional S-1 and roadshow. However, we also believe that sunlight is the best disinfectant.

Pre-operating considerations:

The financial statement requirements and related SEC review process for a SPAC transaction are largely consistent with the requirements for a traditional IPO. SEC Chairman Jay Clayton indicated that SEC staff are focused on disclosures of the compensation and incentives that go to a SPAC’s sponsors. This is critical as it is the company and objective being vetted by the IPO review process.

Again, much of the earnings quality work to be done only happens following the target engagement announcement and furnished financials of the operating company. Traditional SPAC IPOs also operate something like an option, wherein you have the right to convert with the SPAC or cash out prior to conversion. Furthermore, until recently, warrants (or warrant fractions) were also a common component of the SPAC offer that would incentivize longer-term ownership for early investors.

In addition to SEC requirements, the target’s management team may have other reporting considerations related to its support of the transaction, such as assisting in the marketing of PIPE (private investment in public equity) financing and securing additional funding for the transaction.

Adaptations:

The success of SPACs has drawn other institutions to the table. Even beyond high-profile investor-led SPACs, major investment banks are taking their reputation to market as well.

In the case of Evercore (EVR), the company had avoided the SPAC model due to a systemic misalignment between sponsors and investors. In response, the company introduced a so-called “CAPS IPO” (Capital which Aligns and Partners with a Sponsor), which appears to be simply a lower and longer-duration founders stake. The first of these was launched by former Speaker of the House, Paul Ryan.

Furthermore, the convention of warrants is also potentially going by the wayside. Dragoneer II launched without a warrant component of the unit. At first blush, this runs afoul of the intent to lock in longer-term investors and stabilize share pricing. However, realize that Dragoneer I launched in August 2020, trades at a 20% premium, and was 3x the size of Dragoneer II. So, it seems the mantra “success attracts success” is alive and well in the sponsored investment industry.

Other thematic SPACs target ESG-friendly markets like former NRG Energy CEO David Crane. Potentially in an attempt at image rehab, Mr. Crane’s Climate Change Crisis Real Impact 1 Acquisition Corp raised $230 million. Conversely, successful investors expanding their personal brand may benefit from current market conditions and considerations. Chamath Palihapitiya's Social Capital Hedosophia Holdings Corp II (IPOB), which announced a combination with Opendoor Labs, Bill Ackman's Pershing Square Tontine Holdings (PSTH), Alec Litowits, or Sam Zell may all fall into this category.

In the next section, I describe a recent example of a SPAC IPO and share some insights and concerns from a forensic accounting standpoint.

South Mountain – Billtrust:

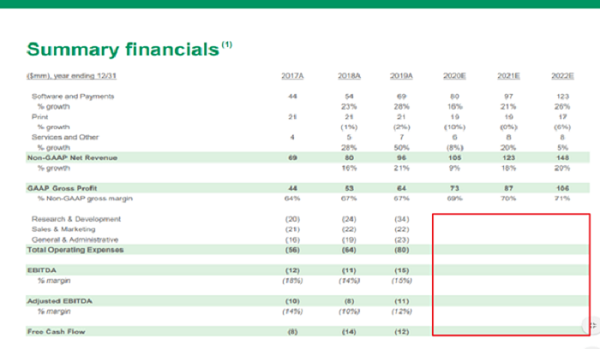

We reviewed S-4s filed over a recent 30 day period in order to apply our brand of analysis to a prospective reverse merger. For the 30 days ended 11/06/2020, there were 33 S-4 filings (according to S&P Capital IQ). We became interested in South Mountain Merger Corp (SMMC) doing a reverse merger with Billtrust, a private SaaS company. The company will change its name to BTRS Holding Inc and trade under a different ticker as well as deleverage the balance sheet leaving $200 million in cash upon closing. The merger implies an enterprise value at closing of $1.3 billion, representing a 10.5x multiple to 2021 expected net revenue of $123 million.

Here are some key considerations:

* History of operating losses and accelerating stock-based compensation (SBC)

* Depends substantially on customers renewing their contracts and subscriptions, and purchasing additional subscriptions

* Fluctuations in new sales and customer cancellations may not be immediately reflected

* May be required to take write-downs or write-offs, or New Billtrust may be subject to restructuring, impairment, or other charges

* Will incur significant increased expenses and administrative burdens as a public company

South Mountain filed its S-4 and presented Billtrust’s last three years of financials along with unaudited interim reporting through 06/30/2020. Billtrust also is not an organic growth machine; instead, it is a “roll-up” that has acquired significant assets, which adds to our sustainability concerns. In the past, Billtrust had acquired Invoice Connection (2011), Open Scan Technologies (2014), C-TABS (2016), and Credit2B (2018). As of 06/30/20, Billtrust's accumulated goodwill was 27.2% of total assets (down from 29.6% of TA at the end of 2018).

