Sector Detector: Congressional dysfunction puts bulls on hold, for the moment

You know by now that the Fed last week opted not to begin tapering its quantitative easing (i.e., buying of Treasuries and mortgage-backed securities), primarily for two reasons, I believe. First, rapidly rising long-term interest rates were already starting to hurt the recovering housing market (and the resulting wealth effect). Second, the fragile economy still faces extreme challenges, not the least of which as to do with our dysfunctional U.S. Congress. Although the post-Fed bullishness has cooled, I still think a melt-up during Q4 is just a matter of time.

You know by now that the Fed last week opted not to begin tapering its quantitative easing (i.e., buying of Treasuries and mortgage-backed securities), primarily for two reasons, I believe. First, rapidly rising long-term interest rates were already starting to hurt the recovering housing market (and the resulting wealth effect). Second, the fragile economy still faces extreme challenges, not the least of which as to do with our dysfunctional U.S. Congress. Although the post-Fed bullishness has cooled, I still think a melt-up during Q4 is just a matter of time.

However, QE has its downside, too. Peter Schiff of Euro Pacific Capital thinks that QE has been like a drug in that it feels good while you’re taking it, but does real long-term damage that is only realized when you stop taking it. He thinks the question isn’t when to begin tapering, but whether QE should exist at all. Long-term, we would be much healthier without it, but the short-term pain would be too great for most Americans (and their elected officials) to tolerate.

Moreover, QE has not been having much of a multiplier effect on the economy, as banks remain reluctant to lend their massive storehouses of cash. In fact, it’s notable that the Financial sector have been underperforming over the past month, and regional banks in particular have been weak. Back in December, I recommended the SPDR S&P Regional Banking ETF (KRE) as a top ETF pick for the first quarter of the New Year, and it indeed was strong all the way through July. But it has underperformed since then. The irony is that as the yield curve steepens with rising long-term rates (as QE tapers), the credit spread will widen and banks should have increasing motivation to lend.

Now that the tapering question has been resolved for the time being, investors’ new “crisis of the moment” as we enter Q4 is the debt ceiling and budget battle. As Roseanne Rosannadanna used to say, "It just goes to show you, it's always something--if it ain't one thing, it's another." Of course, there is no risk of an actual default on Federal debt, since tax revenues easily cover debt payments and existing debt can be rolled over. But that’s not to say that there won’t be a government shutdown to some extent.

To avoid a partial shutdown, Congress must approve a spending or continuation bill by next week. Unfortunately, Senator Ted Cruz and the conservative/activist wing of the Republican Party are battling with the old guard for control of the party’s future with an extreme no-compromise approach. Their premise is that compromising with Democrats is a no-win, slow-bleed on America’s future. Even a loss in this battle could be a longer-term win for the activists if it leads to election victories over incumbents next year.

As I discussed the last time the government was about to be shut down, I never cease to be amazed by the lack of cooperation within democratically-elected governments. In the private sector, failure is all but assured if half the company is trying to undermine the strategies and initiatives that have been debated and decided upon. Cooperation is essential for survival in a competitive marketplace, and everyone must be onboard. But in a representative democracy, cooperation can come back to haunt you at election time, so obstructionism is the norm and blame is the game.

It’s possible that Obamacare ultimately might fail under its own weight. But the fact of the matter is the Affordable Care Act has been debated, passed, and signed into law, and the only way to change this flawed legislation is through legislative debate, not political extortion. My hope is that our elected representatives will find it within themselves to recognize the seriousness of our predicament, put dogma aside, show a modicum of respect for differing views and the legislative process, pass a budget that includes the Affordable Care Act, and allow our economy to move forward, with Obamacare free to either succeed or fail on its own, without further political intervention or obstructionism.

The President’s populist agenda gained traction to begin with because the masses are worried about the basic necessities. They prefer to rely on the certainty of a big socialist-style safety net of entitlements (Libertarians would call it “shackles”) rather than the uncertain potential for a more robust economy, enhanced job opportunities, and a better life overall. Changing this entitlement mentality and returning to the American can-do spirit is the challenge incumbent upon all elected officials everywhere.

