Sector Detector: Global uncertainties, mixed economic signals, and summer doldrums conspire to paralyze investors

After showing weakness last week and creating some bearish-looking technical formations, stocks took a turn for the better on Monday. Perhaps it was renowned value investor Warren Buffett breaking from his usual aversion to tech companies and investing $1 billion in Apple (AAPL) that gave bulls a much-needed shot of confidence. But then things went south again on Tuesday, and some commentators are surmising that the strength in some of the economic data makes investors think the Fed is more likely to raise rates, i.e., we may be back to a good-news-is-bad-news reactionary environment.

Year-to-date, Utilities is the top-performing sector, up +12.6%, while Healthcare and Technology share the laggard tag at -4.2%. However, since the market recovery that began on February 12, Energy and Materials have been leading the way in something of a bottom-fishing speculative frenzy. Notably, gold has been quite strong YTD, but has lagged during the stock rally off the February lows. Typically, such recovery rallies initially are led by a combination of short-covering, oversold bottom-feeding, and speculative “junk” rallies before gradually rotating into higher quality names and improving market breadth, which we are starting to see.

Looking forward, although there are many variables in play and many global uncertainties, for the near term I see improving global stability, rising oil prices, modest inflationary pressures on wages and prices, and the prospects for low double-digit stock market returns -- although we might see a good bit of sideways price action for next few months.

In this periodic update, I give my view of the current market environment, offer a technical analysis of the S&P 500 chart, review our weekly fundamentals-based SectorCast rankings of the ten U.S. business sectors, and then offer up some actionable ETF trading ideas.

Market overview:

On Tuesday, the April CPI came in slightly above expectations at +0.4%, which led to hawkish commentary from some FOMC members. Over the past 12 months, CPI is up +1.1% on an unadjusted basis, while Core CPI is up +2.1%. Retail sales surged 1.3% in April, led by autos and non-store retailers (internet and mail-order). Automakers have reported US sales of 17.6 million cars and light trucks during the past year, which is near the record high.

Oil closed Tuesday at $48.45, which is a 7-month high and marks an 85% move off its February lows near $26. Resistance at the October high of $50.90 may soon be tested. However, much of the increase has been due to declining production and trader speculation, given that the oversupply has not really been that much more than demand, which continues to grow. On the other hand, oil inventories are nearing capacity while some producers are increasing their production plans.

However, fed funds futures still are indicating only a 15% probability of a rate hike in June, but it rises to 33% probability in July, and then 49% for at least one hike by September, and 71% probability of at least one rate hike by December (and 29% chance of two rate hikes).

The 10-year yield closed Tuesday at a 1.76% while the 2-year closed at 0.83%, which shows a spread of 93 bps. Thus, it has broken below the 100 bps threshold, which often indicates impending recession, whereas a steepening yield curve generally indicates accelerating economic growth. However, given the current global economic conditions characterized by sluggish growth, abundant liquidity, and ultra-low interest rates, it is more an indication that global investors are simply choosing the high-probability “carry trade” of borrowing cheaply at home to acquire strong US dollars and buying higher-yielding US Treasuries.

More than 90% of the S&P 500 companies have now reported Q1 earnings results, and the total earnings growth rate seems to be locked in at -6.0%, which is better than the -8.3% forecast from mid-April 13. Only three sectors -- Consumer Services (Discretionary/Cyclical), Telecom, and Healthcare -- have provided positive year-over-year growth, while four sectors are soundly in the negative (led by Energy, which had only 14% of its companies beat analyst estimates) and three are essentially flat. This was the third quarter in a row to show a decline in earnings growth, largely due to a strong dollar and weak commodity prices (including oil). Excluding the Energy sector, Q1 EPS growth came in at -1.4%, which is actually better than the -3.8% consensus estimate. Notably, US companies increased their dividends by an average of 4.6% during Q1.

Looking ahead, expected Q2 EPS growth for the S&P 500 has been reduced to -5.1% (Note: on April 1, it was projected to be -2.5%). Nonetheless, most analysts continue to forecast significant improvement in the back half of the year such that full-year 2016 growth might actually finish flat versus last year. Q3 is now projected to come in at +2.5% and then Q4 at a robust +8.3% (albeit against weak comps, i.e., a low bar). Also, the Atlanta Fed’s GDPNow forecasting model, which has proven to be pretty good at projecting the official GDP estimate prior to its release, forecasts that the seasonally-adjusted annual real GDP growth rate in Q2 2016 will be +2.8%.

As for the overall market looking forward, of course there are many variables in play and many global uncertainties, and I am uncomfortable that the world has been relying on the monetary policies of central banks rather than crafting fiscal policies and structural reforms that might better incentivize real economic growth as opposed to asset inflation. Nevertheless, at least for the near term, I see improving global stability, rising oil prices, modest inflationary pressures on wages and prices, and the prospects for low double-digit stock market returns – hopefully with a continuation of the broadening and flight to quality we have seen recently.

