Sector Detector: All systems are (almost) go into year-end, with tax reform the final missing piece

by Scott Martindale

by Scott Martindale

President, Sabrient Systems LLC

Stocks are rocketing to new highs almost every day. Jeff Bezos of Amazon.com (AMZN) saw his net worth exceed $100 billion. Bonds are still strong (and interest rates low). Real estate pricing is robust. DaVinci painting sells for $450 million. Bitcoin – having no intrinsic value other than a frenzy of speculative demand – trades above $11,000 (up from $1,000 on January 1), with surprising enthusiasm brewing among institutional investors, including some of the wealthiest and most successful, and with futures and derivatives on cryptocurrencies in the pipeline. (By the way, if you are afraid of a global internet crash disrupting your holdings, fear not, as there is a bitcoin satellite accessible by dish.)

Investors are desperately seeking the next hot area before it gets bid up. (Maybe marijuana stocks are next, in anticipation of broader legalization.) Indeed, central bank monetary policies have created significant asset inflation, with cheap money from around the globe burning a hole in investors’ pockets. So now it’s high time to invite to the party some of the huddled masses (who don’t have direct access to the Fed’s largesse) – through fiscal stimulus. We are already getting some of that in the form of regulatory reform, which the Administration has largely done on its own. But the eagerly anticipated big-hitter is tax reform, which requires the cooperation of Congress. And despite the Republicans’ inability to come to consensus on anything else, investors are already bidding up equities in anticipation of the House and Senate reconciling a tax bill that becomes law – so expect to see a big correction if it fails.

The promise of regulatory and tax reform have kept me positive all year on mid and small caps as the primary beneficiaries, and I remain so now more than ever. In addition, they offer a way to better leverage continued economic expansion and rising equity prices, particularly those that supply (or that seek to take away a small piece of a growing pie from) the dominant mega caps. Moreover, as the valuations for the mega-cap Technology names in particular grow ever more elevated, we are starting to see a passing of the baton to smaller players and other market segments that display more attractive forward valuation multiples.

In this periodic update, I give my view of the current market environment, offer a technical analysis of the S&P 500 chart, review Sabrient’s latest fundamentals-based SectorCast rankings of the ten US business sectors, and offer up some actionable ETF trading ideas. In summary, our sector rankings still look bullish, while the sector rotation model also maintains its bullish bias. A steady and improving global growth outlook and a persistently low interest rate environment continues to foster low volatility and an appetite for risk assets. Read on....

Market overview:

Yet another strong month. The S&P 500 was up +3.2% in November (its 8th consecutive positive month for the price index and 13th straight on a total return basis, considering dividends paid). The Dow was +4.0%, Nasdaq +2.6%, S&P Mid Cap 400 +4.2%, and S&P Small Cap 600 +3.7%. All sectors were positive for the month, with standouts like Banks (KRE) +4%, Oil & Gas Equipment (XES) +5%, Transportation (IYT) +5%…and Retail (XRT) up nearly +11%! Notably, the IYT gained +7% in just the last three days of the month! It is encouraging to see the transports finally attempt to catch up after lagging most of the year. Year-to-date through November 30, the S&P 500 (SPY) is +18%, while the Dow Jones (DIA) is +23%, Nasdaq 100 (QQQ) +31%, Nasdaq Composite +28%, S&P 400 mid caps +15%, and Russell 2000 small caps +14%. Among sectors, Technology (IYW) is still the leader at +38% while Telecom (IYZ) is the worst at about -13%. (Of note, Sabrient’s SectorCast model predicts this disparity to continue.)

And Sabrient’s GARP selection strategy has thrived in this market. YTD through December 1, all of Sabrient’s monthly Baker’s Dozen portfolios have outperformed the S&P 500 benchmark. You can see the performance of these model portfolios and their constituent holdings by visiting: http://bakersdozen.sabrient.com.

Economic reports continue to impress. Conference Board's Index of Consumer Confidence climbed to 129.5, marking the highest level since November 2000. State Street Investor Confidence Index posted 97.1. Jobless claims fell to 238,000. Pending Home Sales report showed a robust 3.5% gain. Redbook retail sales showed YOY sales increased 4.8%. The Richmond Fed Manufacturing Index surged from 12 last month to 30, which was the highest since 1993. The BEA’s second estimate of real GDP in Q3 came in at 3.3%, and for Q4, the Atlanta Fed’s GDPNow model is forecasting 3.5% while the New York Fed’s Nowcast model says 3.9%. The AAII Sentiment Survey showed a 5.4% spike in bullish sentiment to 45.1%, which is a 9-month high. Of course, the budget deadline (and potential government shutdown) hits this week, on December 8, so we’ll have to see how that works out and any volatility it creates.