As with Gradient’s traditional bottom-up approach, we look for signs that earnings may not be sustainable. To that end, Billtrust has set the expectations for profitability very low and shifted focus to expanding adjusted gross margin. However, there are several concerns we have with the prospective business as it enters the public markets.

The company reports net revenue that excludes reimbursable costs and are primarily amounts charged to customers for printing and postage (with an offsetting amount recorded as a cost of revenue). By doing that, Billtrust’s adjusted gross margin (AGM) was flat from 2018 to 2019 at 67%, but now guidance implies that the company will add 2% of AGM in 2020 and expand by 1% in both 2021 and 2022 to ultimately reach 71%. The company believes its gross profitability will improve and has highlighted this goal throughout its investor materials by making several adjustments to make growth appear more likely to materialize – but also less sustainable long term, in our view.

It appears evident that Billtrust has highlighted its gross profit to distract from the negative earnings. However, there are several notable adjustments to AGM. Our primary concern is that this metric excludes depreciation & amortization (D&A) expense. As we have discussed previously, Billtrust is a roll-up with a pass-through mailing operation. Despite these facts, the company would have you neglect the very real expenses of growth-through-acquisition and repairing/updating postage and sorting machines. Furthermore, its adjusted gross margin also excludes stock-based compensation which is likely to soar following the merger. As illustrated in Slide 1 (note the empty box in the bottom right corner), while projecting gross profitability over the next 2.5 years, it leaves operating expenses blank. Given that the company has a long-term target of gross margins in the 80% range, and with S&M of 25%, R&D of 20%, and G&A expense at 10% of sales, it would imply an adjusted EBITDA margin of about 25%.

To put current operations in perspective, during 2019 Billtrust posted an adjusted EBITDA loss of $11 million or 32.6% worse than 2018. More recently, during the 6M ended 06/30/20, the company reported negative adjusted EBITDA of $3.4 million which was $3.9 million better than the year-ago losses. However, driving the largest portion of the YOY improvement, interest expense ballooned by $1.7 million YOY, but it is not a fixture on the balance sheet. In fact, the pro forma company will have a $200 million cash balance and no debt.

Billtrust compares itself to Coupa Software (COUP), which represents a much larger and potentially aspirational competitor. Moreover, this competitor does not highlight any gross margin profile at all. If it had, however, COUP would not be comparable as stock-based compensation is accounted for in gross profit and increased by a whopping 52.3% YOY to $58 million on a trailing 6M basis. Interestingly, D&A also more than doubled on a 6M YOY basis (6M ended 07/31/2020). Furthermore, COUP’s incomparable gross margin has compressed on a YOY basis in each of the last eight quarters and despite top-line growth that was 2x that anticipated by Billtrust for the foreseeable future. To make matters worse, 12M sales growth at Billtrust is expected to decelerate from 28% YOY in 2019 to just 16% in 2020.

All this is to say that the much smaller Billtrust has chosen financial metrics that will show early and relatively persistent growth despite operating costs that likely will show outsized growth and suppress future earnings and free cash flow. On the other hand, this is not to say that this is a unique or losing strategy. In fact, the selection of metrics that theoretically support share price in the short term (even over several years or through a lock-up period) benefit all early investors/speculators. However, efforts to report unsustainable-but-attractive metrics may also highlight the disconnect between sponsors and investors’ cost basis and investment timeframe (founders shares, sponsors incentives). If earnings quality tailwinds turn to headwinds, shareholders may be surprised by slowing growth or diminished margins. Unfortunately, by the time these issues begin to negatively impact earnings, insiders may have already divested, or in the case of founders shares, maintain a cost basis of essentially zero.

When we looked deeper into the S-4 filing, we also came away with several earnings quality considerations. While we only have two years of audited balance sheet items, during 2019 the company expanded receivables at a much faster rate than sales. Receivables surged 33.2% ($4.9M) YOY to $19.7M and outpaced sales growth by a wide margin. In fact, even on a relative basis, 12M AR-to-sales ratios increased about 200 bps YOY from 2018 to 2019. During the most recent period, AR also increased slightly relative to Q4 2019.