But of course there are those who feel differently. Jeffrey Gundlach of DoubleLine Capital believes that valuations are too high given that corporate earnings and GDP growth have been falling. Moreover, with the Fed seemingly determined to start rates on a path toward normalization, he sees much more downside than upside potential for US equities (“2 percent upside and 20 downside”).

The CBOE Market Volatility Index (VIX), aka fear gauge, closed Tuesday at 15.57 and has been straddling the 15 fear/complacency threshold.

Of note, Daniel Gamba of BlackRock iShares recently observed that ETF-based managed portfolios and multi-asset strategies now make up a much larger and faster growing portion of the asset management industry than previously thought. Today, such strategies hold about $350 billion in assets globally. Furthermore, his firm expects the number might double to over $700 billion over the next four years as institutional investors increase allocations to ETF-based strategies.

SPY chart review:

The SPDR S&P 500 Trust (SPY) closed Tuesday at 204.85, which is right back to where it closed on Friday and slightly below its 50-day simple moving average. After breaking out above it in late February, SPY appears to have topped out in mid April and has remained in a sideways channel since then. The 50-day has continued to rise and caught up with price in early May such that SPY essentially has been backing-and-filling and testing support at the 50-day SMA for the past 10 trading days. However, I really can’t yet declare that it has lost support there, especially given that prior support at the 204 level is close below. In late April, the 50-day SMA crossed bullishly upward through the 200-day SMA in a bullish Golden Cross, but now the sideways action might be forming a minor head-and-shoulders top. Even if price falls further from here, I think the 200-day SMA around 202 followed by round-number psychological support at 200 will kick in and keep SPY within a broad trading range for the near term. Oscillators RSI, MACD, and Slow Stochastic are all in relatively neutral positions to go either direction. In my opinion, the most likely scenario is that SPY remains in a trading channel -- either a narrow range between 204 and 209 or a wider range between 200 and 212 -- until a strong catalyst emerges.

Other indexes look more bearish, such as the NASDAQ, Russell 2000 small caps, and Dow Jones Transportation Index, which are all well below their 200-day simple moving averages.

Latest sector rankings:

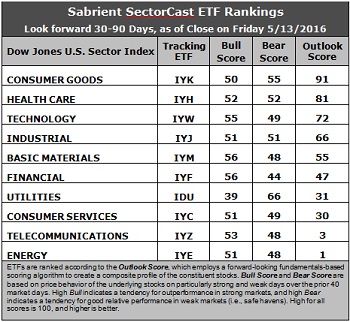

Relative sector rankings are based on our proprietary SectorCast model, which builds a composite profile of each equity ETF based on bottom-up aggregate scoring of the constituent stocks. The Outlook Score employs a forward-looking, fundamentals-based multifactor algorithm considering forward valuation, historical and projected earnings growth, the dynamics of Wall Street analysts’ consensus earnings estimates and recent revisions (up or down), quality and sustainability of reported earnings (forensic accounting), and various return ratios. It helps us predict relative performance over the next 1-3 months.

In addition, SectorCast computes a Bull Score and Bear Score for each ETF based on recent price behavior of the constituent stocks on particularly strong and weak market days. High Bull score indicates that stocks within the ETF recently have tended toward relative outperformance when the market is strong, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well (i.e., safe havens) when the market is weak.

Outlook score is forward-looking while Bull and Bear are backward-looking. As a group, these three scores can be helpful for positioning a portfolio for a given set of anticipated market conditions. Of course, each ETF holds a unique portfolio of stocks and position weights, so the sectors represented will score differently depending upon which set of ETFs is used. We use the iShares that represent the ten major U.S. business sectors: Financial (IYF), Technology (IYW), Industrial (IYJ), Healthcare (IYH), Consumer Goods (IYK), Consumer Services (IYC), Energy (IYE), Basic Materials (IYM), Telecommunications (IYZ), and Utilities (IDU). Whereas the Select Sector SPDRs only contain stocks from the S&P 500, I prefer the iShares for their larger universe and broader diversity. Fidelity also offers a group of sector ETFs with an even larger number of constituents in each.

Here are some of my observations on this week’s scores:

1. Consumer Goods (Staples/Noncyclical) remains in the top spot with a robust Outlook score of 91, primarily due to having by far the best return ratios and Wall Street analyst sentiment (net positive revisions to earnings estimates). However, the sector’s forward valuation remains pricey at about 17.9x). Healthcare is still in second at 81 with generally good factor scores across the board (but none that particularly stand out). Technology takes third again with a 72. It boasts the highest forward long-term growth rate, which is now 13.6%, and its forward P/E has fallen to an attractive 15.2x. Rounding out the top of the rankings are Industrial (whose score continues to creep higher), Basic Materials, and Financial, which are all economically sensitive sectors. Financial still displays the lowest aggregate forward P/E (which has fallen to 14.1x), but the sector continues to be the target of analysts’ negative revisions to earnings estimates.