The CBOE Market Volatility Index (VIX), aka “fear gauge,” closed November at 11.28, after having registered a new intraday low of 8.56 on 11/24. Although investors are still wary that there hasn’t been a significant market correction since February 2016, complacency remains prevalent as VIX has not approached the 20 panic level in a very long time. Nevertheless, low volatility is the historical norm when economic growth is stable and positive, and it is further supported by the solid market breadth (particularly the participation of small caps), elevated performance dispersion among stocks, and lower sector correlations.

Breadth continues to hold up favorably, which is healthy (and indeed necessary) for the sustainability of the bull advance, Although the big mega-cap Tech names (e.g., FAAMG) likely will continue to attract investors, some rotation into smaller players and other market segments is a welcome development. For example, Wednesday brought about an interesting rotation out of Nasdaq and Technology and into Financial, Telecom, Transportation, Retail, and small caps. And then Thursday saw leadership from Energy and Industrial. The future for Financials is largely tied to regulation and interest rates, and the newly-nominated Fed Chair Jerome Powell has commented about unwinding some regulations for smaller banks and rewriting the Volcker rule.

Overall, 2017 has been a year for Growth and Momentum over Value and Quality, as illustrated in the chart below showing a variety of iShares Edge MSCI factor ETFs plotted against the SPY. But after the market pulled back in mid-August, its initial recovery rally seemed to suggest a budding rotation into neglected market segments, including mids and smalls, as well as factors like Value, Low-volatility, and Quality. But then the Momentum factor quickly kicked back into gear for a while, until the last couple of weeks. Again, I firmly believe that a broadening into small caps and the Value and Quality factors is necessary if this bull market is going to be sustainable.

Value has underperformed Growth for most of the past decade. Even a storied Value investor like Warren Buffett has taken positions in growth-oriented Tech-sector names (with “wide moats”) like IBM (IBM) and Apple (AAPL), acknowledging that the impact and ubiquity of their services were far vaster than he ever imagined, penetrating the operations of all of Berkshire Hathaway’s (BRK-B) holdings. But this year has brought about the biggest divergence between Value and Growth since the final year of the dotcom bubble. Many market commentators have been arguing for years that Value is due for a major comeback, but market dynamics have been self-perpetuating. So many managed funds are chasing Momentum while passive funds either seek to replicate active buying or provide cap-weighted exposure that inherently rewards Growth over Value. Nevertheless, there has been a noticeable move into value-oriented strategies this year, especially through low-cost index funds. Year-to-date, U.S. large-cap value ETFs have attracted over $13 billion in net inflows.

About 85% of the world's stock markets are positive this year, and of the 45 countries monitored by the OECD, all are experiencing expanding GDP and two-thirds have accelerating growth. And looking ahead, Goldman Sachs, JP Morgan, and Morgan Stanley all share bullish views on the global economy for next year. In particular, Goldman published a 2018 outlook saying the economy will be “as good as it gets,” with global growth hitting 4% next year while inflation stays low.

Thus, there has been a widespread recommendation among institutions for a tactical tilt toward international equities over US, based primarily on relative valuation. But whenever you start down the path of making valuation comparisons between regions (whether based on Shiller CAPE or trailing P/E or P/B), it can become somewhat apples-and-oranges if you haven’t adjusted for the myriad of external factors, including implicit sector tilts of a given index or local accounting practices, interest rates, GDP growth rates, etc. For example, the MSCI EAFE Index (Europe, Asia, Far East) only has a 6% weighting in Technology, and yet this year it has been outperforming the S&P 500 (with a 25% weighting in Technology). How do you reconcile that? I think it is unlikely to continue.

And from my standpoint, the US is not such a bad place to invest considering our relative safety, stability, innovation, productivity, and work ethic – not to mention robust corporate cash generation, earnings growth, and cash balances. We also enjoy a supportive Fed, low interest rates, an upsloping yield curve, no recession in sight, and an imminent tax reform bill that promises massive stimulus, fueling capex and even greater corporate profit growth, as well as increased dividends, buybacks, and M&A (targeting small and micro caps). But even in the event of a failure to pass tax reform, businesses still are likely to reinvigorate capital expenditures to boost productivity and replace aging PP&E.

