Sector Detector: Earnings looking good and bullish rankings hold steady, but news is now trumping fundamentals

By Scott Martindale

President, Sabrient Systems LLC

It is encouraging to see that Q3 earnings season is looking a bit better than expected and is on track to produce positive earnings growth for the first time since Q1 2015 (that was six straight quarters of negative year-over-year growth!) – and on positive revenue growth, to boot. Entering earnings season, Wall Street’s mood had turned negative after an expectation earlier in the year that Q3 would be the big turnaround quarter, so the upside surprises so far have been most welcome.

On the other hand, stocks appear to be enduring something of a “stealth correction” or risk-off activity, which has been impacting small caps much more than the larges. After seven months of expansion (essentially from Feb 11 until Sept 22), market breadth has been shrinking over the past month, as news headlines take the stage away from fundamentals, which is not surprising given the impending election. I think we will see elevated volatility in advance of election day, but after rationalizing what it all means (no matter what result transpires), I expect the market to stabilize – at least until the December 14 FOMC meeting. From a technical standpoint, the proverbial spring remains tightly coiled for a significant move. But even if the initial move is down, I would consider it a buying opportunity, as I think investors will return to a focus on fundamentals, leading once again to healthier market breadth and diverse leadership, with higher prices in our future.

In this periodic update, I give my view of the current market environment, offer a technical analysis of the S&P 500 chart, review our weekly fundamentals-based SectorCast rankings of the ten U.S. business sectors, and then offer up some actionable ETF trading ideas. Overall, our sector rankings look relatively bullish, although the sector rotation model still suggests a neutral stance. Read on....

Market overview:

Year to date, the S&P 500 price index is up +4.3%, and the Russell 2000 small caps, after greatly outperforming coming off the February 11 recovery, is up +4.8%. But the big action has been overseas, particularly with emerging markets, with the iShares MSCI Emerging Markets ETF (EEM) at +14.7%. The best YTD performance globally is Brazil at +85% (priced in dollars, or +48% priced in reals), and the worst is Italy at -19%.

If it weren’t for the craziness of the election, I think US stocks would be up double digits YTD across all major indexes. Latest manufacturing data and GDP growth reports have been quite solid. Up until September 22, the Russell 2000 small caps had been greatly outperforming S&P 500 large caps this year (+11.6% versus +6.5% YTD). But since September 22, small caps have suddenly underperformed large caps such that the performance gap has closed to within a half percentage point (+4.8% for Russell 2000 versus +4.3% for S&P 500). Notably, although money flows into ETFs during October have continued the net positive trend overall, about 85% of the capital has gone into large caps, whereas smids previously had been getting the bulk of assets for the first nine months of the year.

Moreover, it is looking a lot like FANG all over again, as five stocks – Facebook (FB), Apple (AAPL), Amazon.com (AMZN), Microsoft (MSFT), and Exxon Mobil (XOM), in descending order of relative contribution – have accounted for about 33% of total gains in the S&P 500 this year. To reiterate, 1% of the companies has accounted for 33% of the index gains.

Compare this to last year, which was an extremely narrow and news-driven market in which the large caps, led entirely by FANG and a few other mega caps, greatly outperformed the small caps. The S&P 500 price index was down about -0.8%, while the Russell 2000 small caps were down for -5.3% 2015. But when you look at the breakdown of the S&P components, the Value Index lost -5.5% for the year, while the higher-risk Growth Index gained +3.9% – entirely due to FANG.

However, other than the past month, this year has shaped up quite differently than 2015. For 2016 YTD (through Friday, 10/28), the S&P 500 price index is +4.3%, while Value is outperforming Growth, +5.6% versus +2.9%. The P/E of the S&P 500 has become elevated compared to historical norms, at 24x trailing 12-month EPS and 18x forward 12-month EPS, and a rising rate environment would be expected to put a lid on further multiple expansion and favor value stocks, Value historically tends to perform well in an environment of rising rates and compressing earnings multiples, and indeed, so far this year the trend has reversed, at least so far, and may continue.

Although most stocks traded the first nine months of the year based on fundamentals while market breadth expanded, some segments still have languished under the weight of news headlines and investor caution, holding down a number of fundamentally solid stocks with attractive valuations. Airlines, for example, still are making a lot of money and many of them sport single-digit forward PEs, but they along with many of the travel segment have been hindered by worries about Zika, terrorism, and higher fuel prices, creating general investor aversion. Also, Healthcare names have struggled despite regular drug breakthroughs and favorable demographics, and in fact, biotechs have been the laggards within the S&P 500. Bloomberg reported recently that, “Among the 10 biggest single-stock declines in the benchmark gauge this year, six are health care companies…The weakness is a departure from the past five years, when health-care’s 128% advance through 2015 ranked ahead of any other group.”