The company also records deferred implementation, commission, and other costs as both a current and long-term asset. This has been substantially impacted by the implementation of ASC 606 where previously (under ASC 605) commissions were expensed over the first 12 months of the customer contract. Under current accounting standards, however, Billtrust will now capitalize these costs (paid out in cash and recognized over time) over 4-5 years. This has had the effect of reducing expenses on the income statement that had been previously expensed on a much shorter timeframe. Furthermore, presenting these accounts in an incomparable manner leads us to believe that Billtrust would have investors give them the benefit of earnings growth. However, over a long enough timeframe, these expenses will return, suppressing further earnings growth, which may become a surprise headwind to operating margin.

Deferred costs (both long-term and current) increased by 36.4% YOY during the year ended 12/31/19. Interestingly, the trajectory of these capitalized costs diverged greatly between the 16% ($0.9M) YOY decline in current deferred costs and the more than doubling (118.5% or $4.3M) of long-term costs. However, once we back out the impact of ASC 606, current deferred costs actually would have increased 19.3% while long-term deferred costs would have fallen 8.8% YOY (and 2019 S&M expenses would have been $0.7 million higher). Again, recall that new account commissions are paid over five years and may imply that new contract growth is slowing as a vast majority of commissions would be long-term.

Similar to the slowing of expense recognition relating to commissions, the company also disclosed that prepaid expenses had increased 65% YOY (+$1.3M) during the period ended 12/31/19. While we understand that as an emerging public business, Billtrust will have costs that require prepayment, we also realize that it is very simple to move an expense to the balance sheet only for it to flow back to the income statement following the filing date. As an additional data point, the interim balance sheet for 06/30/20, shows a 35.5% increase in prepaid expense over the last six months. While we have no corresponding ratio from which to measure, it is important to note that 6M sales fell 2.4% YOY in the first half of 2020 making the rise in prepaid expenses more concerning. This may imply the company is continuing to capitalize expenses that would likely have been recognized in past periods.

Finally, while two keys concerns have been discussed, there also are some other factors that a potential investor might overlook. First, Billtrust disclosed that it has not gained a fairness report and that it has a system in place to deal with related party transactions (RPTs). But in fact, the company only disclosed one related party customer, GlobalTranz, which was 0.3% of 6M net revenue (up from 0.2% in 2018) and grew at a significantly higher rate than the company average. While this is a very small number (adding low single-digit bps to sales growth) it is still an important datapoint to watch over time.

Second, the company maintains a minimal allowance for doubtful accounts (AFDA). In fact, at the end of 2018 and 2019 the AFDA was only 2.1% of gross receivables ($313 and $409, respectively). However, while we cannot adjust for seasonality, during the six months following the audited balance sheet the AFDA-to-gross AR metric was decimated, falling 87 bps (41.9%) to only 1.2%. Again, this number is small, but holding this ratio constant through YE19 would suggest that profitability was potentially overstated by $0.2 million. Furthermore, on its face, the liquidation appears concerning as the AFDA was reduced rather than increased in response to COVID-19 distress.

Conclusion:

I have shown various considerations for evaluating SPAC investments both in the pre-target phase and following the release of audited financials. While the former is more difficult and often nebulous, there is a built-in option where an investor can redeem units prior to conversion. This feature subordinates investor analysis in our eyes as we are also partial to reviewing operating results. However, let me emphasize that SPACs that are led by celebrities or other unqualified founders and those running out of time to consummate a deal are particularly concerning and deserving of a higher-than-normal amount of scrutiny.

However, once a target is identified, Gradient’s accounting deep-dive can still provide value, especially if companies report under two different accounting conventions. Furthermore, taking stock of what the company would have you focus on versus what is truly important should inform how management will attempt to portray a desired result going forward.

Regardless, many of these companies will be evaluated (at least initially) on targets and various other fundamental factors they wish to emphasize, such as new users or the number of electronic invoices presented. These bespoke metrics can overshadow accounting concerns for a substantial amount of time, particularly with good access to capital markets. While we do not suggest a short position in SMMC, investors should beware, as it appears the company already may be optically improving its results. Furthermore, it is entering a highly contested space, as illustrated by COUP sporting a short interest-to-float ratio of 11.8% and top-line growth significantly higher than Billtrust’s.

Disclosure: At the time of this writing, the author held no positions in the securities mentioned.

Disclaimer: This newsletter is published solely for informational purposes and is not to be construed as advice or a recommendation to specific individuals. Individuals should take into account their personal financial circumstances in acting on any opinions, commentary, rankings, or stock selections provided by Sabrient Systems or its wholly owned subsidiary Gradient Analytics. Sabrient Systems makes no representations that the techniques used in its rankings or analysis will result in or guarantee profits in trading. Trading involves risk, including possible loss of principal and other losses, and past performance is no indication of future results.