Although the tax bills emerging from the House and Senate are imperfect and have generated plenty of vitriol, I believe that the benefits outweigh the drawbacks. You can’t just look at the immediate impact on personal taxes owed on Day 1 and make a judgement; rather, you need to focus on the longer-term impact on the economy and on American companies’ competitiveness and incentives within the global marketplace, and the ultimate impact on individuals’ overall well-being (not just their tax bills). There is a difference between: 1) a short-term Keynesian demand-side initiative (like Bush’s 2008 stimulus act and Obama’s 2009 package) that immediately puts money into consumers’ pockets to induce spending, versus 2) a longer-term supply-side initiative that incentivizes business output.

For example, if a company is not taxed on foreign earned income, it would be expected to bring cash back home to reinvest rather than leaving it abroad. By focusing on lower corporate taxes, the intent of the tax bill is not to reward the rich corporate cronies and donors of the Republican establishment (as has been charged), but rather to attract capital into the US and to incentivize American multinationals to relocate operations back home and increase capex, hiring, and production, which should lead to increased output, higher rates of sustained economic growth, higher labor participation rates, rising wages, greater productivity, and a larger tax revenue base (offsetting the lower tax rates). Indeed, any worker surely would embrace a tax plan that led to a better, higher-paying job, even if it also came with a slightly higher effective income tax rate.

It is true that there are compelling arguments that say there has been no shortage of capital for corporate expansion, capex, and hiring, so putting more cash in the corporate coffers through tax cuts will simply lead to paying down debt, increasing dividends, and more share buybacks, which only serves the shareholders and not the workers (i.e., even more asset inflation without wage inflation). Nevertheless, although the multinational corporations may indeed take this approach, it is small caps and cash-strapped small businesses that stand to benefit the most, and these are the firms that do most of the hiring. The big idea at work here is to leave more money in the hands of the productive private sector (combined with less regulation) rather than hand it over to the nonproductive public sector for redistribution and entitlements.

After all, this is the core premise of free-market capitalism (as opposed to a centrally-planned economy), which has unleashed so much in the way of scientific and technological breakthroughs, and economic prosperity. But with rising debt levels pushing us toward austerity, rising income inequality, and the threat of broken promises (e.g., Social Security and pensions), many people (around the world, in fact) have lost trust in government, media, the legal system, and even religious institutions.

In particular, it upsets me greatly to see so many young people rejecting capitalism. Rather than embracing charismatic young leaders and entrepreneurs who espouse the free-market “can-do” optimism and self-reliance that made this country great, they instead choose to rally around the tired and misguided theories and assertions of a rumpled septuagenarian socialist. They are willing to accept the shackles of high tax rates, stagnant economic growth, and limited potential in their careers and incomes in exchange for the promise of free college tuition, a high minimum wage, and a broad safety net of government-provided entitlements. But even more troublingly, it appears that many young people would have us roll back some of our Bill of Rights (particularly Amendments 1, 2, 5, and 6), including freedom of speech and rights of accused persons in criminal cases (if the person’s views or actions don’t align with their own doctrine), as well as the right to bear arms and the protection of liberty and property – preferring to give Big Government full power in these areas.

Furthermore, no Democrat in Congress would dare cooperate or negotiate on anything the President wants to accomplish, no matter what, for fear that their “Never Trump” resistance constituency will vilify them back home. It has become more apparent than ever to me that we need to do away with the “career politician” in favor of a “citizen politician” system whereby average citizens leave their careers for a few years to serve their country in government before returning to those careers. Perhaps then we will have politicians who cooperate for the good of the country rather than simply position themselves for the next election. But as usual, I digress….

The December FOMC meeting is in about 10 days, and CME fed funds futures place the odds of a rate hike at 100%, and includes a 7% probability that they will raise 50 bps (rather than just 25 bps). And of course, the Fed is expected to continue the slow path of unwinding its $4.5 trillion balance sheet at a pace that avoids disrupting corporate borrowers or homebuyers. Notably, during the past year, short-term rates have moved higher while long-term rates have held steady, flattening the yield curve to its lowest term spread in a decade.

