Sector Detector: Bulls reclaim their mojo as Healthcare leads

Bulls have regained their footing and recruited some reinforcements, as the S&P 500 on Wednesday powered right through its 5.5-year intraday high of 1576 on increased trading volume to set a new record of 1589. Catalysts appeared to be a promising start to earnings season and the early release of the March FOMC minutes, which indicated to investors that the Fed will continue to inject liquidity until the economy and labor markets display sustainable improvement.

Bulls have regained their footing and recruited some reinforcements, as the S&P 500 on Wednesday powered right through its 5.5-year intraday high of 1576 on increased trading volume to set a new record of 1589. Catalysts appeared to be a promising start to earnings season and the early release of the March FOMC minutes, which indicated to investors that the Fed will continue to inject liquidity until the economy and labor markets display sustainable improvement.

Last week, we saw the “hot money” from end-of-quarter institutional buying of the prior week quickly exit the market after some uninspiring economic reports came out, culminating in a big gap down to open trading on Friday. But stocks have been steadily recovering ever since.

Not surprisingly, the higher-beta Russell 2000 small caps and Nasdaq were Wednesday’s big leaders with 1.8% gains, but it’s notable that equity correlations remain quite high on strongly bullish days, as all boats are lifted in the rising tide. The S&P 500 large caps rose 1.2%.

One of the exceptions to the bullish behavior was Titan Machinery (TITN), which fell 14% on an earnings miss. Sabrient subsidiary Gradient Analytics, which publishes in-depth forensic accounting research and a quantitative Earnings Quality Rank, has been negative on the stock.

Among the 10 U.S. business sectors, Telecom and Technology were the big winners on Wednesday, although Healthcare was also strong yet again and still stands above the rest of the field as the leading sector in year-to-date performance. The iShares Healthcare Sector Fund (IYH) is up nearly 19% YTD, while the iShares Basic Materials Sector Fund (IYM) is only at breakeven after some recovery this week.

However, it’s notable that the top three performers so far this year among the 10 U.S. sector iShares are all considered defensive sectors: Healthcare, Utilities, and Consumer Goods. And this general investor conservatism is also reflected in the general outperformance of value-oriented mutual funds over growth funds over the past four quarters. Furthermore, we can’t ignore the fact that the past three years saw early gains give way in April to significant market pullbacks.

But each of those pullbacks saw the market rise again later in the year. And an underlying conservatism among stock investors with a preference for value and dividends is not necessarily a bad thing. It might suggest that stocks are being led higher by longer-term investors rather than by hot-money “junk rallies.” If earnings season continues to be strong, investors might be treated to sustained market strength this year rather than the usual yo-yo.

Looking at the charts, the S&P500 SPDR Trust (SPY) closed Wednesday at 158.67 and has broken out strongly above the sideways channel between about 153.5 and 157 that has been in place since the gap up on March 5. The 20-day simple moving average has been providing short-term support, and the 40-day SMA has provided reliable secondary support. Oscillators RSI, MACD, and Slow Stochastic are all pointing up. The breakout is letting the Bollinger Bands spread apart after pinching together about as tight as they ever get, and now price might need to consolidate for a day or two to allow the upper band catch up.

The CBOE Market Volatility Index (VIX), a.k.a. “fear gauge,” closed Wednesday at 12.36, which is back to reflecting high levels of investor complacency. Last Friday, it spiked at the open to above 15, but that level held as strong resistance, and equities have steadily recovered ever since.

By the way, Sabrient's "Baker's Dozen" top 13 stocks for 2013 is up a robust 14.3% through Wednesday since its inception on January 11 (which is 5.6% higher than last Wednesday’s close). Over the same 3-month timeframe, the S&P 500 is up 7.9% (which is 2.4% higher than last Wednesday’s close). The portfolio’s impressive performance is led by identical 36% gains in the two Energy Stocks, Marathon Petroleum (MPC) and EPL Oil & Gas (EPL). Note that Sabrient is about to introduce a fresh list of 20 new “Earnings Busters” for Q2.

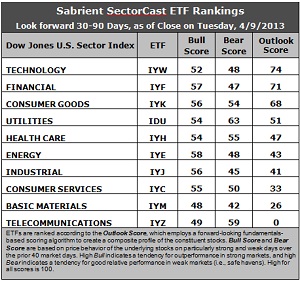

Latest rankings: The table ranks each of the ten U.S. industrial sector iShares ETFs by Sabrient's proprietary Outlook Score, which employs a forward-looking, fundamentals-based, quantitative algorithm to create a bottom-up composite profile of the constituent stocks within the ETF. The multi-factor model considers forward valuation, historical earnings trends, earnings growth prospects, the dynamics of Wall Street analysts' consensus estimates, accounting practices and earnings quality, and various return ratios. In addition, the table also shows Sabrient's proprietary Bull Score and Bear Score for each ETF.

High Bull score indicates that stocks within the ETF have tended recently toward relative outperformance during particularly strong market periods, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well during particularly weak market periods. Bull and Bear are backward-looking indicators of recent sentiment trend.