Nevertheless, compared with the rest of the developed world, we actually look pretty good here. Economist Nouriel Roubini suggested this week that investors should underweight commodities and bonds, and overweight equities -- mainly in the U.S. He thinks the U.S. will be the first to start raising interest rates and the dollar will strengthen. Plus, he expects China is becoming more consumption-oriented and less resource-oriented. All told, he figures that the “commodities super-cycle” is over -- which means more investor focus on equities.

Indeed, ConvergEx Group Chief Market Strategist Nicholas Colas predicted that inflows into U.S.-listed equity ETFs this year will shatter last year’s record, as the Fed’s quantitative easing continues to encourage investment in risk assets.

Moreover, many of the big players and large hedge funds are still underweighted in equities, partly due to the uncertainty surrounding the Fed announcement on tapering.

The SPDR S&P 500 Trust (SPY) closed Wednesday at 169.04, and failed to hold its confirmed breakout to new all-time highs. Nevertheless, it seems to be clinging to support at the uptrend line from the late-June bounce. Although SPY may yet close the price gap up from September 10 down to around 167.50, oscillators like RSI, MACD, and Slow Stochastic have all worked off much of their overbought conditions, so price could reverse back up at any time. I suggested last week that the market needed to take a breather, and it certainly has done so. Support levels are numerous, starting with the uptrend line and the 50-day simple moving average just below, followed by 167.5, the 100-day SMA near 166, 165, 160, and then the 200-day SMA around 158.

The CBOE Market Volatility Index (VIX), a.k.a. “fear gauge,” closed Wednesday at 14.01. It remains below the 15 threshold, indicating relative investor complacency.

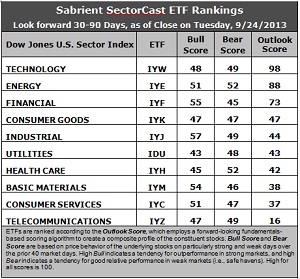

Latest rankings: The table ranks each of the ten U.S. business sector iShares ETFs by Sabrient's proprietary Outlook Score, which employs a forward-looking, fundamentals-based, quantitative algorithm to create a bottom-up composite profile of the constituent stocks within the ETF. The multi-factor model considers forward valuation, historical earnings trends, earnings growth prospects, the dynamics of Wall Street analysts' consensus estimates, accounting practices and earnings quality, and various return ratios. In addition, the table also shows Sabrient's proprietary Bull Score and Bear Score for each ETF.

High Bull score indicates that stocks within the ETF have tended recently toward relative outperformance during particularly strong market periods, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well during particularly weak market periods. Bull and Bear are backward-looking indicators of recent sentiment trend.

As a group, these three scores can be quite helpful for positioning a portfolio for a given set of anticipated market conditions.

Observations:

1. Technology (IYW) remains in the top spot with a near-perfect Outlook score of 98. IYW displays one of the lowest forward P/Es, a solid projected long-term growth rate, the best return ratios, and some of the most positive sentiment among both Wall Street analysts (i.e., upgraded earnings estimates) and company insiders (i.e., open-market buying). Energy (IYE) stays in the second spot with an improved score of 88. IYE displays the lowest forward P/E and solid return ratios, and sentiment has improved among analysts and insiders. In third place is Financial (IYF) at 73.

2. After the top three, there is a 26-point gap down to fourth place Consumer Goods (IYK), followed closely by Industrial (IYJ), Utilities (IDU), and Healthcare (IYH) in a tightly-bunched middle tier.

3. Telecom (IYZ) is in the cellar yet again with an Outlook score of 16, even though it now displays the most positive improvement in sentiment among Wall Street analysts and insiders. Still, IYZ remains weak in most factors across the board, including a high forward P/E, low return ratios, and modest projected long-term growth. In the bottom two this week is Consumer Services (IYC) with a score of 37, mainly due to improved sentiment among analysts toward Basic Materials (IYM).

4. This week’s fundamentals-based rankings maintain their bullish bias as the four of the five highest-ranked sectors are all economically sensitive, and three in particular (Tech, Energy, and Financial) are scoring far above the others.

5. Looking at the Bull scores, Industrial (IYJ) remains the clear leader on particularly strong market days, scoring 57, while Utilities (IDU) is the lowest at 43. The top-bottom spread is 14 points, which continues to indicate somewhat lower sector correlations on particularly strong market days.