The 10-year Treasury closed November at 2.42%, with the 2-year at 1.79%. So, the closely-watched 2-10 spread closed November at only 63 bps, which is continuing to flatten, and is well under the 100 bps threshold of “normalcy,” the 101 bps on Election Day, and the 136 bps spread achieved after the November election. So, the trend is not favorable for steepening, and in fact, Morgan Stanley came out with a prediction that the yield curve will become completely flat sometime in 2018, opining that “all Treasury yields will be in the lower end of that 2.00-2.25% range.” Nonetheless, I wouldn’t worry too much about this because history shows that, as long as it does not invert, a flattening yield curve has been a precursor to a strong stock market.

I have been saying for quite some time that global dynamics should keep Treasury yields low, as long as the Fed remains slow and cautious in their path toward normalization. Drivers like global QE, the “carry trade” from ultra-low rate countries (have you looked lately at the 10-year German bund paying a meager 30 bps?), aging demographics in developed countries, and capital inflows into fixed income funds (largely from 401k and IRA accounts for formulaic strategic allocations) are all perpetuating the demand for bonds. I still don’t see the 10-year Treasury yield reaching 3.0% anytime soon. My observation has been that 2.6% is a yield that has attracted a strong bid, such as last December and March. Moreover, given the generally disinflationary global economy (driven by persistent technological breakthroughs and improved productivity) and global debt levels, a spike in developed-market interest rates is not likely – and certainly not desirable. The Fed (especially when you consider its new self-imposed mandate to consider asset prices and not just inflation and employment metrics) does not want to be responsible for upsetting the economic apple cart and killing the stock market through stubborn monetary tightening.

So, we are enjoying global economic expansion, impressive economic reports, strong (and improving) corporate cash flow and earnings, low inflation, a still-accommodative Fed (guarding against causing disruptive financial shocks), low interest rates, an upsloping yield curve, persistent investor caution (especially among institutions and hedge funds), some regulatory reform (with more on the way), and imminent major tax reform (incentivizing expansion, domestic relocation, capex, hiring, production, higher dividends, and M&A). Moreover, technological breakthroughs continue to disrupt and revolutionize the economy. There are fewer publicly-traded companies and shares outstanding being chased by more global capital (supply/demand dynamics). There are signs of a long-awaited sustained rotation and broadening from the mega caps and the Growth and Momentum factors into small caps and the Value factor. Thus, going forward, I expect there to be winners and losers, not just the “all boats lifted” of the early recovery stage or “blow-off top” of the late stage of a bull market. We have some years left in this uptrend.

I will stop here, but I invite you to visit the Sabrient.com blog to look back at some of my prior articles in which I discussed market valuations and risks to the global economy (primarily the over-reliance on credit, led by China).

SPY chart review:

The SPDR S&P 500 ETF (SPY) closed Friday, December 1, at 264.46 in a relentless march higher. One convincing breakout above resistance is followed by another. This time, it was the 260 level (corresponding to 2,600 on the S&P 500) last week. Positive divergences abound, including the various oscillators like RSI, MACD, and Slow Stochastic. However, last week’s big move created a bit too much divergence from the 20-day simple moving average (i.e., the proverbial “rubber band” is stretched), and although the intraday selloff on Friday allowed price to test support at the 20-day, it was quickly bought and is back to a stretched position. In addition, Bollinger Bands have widened considerably, while the oscillators are all near overbought territory and look poised to cycle back down. Thus, I expect some price consolidation to ensue so that the stretched and overbought conditions can at least neutralize. This observation would appear to jibe with the current tax situation, as both houses of Congress now must reconcile their respective tax bills before becoming the law of the land, as well as the uncertainty around the looming budget deadline. The 20-day SMA (now approaching 260, coinciding with the breakout resistance level) has been providing strong support since late August. Further support levels come in at the uptrend line (near 258), the 50-day SMA (near 257), and a prior breakout level at 255, followed by the 100-day SMA (around 253), a prior breakout at 250, and the critical 200-day SMA (down near 245). SPY still hasn’t tested its 200-day SMA since the election.

