Sector Detector: Stocks break out from their holding pattern as global uncertainties begin to settle out

We all know the big news stories that have kept both corporate leaders and investors in a semi-state of paralysis. They involve the future of Greece in the Eurozone, China’s growth and stock market stability, and the Federal Reserve’s plan for gradually normalizing the fed funds rate. I noted in my article last week that the technical picture appeared to be firming up for the bulls as the 200-day moving average kicked in with solid support and traders seemed to be doing an orderly retreat-and-retrench rather than panic-selling. As if on cue, today brought news of a deal to keep Greece in the Eurozone, and bulls appear to have seized a new buying opportunity.

In this weekly update, I give my view of the current market environment, offer a technical analysis of the S&P 500 chart, review our weekly fundamentals-based SectorCast rankings of the ten U.S. business sectors, and then offer up some actionable trading ideas, including a sector rotation strategy using ETFs and an enhanced version using top-ranked stocks from the top-ranked sectors.

Market overview:

Although today’s news about a deal for Greece was met with cheer by equity investors, the truth of the matter is that the proverbial can is merely being kicked down the road a bit further, with no confidence-inducing signs that anything in that country is going to change in a significant way. And although Greece has a trivial impact on EU GDP, a Grexit would leave too much uncertainty about the future of the euro. As for China, their experiment with their unique brand of authoritarian-capitalism is being tested to the extremes, particularly what happens when unfettered growth runs up against some natural limits. And then of course there is the Federal Reserve, which is bound-and-determined to start hiking rates at some point soon, which investors seem to fear but which history shows does not tank markets if done in a measured way.

All of this has brought back the risk-on/risk-off behavior that traders and institutional portfolio managers loathe.

S&P Capital IQ reports that the Q2 earnings growth expectation for S&P 500 companies is a year-over-year drop of -4.3%, which would be the first decline since Q3 2009. However, excluding the energy sector (which is projected to show a dismal decline of -63%), the balance of the sectors would be up +3.8%, with Healthcare, Consumer Discretionary, and Telecom the expected leaders. The lowest growth is expected to be in Energy, Utilities, and Consumer Staples sectors. In addition, total revenues for the S&P 500 are expected to fall -2.2%, largely due to the strength of the dollar.

Of course, equity valuations continue to be a hotly debated topic. Looking forward, with an expected EPS for the S&P 500 next year in the range of $120-130, the forward P/E sits in the 16-17x range. This equates to a forward earnings yield right around 6%, which still compares favorably with the current yield on the 10-year US Treasury of about 2.4%, i.e., a spread of +3.6% versus an historical spread of about +3%. Of course, this assumes that demand for the longer-dated Treasuries remains strong even after the Fed makes its initial boosts in the fed funds rate.

Moreover, much has been made of Robert Shiller’s cyclically-adjusted 10-year-average trailing P/E (aka, CAPE), which stands near 27x (3.7% trailing earnings yield) versus a long-term average around 16x (6.3%). But since 1987 it has averaged closer to 24x (4.2%). And when the CAPE last hit current levels back in 2007, the 10-year Treasury yield was up around 5% (i.e., a spread versus 10-year Treasury yield of only +1%).

All told, I think equity valuations are still attractive, particularly for the highest quality stocks. Also worth mentioning is that historically, equities tend to mark market bottoms during the first two weeks of March, July and October. This is where we are on the calendar right now.

The CBOE Market Volatility Index (VIX), a.k.a. fear gauge, closed last Friday at 16.83 and it closed Monday at 13.99, which is back to levels of complacency. In fact, it never did eclipse the 20 panic threshold during the recent market turmoil.

By the way, ETFGI reports that a record level of $103 billion in net new assets flowed into US-listed exchange-traded products during 1H 2015, which surpassed the prior record of $76 billion during 1H 2012. As a result, as of June 30, there were 1,742 exchange-traded products with AUM of $2.1 trillion from 82 issuers.