As a group, these three scores can be quite helpful for positioning a portfolio for a given set of anticipated market conditions.

Observations:

1. Technology (IYW) continues to hold the top spot with an Outlook score of 74, although it continues to drop from its recent highs above 90. IYW continues to display a low forward P/E, strong projected long-term growth, and the best trailing return ratios. Financial (IYF) moves into second place with a 71 this week as its score rose 6 points, while defensive sector Consumer Goods (IYK) saw its score fall a few points to 68.

2. Telecom (IYZ) stays in the cellar with an Outlook score of 0. It is among the worst in every metric in the model, particularly forward P/E, trailing return ratios, and insider sentiment. It is joined in the bottom two again this week by Basic Materials (IYM).

3. Financial (IYF) and Utilities (IDU) have seen the most improvement in Wall Street sentiment this week, while Basic Materials (IYM) and Energy (IYE) endured eroding sentiment, i.e., the greatest net earnings downgrades.

4. Overall, this week’s rankings maintain a neutral tone, although I think there’s slightly less of a defensive tilt than last week, given the reemergence of IYF. Defensive sectors IYK, IDU, and IYH still rank in the top five, while economically-sensitive sectors IYE, IYJ, IYM, and IYC are all in the bottom half, while the top-bottom spread continues to narrow.

5. Looking at the Bull scores, Energy (IYE) remains the leader on particularly strong market days, scoring 58. Surprisingly, Basic Materials (IYM) is the laggard on strong market days, scoring 48. But the top-bottom spread is a relatively narrow 10 points, which continues to indicate high correlation on strongly bullish days.

6. Looking at the Bear scores, Utilities (IDU) is serving as the favorite “safe haven” on weak market days, scoring 63. Basic Materials (IYM) is by far the worst during extreme market weakness as reflected in its low Bear score of 42. The top-bottom spread has widened to 21 points, which indicates low correlations on weak market days -- i.e., it pays to be in the right sectors when the market is bearish.

7. Overall, Consumer Goods (IYK) shows the best all-weather combination of Outlook/Bull/Bear scores. Adding up the three scores gives a total of 178. Telecom (IYZ) is by far the worst at 108. Looking at just the Bull/Bear combination, Utilities (IDU) shows an impressive total score of 117, as both its Bull and Bear score jumped this week. Materials (IYM) displays by far the lowest score at 90. This indicates that Utilities stocks have performed the best in extreme market conditions (whether bullish or bearish) while Materials stocks are avoided altogether.

These Outlook scores represent the view that Technology and Financial sectors may be relatively undervalued, while Telecom and Basic Materials sectors may be relatively overvalued based on our 1-3 month forward look.

Top-ranked stocks within Technology and Financial include QUALCOMM (QCOM), SanDisk (SNDK), The Howard Hughes Corp (HHC), and Berkshire Hathaway (BRKB).

Disclosure: Author has no positions in stocks or ETFs mentioned.

About SectorCast: Rankings are based on Sabrient’s SectorCast model, which builds a composite profile of each equity ETF based on bottom-up aggregate scoring of the constituent stocks. The Outlook Score employs a fundamentals-based multi-factor approach considering forward valuation, earnings growth prospects, Wall Street analysts’ consensus revisions, accounting practices, and various return ratios. It has tested to be highly predictive for identifying the best (most undervalued) and worst (most overvalued) sectors, with a 1-3 month forward look.

Bull Score and Bear Score are based on the price behavior of the underlying stocks on particularly strong and weak days during the prior 40 market days. They reflect investor sentiment toward the stocks (on a relative basis) as either aggressive plays or safe havens. So, a high Bull score indicates that stocks within the ETF have tended recently toward relative outperformance during particularly strong market periods, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well during particularly weak market periods.

Thus, ETFs with high Bull scores generally perform better when the market is hot, ETFs with high Bear scores generally perform better when the market is weak, and ETFs with high Outlook scores generally perform well over time in various market conditions.

Of course, each ETF has a unique set of constituent stocks, so the sectors represented will score differently depending upon which set of ETFs is used. For Sector Detector, I use ten iShares ETFs representing the major U.S. business sectors.

About Trading Strategies: There are various ways to trade these rankings. First, you might run a sector rotation strategy in which you buy long the top 2-4 ETFs from SectorCast-ETF, rebalancing either on a fixed schedule (e.g., monthly or quarterly) or when the rankings change significantly. Another alternative is to enhance a position in the SPDR Trust exchange-traded fund (SPY) depending upon your market bias. If you are bullish on the broad market, you can go long the SPY and enhance it with additional long positions in the top-ranked sector ETFs. Conversely, if you are bearish and short (or buy puts on) the SPY, you could also consider shorting the two lowest-ranked sector ETFs to enhance your short bias.

However, if you prefer not to bet on market direction, you could try a market-neutral, long/short trade—that is, go long (or buy call options on) the top-ranked ETFs and short (or buy put options on) the lowest-ranked ETFs. And here’s a more aggressive strategy to consider: You might trade some of the highest and lowest ranked stocks from within those top and bottom-ranked ETFs.