On the earnings front, the pattern of six straight quarterly earnings declines appears to have finally come to an end. Moreover, Q3 earnings season includes more in the way of positive surprises and fewer negative revisions. Looking ahead, positive growth is expected to continue in Q4 (likely led by the Energy sector, given higher oil prices) and then ramp up in the following quarters. As forecasts stand today, earnings growth is expected to be in double-digits in 2017 and the following year.

Furthermore, stocks have continued to be supported by corporate buybacks and M&A, which is bullish. In fact, several large acquisitions (or proposed deals) were announced just last week, and October set a record for M&A deals in the US at roughly $250 billion.

The U.S. Treasury reported on October 14th that the federal deficit rose by 34% in fiscal-year 2016 (which ended 9/30/2016), rising from $438 billion in fiscal-2015 to $587 billion in fiscal-2016. Furthermore, over the past eight years, federal debt has grown by more than $7 trillion, rising from 48% of US GDP to 77%. Byproducts of our reliance on monetary policy as the only form of economic stimulus have been high asset inflation, slow growth and low price inflation, along with worsening income inequality. And as the wealthy get wealthier, the net savings rate goes up while lending and spending both stagnate.

And so, populism and protectionism grow while globalization becomes a dirty word, and policy makers come under pressure to do something in the way of fiscal stimulus, rather than rely solely on the central banks. Many in the investment community and central banks have been pushing for fiscal stimulus to boost the economy, including economist and former Treasury Secretary Lawrence Summers who believes that the current policies are allowing “secular stagnation” to set in. My take on this is that accommodative monetary policy needs to be complemented by (rather than offset by, as it has been) stimulative tax policy and regulatory reforms.

Pension funds, endowments, and sovereign wealth funds – as well as many financial advisors – are feeling the pressure to deliver higher returns, and that means taking on greater risk, which would imply greater equity exposure. For example, Norway’s $880bln sovereign wealth fund indicated that it may lift its equity allocation by 10 points, to 70%. Moreover, the dividend yield of the S&P 500 at 2.16% is still quite a bit higher than the 10-year Treasury at 1.85% and should continue to attract yield-hungry investors.

During October, fund managers in aggregate reached cash balances of about 5.8%, which is up from 5.5% at the end of September. This is similar to levels seen after the Brexit vote, and it hasn’t been higher than this since November 2001, after the 9/11 attacks. But such a display of caution and conservatism may be a contrarian indicator of a stock-market rally. Bank of America wrote that, historically, whenever cash has exceeded 4.5%, it has typically served as a buy signal for stocks (and whenever cash has fallen to 3.5%, it has been a sell signal).

Some major bonds funds at houses like Eaton Vance now have as much as 30% of their holdings in cash. As bond holders moved to cash, yields have been climbing steadily since bottoming in July. The 10-year Treasury yield closed Friday at 1.85% and the 30-year at 2.62%, while on the short end the 2-year is 0.85% and the 5-year is 1.32%. The spread between the 10-year and 2-year is right at 100 bps, and the spread between the 30-year and 5-year is 130 bps, as the yield curve has been steepening. But I don’t expect yields to skyrocket.

CME fed funds futures place the odds of a rate hike on November 2 at only 9%, but then it jumps to 74% for the December 14 FOMC meeting. It’s funny, but 12 months ago, we were in this same state of anticipation about a December rate hike. It’s déjà vu. At that time, the Fed was intent on normalizing interest rates, and they were signaling us to expect four more hikes in 2016. But instead we haven’t seen any further hikes, and today, it’s not so clear what their plan is. What is clear is that the Fed doesn’t intend to make monetary policy “tight,” just a little tighter than it has been. But that doesn’t mean we won’t see the requisite initial knee-jerk risk-off reaction to a hike.

The CBOE Market Volatility Index (VIX), aka fear gauge, closed Friday at 16.19, which is back above the 15 threshold (between complacency and fear). I would not be surprised to see it rise to challenge the 20 threshold (between fear and panic) as we approach election day, particularly given the latest news regarding the FBI reopening its investigation of Hillary’s new emails that have come to light.

While China’s renminbi is making new lows, the US dollar has been on an upward tear in anticipation of a December rate hike. As a result, whereas large caps likely will suffer on a relative basis due to a stronger dollar making exports more expensive, small-caps will mostly benefit to the extent that they sell mostly domestically and can leverage a strong dollar to lower the cost of their parts imports. Thus, after the election results shake out, I expect NASDAQ and Russell 2000 will resume their outperformance going forward.