2. Energy remains at the bottom with an Outlook score of 1 as the sector scores among the worst in several factors of the GARP model, including by far the highest forward P/E at 26x. On the bright side, however, its forward long-term growth rate has turned nicely positive as oil price forecasts firm up, and now stands at 10.8% (whereas just a few weeks ago it was still negative). Telecom takes the other spot in the bottom two with an Outlook score of 3 as analysts have been cutting estimates.

3. Looking at the Bull scores, Basic Materials and Financial share the top score of 56 as they display relative strength on strong market days, while Utilities is the lowest at 39. The top-bottom spread is 17 points, which reflects moderately low sector correlations on strong market days, which can be good for stock picking. It is desirable in a healthy market to see low correlations reflected in a top-bottom spread of at least 20 points, which indicates that investors have clear preferences in the stocks they want to hold (rather than broad risk-on behavior).

4. Looking at the Bear scores, Utilities (as usual) displays the top score of 66, which means that stocks within this sector have been the preferred safe havens on weak market days. Financial scores the lowest at 44, as investors flee during market weakness. The top-bottom spread is 22 points, which reflects low sector correlations on weak market days, which can be good for stock picking. Ideally, certain sectors will hold up relatively well while others are selling off (rather than broad risk-off behavior), so it is desirable in a healthy market to see low correlations reflected in a top-bottom spread of at least 20 points.

5. Consumer Goods (Staples/Noncyclical) displays the best all-around combination of Outlook/Bull/Bear scores, while Energy is the worst. However, looking at just the Bull/Bear combination, Consumer Goods (Staples/Noncyclical) and Utilities are the best, indicating superior relative performance (on average) in extreme market conditions (whether bullish or bearish), while Energy is the worst.

6. Once again, despite a defensive sector showing up at the top, this week’s fundamentals-based Outlook rankings still have a somewhat bullish tilt, in my opinion, given the scoring strength in Healthcare, Technology, Industrial, Basic Materials, and Financial and the relative weakness of Utilities and Telecom. Keep in mind, the Outlook Rank does not include timing, momentum, or relative strength factors, but rather is a reflection of the fundamental expectations for individual stocks aggregated by sector.

ETF Trading Ideas:

Our Sector Rotation model, which appropriately weights Outlook, Bull, and Bear scores in accordance with the overall market’s prevailing trend (bullish, neutral, or defensive), now reflects a neutral bias and suggests holding Consumer Goods (Staples/Noncyclical), Healthcare, and Technology, in that order. (Note: In this model, we consider the bias to be neutral from a rules-based trend-following standpoint when SPY is between its 50-day and 200-day simple moving averages.) Although it is not yet definitive whether the 50-day SMA will hold, it seems prudent given the latest market action to take the more conservative approach.

Besides iShares’ IYM, IYW, and IYH, Other highly-ranked ETFs in SectorCast from the Consumer Goods (Staples/Noncyclical), Healthcare, and Technology sectors include PowerShares DWA Consumer Staples Momentum Portfolio (PSL), VanEck Vectors Pharmaceutical ETF (PPH), and PowerShares Dynamic Semiconductors Portfolio (PYZ).

Others scoring near the top of the rankings with a strong combination of Outlook, Bull, and Bear Scores include PureFunds ISE Mobile Payments ETF (IPAY), iShares US Home Construction ETF (ITB), PowerShares Dynamic Market ETF (PWC), and Market Vectors Morningstar Wide Moat ETF (MOAT).

If you prefer a bullish bias, the Sector Rotation model suggests holding Technology, Basic Materials, and Healthcare, in that order. On the other hand, if you prefer a defensive stance on the market, the model suggests holding Utilities, Consumer Goods (Staples/Noncyclical), and Healthcare, in that order.

IMPORTANT NOTE: I post this information periodically as a free look inside some of our institutional research and as a source of some trading ideas for your own further investigation. It is not intended to be traded directly as a rules-based strategy in a real money portfolio. I am simply showing what a sector rotation model might suggest if a given portfolio was due for a rebalance, and I may or may not update the information on a regular schedule. There are many ways for a client to trade such a strategy, including monthly or quarterly rebalancing, perhaps with interim adjustments to the bullish/neutral/defensive bias when warranted -- but not necessarily on the days that I happen to post this article. The enhanced strategy seeks higher returns by employing individual stocks (or stock options) that are also highly ranked, but this introduces greater risks and volatility. I do not track performance of the ideas mentioned here as a managed portfolio.

Disclosure: Author has no positions in stocks or ETFs mentioned.

Disclaimer: This newsletter is published solely for informational purposes and is not to be construed as advice or a recommendation to specific individuals. Individuals should take into account their personal financial circumstances in acting on any rankings or stock selections provided by Sabrient. Sabrient makes no representations that the techniques used in its rankings or selections will result in or guarantee profits in trading. Trading involves risk, including possible loss of principal and other losses, and past performance is no indication of future results.