SPY chart review:

The SPDR S&P 500 Trust (SPY) closed last week at 207.48, after finding solid support at the important 200-day simple moving average. And of course today (Monday) it rallied strongly with the promising news out of Greece to close at 209.75, which is right up against the convergence of its 50-day and 100-day simple moving averages. SPY appears likely to continue up to test the long-standing uptrend line that offered reliable support for so long. Whether it easily recaptures it, or fails and falls again, depends upon the next chapter in the ongoing saga of Greece’s debt as well as China’s growth and stock market stability. Although some technicians are saying that the uptrend line could now serve as prior support-turned-resistance, I think bulls will be eager to retake that line if the global news allows it. Oscillators RSI, MACD, and Slow Stochastic all have room to run to the upside. Minor resistance at the 208 level (prior failed support) gave way easily on Monday’s Greece news, and the 100-day simple moving average is the next level to be challenged. Major support remains the critical 200-day SMA (flat around 206), followed by earlier-in-year support at 205, then round-number support at the 200 price level.

Latest sector rankings:

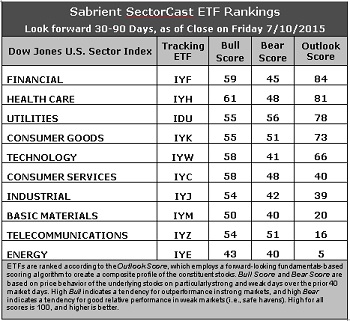

Relative sector rankings are based on our proprietary SectorCast model, which builds a composite profile of each equity ETF based on bottom-up aggregate scoring of the constituent stocks. The Outlook Score employs a forward-looking, fundamentals-based multifactor algorithm considering forward valuation, historical and projected earnings growth, the dynamics of Wall Street analysts’ consensus earnings estimates and recent revisions (up or down), quality and sustainability of reported earnings (forensic accounting), and various return ratios. It helps us predict relative performance over the next 1-3 months.

In addition, SectorCast computes a Bull Score and Bear Score for each ETF based on recent price behavior of the constituent stocks on particularly strong and weak market days. High Bull score indicates that stocks within the ETF recently have tended toward relative outperformance when the market is strong, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well (i.e., safe havens) when the market is weak.

Outlook score is forward-looking while Bull and Bear are backward-looking. As a group, these three scores can be helpful for positioning a portfolio for a given set of anticipated market conditions. Of course, each ETF holds a unique portfolio of stocks and position weights, so the sectors represented will score differently depending upon which set of ETFs is used. We use the iShares that represent the ten major U.S. business sectors: Financial (IYF), Technology (IYW), Industrial (IYJ), Healthcare (IYH), Consumer Goods (IYK), Consumer Services (IYC), Energy (IYE), Basic Materials (IYM), Telecommunications (IYZ), and Utilities (IDU). Whereas the Select Sector SPDRs only contain stocks from the S&P 500, I prefer the iShares for their larger universe and broader diversity. Fidelity also offers a group of sector ETFs with an even larger number of constituents in each.

Here are some of my observations on this week’s scores:

1. Financial is back in the top spot with an Outlook score of 84, primarily due to its low (best) forward P/E and relatively good scores in most factors in the model. Healthcare takes second with a score of 81 with the best sentiment among both Wall Street analysts (upward revisions to earnings estimates) and a solid forward long-term growth rate. Utilities falls to third place with a score of 78, followed by Consumer Goods (Staples/Noncyclical) and then Technology to round out the top five. All five score above 60, and then there is a gap down to Consumer Services (Discretionary/Cyclical) at 40.

2. Energy remains in the cellar with an Outlook score of 5, while Telecom takes the second spot in the bottom two with a 16. Both sectors score poorly in most factors of the GARP model across the board.

3. Looking at the Bull scores, Healthcare displays the top score of 61, followed by Financial. Energy has the lowest Bull score of 43 and is the only one below 50. The top-bottom spread is 18 points, reflecting relatively low sector correlations on particularly strong market days. It is generally desirable in a healthy market to see low correlations reflected in a top-bottom spread of at least 20 points, which indicates that investors have clear preferences in the stocks they want to hold.