Last month, I said that I expect the bullish sentiment and technical breakout to hold at least through year end, unless some form of major unwanted (“Black Swan”) news event sends investors running for cover. And indeed, the end of last week brought some political news (e.g., Michael Flynn plea and doubts about tax bill) that sent at least some momentum traders to the sidelines. But the dip was quickly bought, and ultimately we saw some unusual behavior in that both stocks and the VIX ended up rallying at the same time. I think it was a result of some internal rotation out of the long-time leading Tech stocks. But the shake-up was brief, and the pullback was quickly bought on elevated volume, and the path of least resistance still appears to be to the upside.

Latest sector rankings:

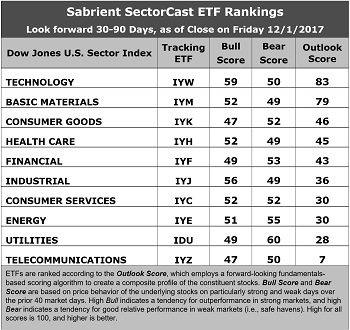

Relative sector rankings are based on our proprietary SectorCast model, which builds a composite profile of each of over 600 equity ETFs based on bottom-up aggregate scoring of the constituent stocks. The Outlook Score employs a forward-looking, fundamentals-based multifactor algorithm considering forward valuation, historical and projected earnings growth, the dynamics of Wall Street analysts’ consensus earnings estimates and recent revisions (up or down), quality and sustainability of reported earnings, and various return ratios. It helps us predict relative performance over the next 1-3 months.

In addition, SectorCast computes a Bull Score and Bear Score for each ETF based on recent price behavior of the constituent stocks on particularly strong and weak market days. High Bull score indicates that stocks within the ETF recently have tended toward relative outperformance when the market is strong, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well (i.e., safe havens) when the market is weak.

Outlook score is forward-looking while Bull and Bear are backward-looking. As a group, these three scores can be helpful for positioning a portfolio for a given set of anticipated market conditions. Of course, each ETF holds a unique portfolio of stocks and position weights, so the sectors represented will score differently depending upon which set of ETFs is used. We use the iShares that represent the ten major U.S. business sectors: Financial (IYF), Technology (IYW), Industrial (IYJ), Healthcare (IYH), Consumer Goods (IYK), Consumer Services (IYC), Energy (IYE), Basic Materials (IYM), Telecommunications (IYZ), and Utilities (IDU). Whereas the Select Sector SPDRs only contain stocks from the S&P 500, I prefer the iShares for their larger universe and broader diversity.

Here are some of my observations on this week’s scores:

1. Technology and Basic Materials sit alone at the top of the pack. Tech again takes the top spot with an Outlook score of 83, followed again by Materials with a score of 79. Tech displays a strong projected EPS year-over-year growth rate of 15.0%, solid Wall Street sell-side analyst sentiment (i.e., net positive revisions to EPS estimates), the highest return ratios, and a low forward PEG of 1.21 (ratio of forward P/E to forward EPS growth rate). Basic Materials also boasts strong sentiment among sell-side analysts, along with good return ratios and a relatively low forward PEG of 1.57. Then there is a 33-point gap down to third place Consumer Goods (Staples/Noncyclical), followed closely by Healthcare and Financial. Healthcare still sports the lowest forward P/E of 17.4x, although it is significantly higher than it was just one month ago. Rounding out the top eight are Industrial, Consumer Services (Discretionary/Cyclical), and Energy.

2. Defensive sectors Telecom and Utilities are the new bottom dwellers with Outlook scores of 7 and 28, respectively. Telecom displays generally weak scores across the board, including the highest forward P/E (26x) and second-highest forward PEG (3.44), while Utilities has the lowest growth rate and by far the highest forward PEG of 4.59. Notably, Energy has moved out of the bottom two on the strength of strong sell-side analyst sentiment (positive revisions) and has by far the best projected EPS year-over-year growth rate of 29.8%, as well as the lowest forward PEG of 0.82.

3. Looking at the Bull scores, Technology has the top score of 59, followed by Industrial at 56, as these sectors have displayed relative strength on strong market days. Defensive sectors Consumer Goods and Telecom share the lowest at 47. The top-bottom spread is only 12 points, which reflects moderate sector correlations on strong market days. It is desirable in a healthy market to see low correlations reflected in a top-bottom spread of at least 20 points, which indicates that investors have clear preferences in the market segments and stocks they want to hold (rather than broad risk-on behavior).