6. Looking at the Bear scores, only Healthcare (IYH) and Energy (IYE) are scoring above 50, with each scoring 52, as the favorite “safe haven” on weak market days, while Financial (IYF) is the lowest at 45. The top-bottom spread is a narrow 7 points, and 8 of the 10 are bunched in the range of 45-49, all of which indicates relatively high sector correlations on particularly weak market days, i.e., across-the-board selling during extreme market weakness.

7. Overall, IYW shows the best all-weather combination of Outlook/Bull/Bear scores. Adding up the three scores gives a total of 195. IYZ is the by far the worst at 112. Looking at just the Bull/Bear combination, IYJ displays the highest score of 106 this week, which indicates good relative performance in extreme market conditions (whether bullish or bearish), while IDU is still by far the lowest at 91, which indicates notable investor avoidance during extreme conditions.

These Outlook scores represent the view that Technology and Energy sectors are still relatively undervalued, while Telecom and Consumer Services may be relatively overvalued based on our 1-3 month forward look.

Some top-ranked stocks within IYW and IYE that look good to me this week include SanDisk (SNDK), CACI International (CACI), Core Labs (CLB), and Continental Resources (CLR).

As a reminder, Sabrient’s annual Baker’s Dozen portfolio of top stocks for 2013 continues to impress. It is now up +32% from the portfolio’s inception on January 11, versus the S&P 500 return of +15% over the same timeframe. In fact, all 13 stocks are comfortably positive, led by Jazz Pharmaceuticals (JAZZ), Genworth Financial (GNW), EPL Oil & Gas (EPL), and Ocwen Financial (OCN). (Note: last year’s portfolio was up +43%.)

Furthermore, our new “Earnings Busters” portfolio for Q4 launches on October 1. Each quarterly portfolio of 20 stocks is based on a similar model to what we use in the annual Baker’s Dozen portfolio. The Q2 and Q3 portfolios have performed quite well.

Disclosure: Author has no positions in stocks or ETFs mentioned.

About SectorCast: Rankings are based on Sabrient’s SectorCast model, which builds a composite profile of each equity ETF based on bottom-up aggregate scoring of the constituent stocks. The Outlook Score employs a fundamentals-based multi-factor approach considering forward valuation, earnings growth prospects, Wall Street analysts’ consensus revisions, accounting practices, and various return ratios. It has tested to be highly predictive for identifying the best (most undervalued) and worst (most overvalued) sectors, with a 1-3 month forward look.

Bull Score and Bear Score are based on the price behavior of the underlying stocks on particularly strong and weak days during the prior 40 market days. They reflect investor sentiment toward the stocks (on a relative basis) as either aggressive plays or safe havens. So, a high Bull score indicates that stocks within the ETF have tended recently toward relative outperformance during particularly strong market periods, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well during particularly weak market periods.

Thus, ETFs with high Bull scores generally perform better when the market is hot, ETFs with high Bear scores generally perform better when the market is weak, and ETFs with high Outlook scores generally perform well over time in various market conditions.

Of course, each ETF has a unique set of constituent stocks, so the sectors represented will score differently depending upon which set of ETFs is used. For Sector Detector, I use ten iShares ETFs representing the major U.S. business sectors.

About Trading Strategies: There are various ways to trade these rankings. First, you might run a sector rotation strategy in which you buy long the top 2-4 ETFs from SectorCast-ETF, rebalancing either on a fixed schedule (e.g., monthly or quarterly) or when the rankings change significantly. Another alternative is to enhance a position in the SPDR Trust exchange-traded fund (SPY) depending upon your market bias. If you are bullish on the broad market, you can go long the SPY and enhance it with additional long positions in the top-ranked sector ETFs. Conversely, if you are bearish and short (or buy puts on) the SPY, you could also consider shorting the two lowest-ranked sector ETFs to enhance your short bias.

However, if you prefer not to bet on market direction, you could try a market-neutral, long/short trade—that is, go long (or buy call options on) the top-ranked ETFs and short (or buy put options on) the lowest-ranked ETFs. And here’s a more aggressive strategy to consider: You might trade some of the highest and lowest ranked stocks from within those top and bottom-ranked ETFs.