SPY chart review:

The SPY closed Friday at 212.54. I had expected the symmetrical triangle and ascending wedge patterns to resolve to the upside, given any positive catalyst, but instead it broke to the downside due more to risk-off sentiment than to a specific negative catalyst, although it didn’t fall far before finding support at the September lows. Now, SPY finds itself stuck in yet another tight trading range between 212 and 215 – and once again with Bollinger Bands pinching together as it coils in anticipation of a solid upside catalyst. The 50-day simple moving average is falling and will soon converge with the upper resistance line at 215. Above that, the bearish gap down from 218 on September 8 will serve as a magnet to be filled. The 100-day SMA (near 214) has become prior-support-turned-resistance, while the rising 200-day SMA (near 208) should be strong support. Oscillators RSI, MACD and Slow Stochastic are all moving further into oversold territory, and could go even further before cycling back higher. Overall, however, I continue to be confident in the technical picture – even though small caps are suddenly looking quite weak in this (hopefully temporary) period of news-driven risk-off behavior.

Latest sector rankings:

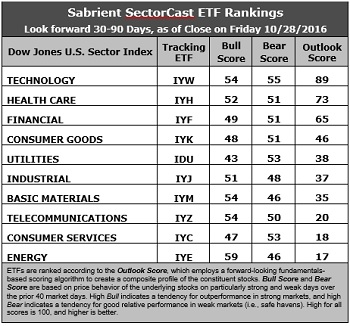

Relative sector rankings are based on our proprietary SectorCast model, which builds a composite profile of each of over 600 equity ETFs based on bottom-up aggregate scoring of the constituent stocks. The Outlook Score employs a forward-looking, fundamentals-based multifactor algorithm considering forward valuation, historical and projected earnings growth, the dynamics of Wall Street analysts’ consensus earnings estimates and recent revisions (up or down), quality and sustainability of reported earnings (forensic accounting), and various return ratios. It helps us predict relative performance over the next 1-3 months.

In addition, SectorCast computes a Bull Score and Bear Score for each ETF based on recent price behavior of the constituent stocks on particularly strong and weak market days. High Bull score indicates that stocks within the ETF recently have tended toward relative outperformance when the market is strong, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well (i.e., safe havens) when the market is weak.

Outlook score is forward-looking while Bull and Bear are backward-looking. As a group, these three scores can be helpful for positioning a portfolio for a given set of anticipated market conditions. Of course, each ETF holds a unique portfolio of stocks and position weights, so the sectors represented will score differently depending upon which set of ETFs is used. We use the iShares that represent the ten major U.S. business sectors: Financial (IYF), Technology (IYW), Industrial (IYJ), Healthcare (IYH), Consumer Goods (IYK), Consumer Services (IYC), Energy (IYE), Basic Materials (IYM), Telecommunications (IYZ), and Utilities (IDU). Whereas the Select Sector SPDRs only contain stocks from the S&P 500, I prefer the iShares for their larger universe and broader diversity.

Here are some of my observations on this week’s scores:

1. Technology retains the top spot with an Outlook score of 89. In aggregate, stocks within the sector now display by far the best Wall Street sell-side analyst sentiment (net positive revisions to earnings estimates), strong return ratios, a reasonable forward P/E of about 16.5x, the highest forward long-term EPS growth rate (14.4%/yr), and the lowest forward PEG of 1.1 (ratio of forward P/E to forward EPS growth rate). Healthcare comes in second with an Outlook score of 73 and displays the lowest forward P/E of 14.6x, solid insider buyer, an expected EPS growth rate of 10.7%/yr, and the second lowest forward PEG of 1.4, although stocks within the sector continue to see net negative earnings revisions. Rounding out the top seven are Financial, Consumer Goods (Staples/Noncyclical), Utilities, Industrial, and Basic Materials. Notably, Financial no longer displays the lowest forward P/E (15.1x), as the news-driven underperformance of Healthcare has dropped its forward P/E even lower.

2. Energy, Consumer Services (Discretionary/Cyclical), and Telecom take the bottom three with Outlook scores of 17, 18, 20, respectively. Energy displays the second highest forward long-term growth rate of 13.6%/yr as oil prices stabilize, but it is held back by a high forward P/E (28.8x), a forward PEG of 2.1, and weak return ratios. Telecom also displays a relatively high forward P/E (24.9x) and forward PEG (2.6), while Consumer Services (Discretionary/Cyclical) has a high forward P/E (18.5x) and weak sentiment among both sell-side analysts (net negative earnings revisions) and insiders (net selling).