4. Looking at the Bear scores, we find Utilities at the top with a score of 60, followed by Energy at 55, which means that stocks within these sectors have been the preferred safe havens lately on weak market days. Basic Materials, Healthcare, and Industrial share the lowest score of 49, as investors have fled during market weakness. However, it is worth noting that there haven’t been many weak market days lately to create a good sample size. The top-bottom spread is only 11 points, which reflects moderate sector correlations on weak market days. Ideally, certain sectors will hold up relatively well while others are selling off (rather than broad risk-off behavior), so it is desirable in a healthy market to see low correlations reflected in a top-bottom spread of at least 20 points.

5. Technology displays the best all-around combination of Outlook/Bull/Bear scores, while Telecom is by far the worst. Looking at just the Bull/Bear combination, Technology and Utilities are the best, indicating superior relative performance (on average) in extreme market conditions (whether bullish or bearish), while Telecom scores the worst, as investors have generally avoided the sector.

6. This week’s fundamentals-based Outlook rankings still reflect a bullish bias, given that seven of the top eight sectors are economically-sensitive or all-weather (Technology, Materials, Financial, Healthcare, Industrial). However, I am somewhat disturbed by the fact that only the top two are scoring above 50. Keep in mind, the Outlook Rank does not include timing, momentum, or relative strength factors, but rather reflects the consensus fundamental expectations at a given point in time for individual stocks, aggregated by sector.

ETF Trading Ideas:

Our Sector Rotation model, which appropriately weights Outlook, Bull, and Bear scores in accordance with the overall market’s prevailing trend (bullish, neutral, or defensive), displays a bullish bias and suggests holding Technology (IYW), Industrial (IYJ), and Materials (IYM), in that order. (Note: In this model, we consider the bias to be bullish from a rules-based trend-following standpoint when SPY is above both its 50-day and 200-day simple moving averages.)

Besides iShares’ IYW, IYJ, and IYM, other highly-ranked ETFs in our SectorCast model (which scores nearly 700 US-listed equity ETFs) from the Technology, Industrial, Materials sectors include iShares PHLX Semiconductor (SOXX), VanEck Vectors Steel ETF (SLX), and First Trust Materials AlphaDEX Fund (FXZ).

If you prefer a neutral bias, the Sector Rotation model suggests holding Technology, Basic Materials, and Consumer Goods (Staples/Noncyclical), in that order. On the other hand, if you are more comfortable with a defensive stance on the market, the model suggests holding Utilities, Energy, and Technology, in that order.

An assortment of other interesting ETFs that are scoring well in our latest rankings include SPDR S&P Retail (XRT, which is the top-ranked ETF in our system right now), Deep Value ETF (DVP), PowerShares Contrarian Opportunities Portfolio (CNTR), Pacer US Cash Cows 100 (COWZ), VanEck Vectors Mortgage REIT Income (MORT), Arrow QVM Equity Factor (QVM), iShares Edge MSCI USA Value Factor (VLUE), PowerShares S&P Small Cap Materials (PSCM), Validea Market Legends (VALX), ValueShares US Quantitative Value (QVAL), John Hancock Multifactor Technology (JHMT), First Trust NASDAQ Smartphone Index Fund (FONE), and Direxion iBillionaire Index (IBLN).

IMPORTANT NOTE: I post this information periodically as a free look inside some of our institutional research and as a source of some trading ideas for your own further investigation. It is not intended to be traded directly as a rules-based strategy in a real money portfolio. I am simply showing what a sector rotation model might suggest if a given portfolio was due for a rebalance, and I may or may not update the information on a regular schedule. There are many ways for a client to trade such a strategy, including monthly or quarterly rebalancing, perhaps with interim adjustments to the bullish/neutral/defensive bias when warranted, but not necessarily on the days that I happen to post this article. The enhanced strategy seeks higher returns by employing individual stocks (or stock options) that are also highly ranked, but this introduces greater risks and volatility. I do not track performance of the ideas mentioned here as a managed portfolio.

Disclosure: The author has no positions in stocks or ETFs mentioned.

Disclaimer: This newsletter is published solely for informational purposes and is not to be construed as advice or a recommendation to specific individuals. Individuals should take into account their personal financial circumstances in acting on any opinions, commentary, rankings, or stock selections provided by Sabrient Systems or its wholly-owned subsidiary Gradient Analytics. Sabrient makes no representations that the techniques used in its rankings or analysis will result in or guarantee profits in trading. Trading involves risk, including possible loss of principal and other losses, and past performance is no indication of future results.