4. Looking at the Bear scores, Utilities displays the top score of 56, followed by Consumer Goods (Staples/Noncyclical) and Telecom, which means that stocks within these sectors have been the preferred safe havens (relatively speaking) on weak market days. Energy and Materials score the lowest at 40. The top-bottom spread has expanded to 16 points, which reflects fairly low sector correlations on particularly weak market days. Ideally, certain sectors will hold up relatively well while others are selling off, so it is generally desirable in a healthy market to see low correlations reflected in a top-bottom spread of at least 20 points.

5. Healthcare, Utilities, and Financial are bunched together at the top in their all-around combination of Outlook/Bull/Bear scores, while Energy is clearly the worst. Looking at just the Bull/Bear combination, Utilities is the best, followed by Healthcare, indicating superior relative performance (on average) in extreme market conditions (whether bullish or bearish), while Energy by far the worst, followed by Materials.

6. Overall, this week’s fundamentals-based Outlook rankings look neutral, with Utilities and Consumer Goods (Staples/Noncyclical) in the top four, ahead of Technology, Consumer Services (Discretionary/Cyclical), Industrial, and Basic Materials. Keep in mind, the Outlook Rank does not include timing or momentum factors, but rather is a reflection of the fundamental expectations of individual stocks aggregated by sector.

Stock and ETF Ideas:

Our Sector Rotation model, which appropriately weights Outlook, Bull, and Bear scores in accordance with the overall market’s prevailing trend (bullish, neutral, or defensive), now reflects a neutral bias and suggests holding Financial, Healthcare, and Utilities in that order. (Note: In this model, we consider the bias to be neutral from a rules-based trend-following standpoint when SPY is below its 50-day but still above its 200-day simple moving average.)

Other highly-ranked ETFs in SectorCast from the Financial, Healthcare, and Utilities sectors include iShares Mortgage Real Estate Capped ETF (REM), Market Vectors Pharmaceutical ETF (PPH), and Guggenheim Invest S&P 500 Equal Weight Utilities ETF (RYU).

For an enhanced sector portfolio that enlists some top-ranked stocks (instead of ETFs) from within the top-ranked sectors, some long ideas from Financial, Healthcare, and Utilities sectors include Blackstone Mortgage Trust (BXMT), KeyCorp (KEY), Chemed (CHE), Cambrex (CBM), AGL Resources (GAS), and Level 3 Communications (LVLT). All are highly ranked in the Sabrient Ratings Algorithm.

If you prefer to play a bounce and maintain a bullish bias, the Sector Rotation model suggests holding Healthcare, Financial, and Technology, in that order. But if you prefer a defensive stance on the market, the model suggests holding Utilities, Consumer Goods (Staples/Noncyclical), and Healthcare, in that order.

IMPORTANT NOTE: I post this information each week as a free look inside some of our institutional research and as a source of some trading ideas for your own further investigation. It is not intended to be traded directly as a rules-based strategy in a real money portfolio. I am simply showing what a sector rotation model might suggest if a given portfolio was due for a rebalance, and I may or may not update the information each week. There are many ways for a client to trade such a strategy, including monthly or quarterly rebalancing, perhaps with interim adjustments to the bullish/neutral/defensive bias when warranted -- but not necessarily on the days that I happen to post this weekly article. The enhanced strategy seeks higher returns by employing individual stocks (or stock options) that are also highly ranked, but this introduces greater risks and volatility. I do not track performance of the ETF and stock ideas mentioned here as a managed portfolio.

Disclosure: Author has no positions in stocks or ETFs mentioned.

Disclaimer: This newsletter is published solely for informational purposes and is not to be construed as advice or a recommendation to specific individuals. Individuals should take into account their personal financial circumstances in acting on any rankings or stock selections provided by Sabrient. Sabrient makes no representations that the techniques used in its rankings or selections will result in or guarantee profits in trading. Trading involves risk, including possible loss of principal and other losses, and past performance is no indication of future results.