3. Looking at the Bull scores, Energy has the top score of 58 as it displays relative strength on strong market days, while Utilities is the lowest at 46. The top-bottom spread has shrunk to 14 points, which for the moment reflects elevated sector correlations on strong market days, which is not as favorable for stock picking. It is desirable in a healthy market to see low correlations reflected in a top-bottom spread of at least 20 points, which indicates that investors have clear preferences in the stocks they want to hold (rather than broad risk-on behavior).

4. Looking at the Bear scores, Utilities and Telecom have been lagging lately as defensive “safe havens.” Consumer Services (Discretionary/Cyclical) surprisingly displays the top score of 55, followed closely by Technology, which means that stocks within the sectors have been the preferred safe havens lately on weak market days. Energy scores the lowest at 46, as investors flee during market weakness. The top-bottom spread is down to only 9 points, which reflects high sector correlations on weak market days, which isn’t great for stock picking. Ideally, certain sectors will hold up relatively well while others are selling off (rather than broad risk-off behavior), so it is desirable in a healthy market to see low correlations reflected in a top-bottom spread of at least 20 points.

5. Technology displays the best all-around combination of Outlook/Bull/Bear scores, while Telecom and Energy tie for the worst. However, looking at just the Bull/Bear combination, Technology has been the best, indicating superior relative performance (on average) in extreme market conditions (whether bullish or bearish), while Healthcare is the worst. So, while Healthcare scores well from a fundamental standpoint, investors have been less than enthusiastic. Technology on the other hand is doing well both in our rankings and with investor sentiment.

6. This week’s fundamentals-based Outlook rankings still look mostly bullish to me, given that economically-sensitive sectors continue to dominate. Although a couple of defensive sectors are scoring well, too, they are bunched in the middle group of what I would characterize as a 3-tier ranking, with the middle group comprising Consumer Goods, Utilities, Industrial, and Basic Materials. Keep in mind, the Outlook Rank does not include timing, momentum, or relative strength factors, but rather is a reflection of the fundamental expectations for individual stocks aggregated by sector.

ETF Trading Ideas:

Our Sector Rotation model, which appropriately weights Outlook, Bull, and Bear scores in accordance with the overall market’s prevailing trend (bullish, neutral, or defensive), continues to display a neutral bias, as the 50-day simple moving average keeps a lid on price, and suggests holding Technology (IYW), Healthcare (IYH), and Financial (IYF), in that order. (Note: In this model, we consider the bias to be neutral from a rules-based trend-following standpoint when SPY is between its 50-day and 200-day simple moving averages on the rebalance day.)

Besides iShares’ IYW, IYH, and IYF, other highly-ranked ETFs in our SectorCast model (which scores over 600 US-listed equity ETFs) from the Technology, Healthcare, and Financial sectors include First Trust Technology AlphaDEX Fund (FXL), PowerShares Dynamic Pharmaceuticals Portfolio (PJP), and Guggenheim Invest S&P 500 Equal Weight Financials ETF (RYF).

An assortment of other ETFs that are scoring well in our rankings include VanEck Vectors Mortgage REIT Income ETF (MORT), Guggenheim Invest S&P 500 Equal Weight Technology ETF (RYT), VanEck Vectors BDC Income ETF (BIZD), and John Hancock Multifactor Technology ETF (JHMT).

However, if you prefer a bullish bias, the Sector Rotation model suggests holding Technology, Energy, and Healthcare, in that order. On the other hand, if you are more comfortable with a defensive stance on the market, the model suggests holding Technology, Healthcare, and Financial, in that order, which is identical to the neutral allocation.

IMPORTANT NOTE: I post this information periodically as a free look inside some of our institutional research and as a source of some trading ideas for your own further investigation. It is not intended to be traded directly as a rules-based strategy in a real money portfolio. I am simply showing what a sector rotation model might suggest if a given portfolio was due for a rebalance, and I may or may not update the information on a regular schedule. There are many ways for a client to trade such a strategy, including monthly or quarterly rebalancing, perhaps with interim adjustments to the bullish/neutral/defensive bias when warranted -- but not necessarily on the days that I happen to post this article. The enhanced strategy seeks higher returns by employing individual stocks (or stock options) that are also highly ranked, but this introduces greater risks and volatility. I do not track performance of the ideas mentioned here as a managed portfolio.

Disclosure: The author has no positions in stocks or ETFs mentioned.

Disclaimer: This newsletter is published solely for informational purposes and is not to be construed as advice or a recommendation to specific individuals. Individuals should take into account their personal financial circumstances in acting on any rankings or stock selections provided by Sabrient. Sabrient makes no representations that the techniques used in its rankings or selections will result in or guarantee profits in trading. Trading involves risk, including possible loss of principal and other losses, and past performance is no indication of future results.